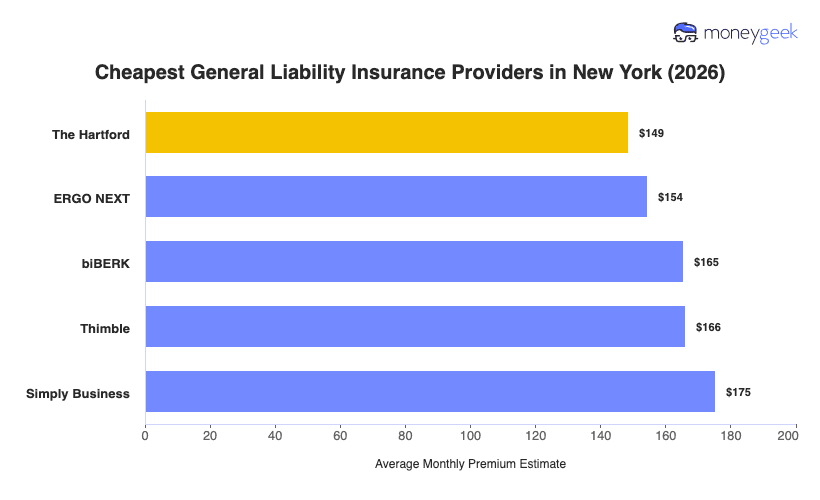

If you're options by price, these three insurers most often deliver the lowest general liability insurance rates across over 400 New York small businesses, though your sweet spot depends on what you do and where you operate.

- The Hartford: Often cheapest for professional services (tech/IT, financial services, education, healthcare and medical)

- ERGO NEXT: Typically most affordable for hands-on trades and food services (construction contractors, food and beverage, manufacturing)

- biBERK: Generally offers the lowest rates for personal and property services (cleaning services, fitness studios, pet care, real estate agencies)

>> [Click each provider to learn more]

These patterns reflect where each insurer tends to price most competitively across New York industries. Your actual premium depends on your specific operations, revenue, employee count and location. Use this as your starting point, then request quotes from at least two of these providers to confirm which delivers your lowest rate.