The Hartford leads our study for welding business insurance with a MoneyGeek score of 4.78 out of 5.00, earning top marks across all categories. At $127 per month or $1,522 annually, The Hartford combines comprehensive coverage with competitive pricing. We also recommend comparing quotes from our other top picks, including NEXT, biBERK, Simply Business and Coverdash.

Best Welding Business Insurance

The Hartford, NEXT and biBerk offer the best cheap business insurance for welding companies, with rates starting at $68 monthly.

Get personalized quotes to find the best business insurance welding contractors.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Welding businesses need several types of coverage, including workers' compensation for employee injuries, general liability for fire damage, commercial auto for work vehicles and professional liability for weld failures.

The best business insurance provider for welding contractors is The Hartford, with a MoneyGeek score of 4.78out of 5, providing quality service with affordable rates.

The cheapest business insurance for welding companies comes from The Hartford at $127 monthly, with professional liability rates starting at $68 monthly.

Best Business Insurance for Welding Companies

| The Hartford | 4.78 | $127 |

| NEXT Insurance | 4.73 | $132 |

| biBERK | 4.70 | $132 |

| Simply Business | 4.40 | $158 |

| Coverdash | 4.40 | $153 |

| Nationwide | 4.40 | $163 |

| Hiscox | 4.30 | $155 |

| Chubb | 4.30 | $176 |

| Progressive Commercial | 4.30 | $156 |

| Thimble | 4.10 | $167 |

*We based all scores on a welding business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Welding Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

Use these resources to find coverage that fits your welding company's needs:

1. The Hartford: Best and Cheapest Overall for Welding Businesses

Lowest rates for general liability and professional liability coverage

Best claims processing score among business insurers nationally

A+ AM Best rating guarantees your welding claims get paid

Top-ranked customer service with dedicated business support

Digital experience ranks 10th nationally, limiting online policy management

Business owner's policies unavailable in Alaska, Hawaii and Michigan

For welding contractors and welding companies, The Hartford offers the lowest rates for two coverage types: $137 monthly for general liability and $68 for professional liability. These competitive prices matter when you're managing equipment costs and the liability risks that come with high-heat work on customer property.

The Hartford ranks first nationally for claims processing, responding fast when you file claims for property damage from sparks, equipment failures or job site injuries. Their A+ AM Best rating guarantees it'll pay your claim, whether it's minor equipment damage or a major liability lawsuit involving your welding operations.

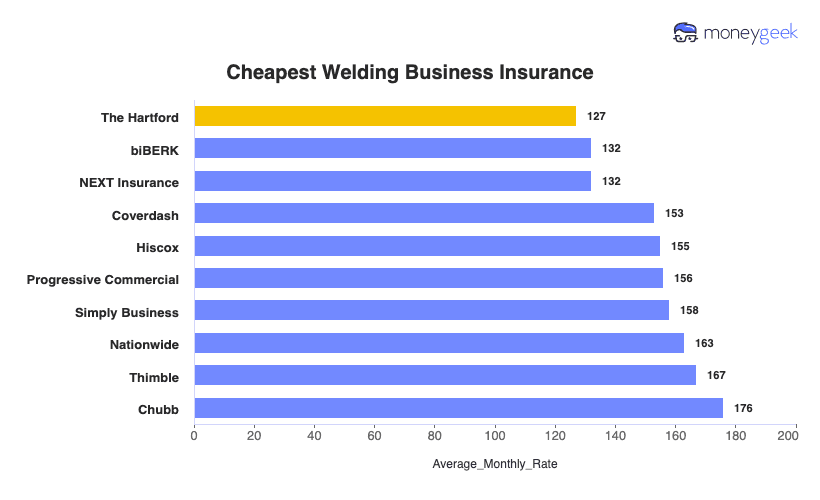

Cheapest Business Insurance for Welding Companies

The Hartford offers the most affordable insurance for welding businesses at $127 monthly ($1,522 annually), with the lowest rates for general liability ($137 monthly) and professional liability ($68 monthly) coverage. For workers compensation, NEXT provides cheaper coverage at $55 monthly. biBERK leads for business owner's policies at $185 monthly, compared to The Hartford's $189 rate.

| The Hartford | $127 | $1,522 |

| biBERK | $132 | $1,580 |

| NEXT Insurance | $132 | $1,585 |

| Coverdash | $153 | $1,832 |

| Hiscox | $155 | $1,856 |

| Progressive Commercial | $156 | $1,875 |

| Simply Business | $158 | $1,901 |

| Nationwide | $163 | $1,951 |

| Thimble | $167 | $2,003 |

| Chubb | $176 | $2,108 |

What Does Welding Business Insurance Cost?

