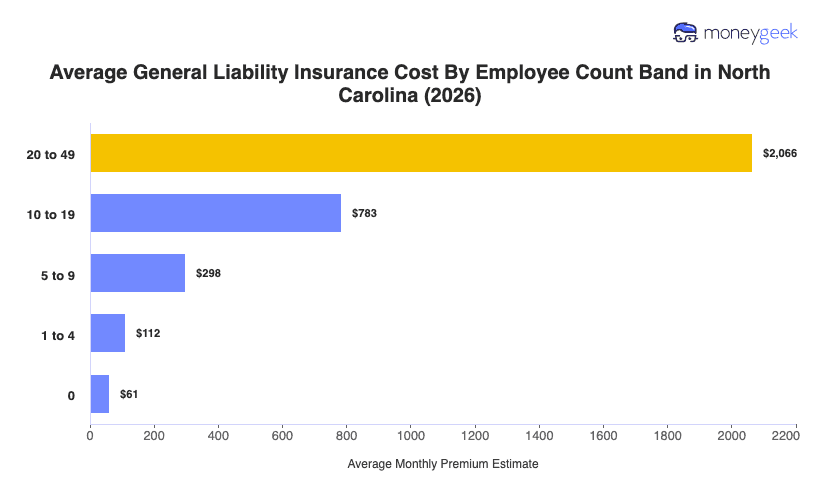

Small North Carolina businesses face a middle-tier premium landscape. It’s not the region's cheapest option, but well below what companies pay in Virginia or Maryland. The cost of general liability insurance in the state averages $112 monthly ($1,341 annually) for businesses with one to four employees, making North Carolina 23rd for affordability nationally.

That position becomes clearer when you map the surrounding states. South Carolina undercuts North Carolina by $16 monthly, claiming the 6th most affordable spot nationally, while Tennessee’s rates are nearly identical to North Carolina at $112 monthly. But cross into Virginia and costs jump 21% to $136 monthly for similar business profiles. Maryland reaches $155 monthly, reflecting the legal and commercial pressures from Washington D.C.'s plaintiff-friendly courts and denser metro corridors.

MoneyGeek's analysis covers over 400 business types statewide, which means North Carolina's average blends vastly different risk profiles. Your actual cost depends on which variables push you away from that center point.