The Hartford ranks first for bakery insurance with a MoneyGeek score of 4.78 out of 5. Bakers pay $66 monthly for coverage that earned perfect scores in affordability, customer service, coverage and financial stability. Each bakery has different needs, so comparing quotes from Nationwide, biBERK and Simply Business helps you find the right protection for your baking business.

Best Bakery Business Insurance

The Hartford, Nationwide and biBerk offer the best cheap business insurance for bakery companies, with rates starting at $47 monthly.

Get personalized quotes from the best bakery business insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Bakeries need several types of business insurance: general liability for customer injuries, workers' compensation for employee accidents, commercial property for equipment and product liability for foodborne illness claims.

The Hartford ranks as the best business insurance provider for bakers, leading in affordability, customer service, coverage and financial strength.

The Hartford offers the cheapest business insurance for bakeries at $66 monthly, including professional liability coverage starting at $53 per month.

Best Business Insurance for Bakery Companies

| The Hartford | 4.78 | $66 |

| Nationwide | 4.60 | $79 |

| biBERK | 4.60 | $73 |

| Simply Business | 4.50 | $80 |

| Coverdash | 4.50 | $77 |

| Progressive Commercial | 4.40 | $81 |

| ERGO NEXT | 4.37 | $103 |

| Thimble | 4.30 | $88 |

| Hiscox | 4.30 | $87 |

| Chubb | 4.30 | $99 |

Note: We based all scores on a bakery business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Bakery Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

Use these resources to find coverage that fits your bakery's insurance needs:

1. The Hartford: Best and Cheapest Overall for Bakery Businesses

Perfect scores in affordability, customer service, coverage and financial stability

Most affordable rates for bakery owners

Ranks first nationally for claims processing and customer service

Bakery-specific coverage for food spoilage and equipment breakdown

Strong financial stability with A- rating from AM Best

Ranks 10th for digital experience among surveyed companies

Not available in Alaska and Hawaii

The Hartford is a reliable partner when you're dealing with food-related claims or equipment failures in your bakery. The Hartford covers bakery-specific risks that other insurers exclude. Your policy protects refrigerated ingredients and finished goods from spoilage, covers commercial ovens and mixers when they break down and includes food contamination liability if customers get sick from your baked goods.

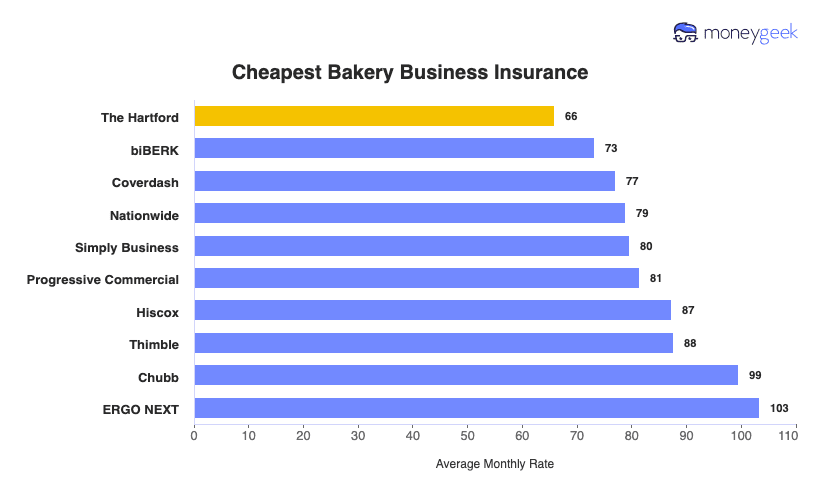

Cheapest Business Insurance for Bakery Owners

The Hartford offers the cheapest bakery insurance at $66 monthly ($792 annually), the most affordable option for business owner's policies, general liability and professional liability coverage. For workers' compensation insurance, ERGO NEXT provides the lowest rates.

| The Hartford | $66 | $792 |

| biBERK | $73 | $879 |

| Coverdash | $77 | $925 |

| Nationwide | $79 | $947 |

| Simply Business | $80 | $954 |

| Progressive Commercial | $81 | $977 |

| Hiscox | $87 | $1,047 |

| Thimble | $88 | $1,051 |

| Chubb | $99 | $1,193 |

| ERGO NEXT | $103 | $1,240 |

What Does Bakery Insurance Cost?