In general, business insurance costs for welding companies are the following for the four most popular coverage types:

- General Liability: $166 on average per month, ranging from $144 to $193, depending on the state

- Workers' Comp: $117 on average per month, ranging from $100 to $137, depending on the state

- Professional Liability (E&O): $77 on average per month, ranging from $66 to $90, depending on the state

- BOP Insurance: $244 on average per month, ranging from $210 to $283, depending on the state

| BOP | $244 | $2,928 |

| General Liability | $166 | $1,987 |

| Workers' Comp | $117 | $1,406 |

| Professional Liability (E&O) | $77 | $923 |

What Type of Insurance Is Best for a Welding Business?

Welding contractors face unique liability exposures from high-heat work, making workers' compensation a required coverage for welding contractors. You’ll also need commercial auto essential for legal compliance and financial protection. Beyond these, general liability and professional liability insurance address the fire risks and structural integrity concerns that define your welding business.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Welding Company

Here's our step-by-step method for getting business insurance that protects your welding operation without overpaying.

- 1Decide on Coverage Needs Before Buying

Consider what happens when your grinding sparks ignite a client's warehouse or arc flash injures a bystander at your fabrication site. Connect with welding contractors in your area who've filed claims for warped steel plates or equipment damage. Find agents experienced with welding operations who understand liability from acetylene torch work and molten slag burns.

- 2Research Costs

Check what other welding businesses pay before shopping for quotes. Structural welders doing certified work pay more than mobile welders handling basic repairs. Fabrication shops with multiple welding booths face different rates than solo contractors running MIG welders from their trucks. Know these pricing differences before you negotiate with insurers.

- 3Look Into Company Reputations and Coverage Options

Read reviews from welding contractors about how insurers handled their fire damage claims or equipment theft losses. Check whether carriers understand completed operations coverage for welds that fail months after you finish a job. Verify they offer adequate protection for your plasma cutters, welding rigs and specialty torches stored at job sites.

- 4Compare Multiple Quotes Through Different Means

Get quotes from three insurers who actually cover welding operations since many carriers reject welding businesses outright. Independent agents access specialty insurers for high-heat trades while online platforms show mainstream options. Some carriers exclude overhead structural welding or confined space work, so compare what's actually covered for your specific welding services.

- 5Reassess Annually

Your welding company evolves as you hire certified welders, invest in robotic welding equipment or shift from repair work to structural fabrication. Review coverage when you upgrade from stick welding to Tungsten Inert Gas (TIG), expand your metal fabrication services or add a second welding truck. Premium reductions often come from improved safety records or installing better ventilation systems.

Best Welding Liability Insurance: Bottom Line

The Hartford earns our top ranking for welding business insurance with a 4.78 MoneyGeek score, offering comprehensive coverage at $127 monthly. Your welding operation needs financial protection against fire damage from sparks, employee injuries and weld failures. Professional liability starts at just $68 monthly, combining affordable rates with exceptional customer service for welding contractors.

Welding Business Insurance: FAQ

Common questions about welding business insurance:

Who offers the best welding business insurance overall?

The Hartford delivers the best overall business insurance for welding firms, earning a MoneyGeek score of 4.78 out of 5. NEXT comes in second with a score of 4.73, offering competitive rates and comprehensive protection.

Who has the cheapest business insurance for welding firms?

Here are the cheapest business insurance companies for welding businesses by coverage type:

- Cheapest general liability insurance: The Hartford at $137 monthly

- Cheapest workers' comp insurance: NEXT at $110 monthly

- Cheapest professional liability insurance: The Hartford at $68 monthly

- Cheapest BOP insurance: biBERK at $185 monthly

What business insurance is required for welding organizations?

Workers' compensation insurance (for employees) and commercial auto insurance (for business vehicles) are legally mandated for welding businesses, though requirements differ by state. General liability insurance remains essential for securing commercial contracts and property leases.

How much does welding business insurance cost?

Welding business insurance costs by coverage type are as follows:

- General Liability: $166/mo

- Workers' Comp: $117/mo

- Professional Liability: $77/mo

- BOP Insurance: $244/mo

How We Chose the Best Welding Business Insurance

We selected the best business insurer for welding companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 10, 2025.

- NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.