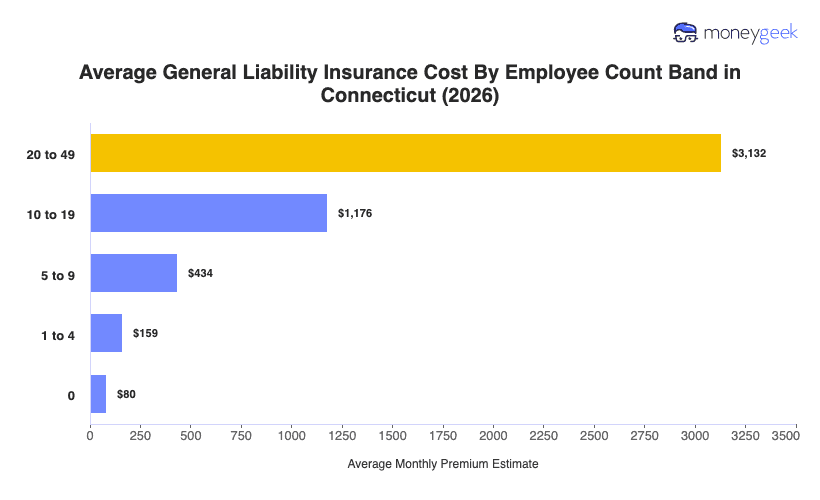

General liability insurance costs in Connecticut average $159 monthly ($1,906 annually) for businesses with one to four employees carrying limits of $1 million per occurrence/$2 million aggregate. This benchmark runs 29% above the national average of $123 monthly, placing Connecticut 45th nationally for affordability, making it the sixth most expensive state for general liability coverage.

Connecticut's positioning reflects the broader Northeast cost structure, where costs vary considerably across neighboring and regional markets. Among adjacent states, Rhode Island averages $130 monthly, Massachusetts $169, and New York $180. Within the broader Northeast region, Maine ($112) and New Hampshire ($135) run $24 to $47 below Connecticut's benchmark. Connecticut sits in the upper-middle tier of this distribution, exceeding Rhode Island but remaining below both Massachusetts and New York.

Use this state average as a starting reference for understanding whether your quoted price falls within expected parameters given your operational profile, not as a prediction of your final premium.