In general, bakery business insurance costs are the following for the four most popular coverage types:

- General Liability: $91 on average per month, ranging from $79 to $106, depending on the state

- Workers' Comp: $54 on average per month, ranging from $46 to $63, depending on the state

- Professional Liability (E&O): $53 on average per month, ranging from $46 to $62, depending on the state

- BOP Insurance: $134 on average per month, ranging from $114 to $158, depending on the state

| BOP | $134 | $1,606 |

| General Liability | $91 | $1,089 |

| Workers' Comp | $54 | $643 |

| Professional Liability (E&O) | $53 | $634 |

What Type of Insurance Is Best for Bakery Businesses?

Workers' compensation is legally required in most states once you hire employees, while general liability protects against the most common bakery risks like customer injuries and foodborne illness claims. Get these required coverages for bakeries first, then add commercial property insurance to protect expensive equipment, product liability for wholesale operations and commercial auto if you make deliveries.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Bakery Owners

Finding affordable coverage that actually protects your baking business takes some research. Use this guide on how to get business insurance to find coverage that protects your business at the right price.

- 1Decide on Coverage Needs Before Buying

Think through scenarios that would hurt your bakery financially: a grease fire spreading from your fryer, mold contamination forcing you to dump inventory or a car accident during a catering delivery. Talk with other bakers about which coverage types protected them when problems happened. Understanding your real vulnerabilities helps you prioritize essential protection over optional add-ons.

- 2Research Costs

Find out what bakeries in your area pay for coverage. A retail bakery with three employees faces different rates than a wholesale operation with 15 staff members. Location matters too, since premiums in high-cost cities run higher than rural areas. Research average costs for your specific situation so you recognize reasonable quotes from inflated ones.

- 3Look Into Company Reputations and Coverage Options

Research which insurers specialize in food businesses versus those treating bakeries like generic retail shops. Check complaint ratios with your state insurance department to see how each company handles disputes. Bakeries selling at farmers markets need carriers experienced with artisan food producers, while production facilities need insurers familiar with commercial kitchen operations.

- 4Compare Multiple Quotes Through Different Means

Get quotes online through independent agents and directly from insurers. Tell each one about your safety measures like commercial hood cleaning schedules, employee training programs or allergen protocols since these details unlock discounts. Online quotes work fast for standard coverage, but agents find specialized options for unique situations like gluten-free facilities or cottage food operations.

- 5Reassess Annually

Reevaluate coverage when you expand into wedding cakes, start shipping nationwide or move to a larger space with more expensive equipment. Premium increases don't always match market rates, so shopping around at renewal often reveals better deals. Document any improvements like installing security systems or completing food safety certifications since these changes qualify you for lower rates with current or new insurers.

Best Insurance for Bakery Business: Bottom Line

The Hartford leads bakery insurance with rates starting at $66 monthly and top rankings for customer service and claims processing. Your bakery needs general liability, workers' compensation, commercial property and product liability to handle daily risks from customer injuries to equipment breakdowns. Get quotes from several insurers to get coverage that provides your baking business financial protection without straining your budget.

Bakery Insurance: FAQ

Common questions about bakery business insurance:

Who offers the best bakery business insurance overall?

The Hartford leads bakery business insurance with a MoneyGeek score of 4.78 out of 5. Nationwide and biBERK tie for second place at 4.60, both delivering excellent affordability and comprehensive coverage options.

Who has the cheapest business insurance for bakery firms?

Here are the cheapest business insurance companies for Bakery businesses by coverage type:

- Cheapest general liability insurance: The Hartford at $70 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $50 monthly

- Cheapest professional liability insurance: The Hartford at $47 monthly

- Cheapest BOP insurance: The Hartford at $95 monthly

What business insurance is required for bakery organizations?

Bakery businesses must carry workers' compensation insurance with employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability insurance isn't legally mandated but most commercial clients and property leases require it.

How much does bakery business insurance cost?

Bakery business insurance costs by coverage type are as follows:

- General Liability: $91/mo

- Workers' Comp: $54/mo

- Professional Liability: $53/mo

- BOP Insurance: $134/mo

How We Chose the Best Bakery Business Insurance

We selected the best business insurer for bakery companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 8, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 8, 2026.

- Trustpilot. "Thimble." Accessed February 8, 2026.