Finding the right business insurance for your tree service company protects your finances when accidents happen. NEXT ERGO earned our top spot with a MoneyGeek score of 4.67 out of 5, thanks to its competitive rates, quality customer service and comprehensive coverage options for tree care businesses. The Hartford and Thimble also ranked highly for arborists and tree removal companies seeking reliable financial protection.

Best Tree Service Business Insurance

NEXT ERGO, The Hartford and Thimble offer the best cheap business insurance for tree service companies, with rates starting at $68 monthly.

Discover the best business insurance provider for tree services and arborists.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Your tree service business requires multiple types of business insurance protecting against industry-specific dangers. Essential policies include general liability, workers' compensation, commercial auto and equipment coverage.

NEXT ERGO delivers the best business insurance for tree care companies with a MoneyGeek score of 4.67 through strong customer service, competitive rates and comprehensive coverage options.

Thimble provides the cheapest business insurance for arborists at $100 monthly, with general liability coverage starting at just $49 monthly for basic financial protection.

Best Business Insurance for Tree Service Companies

| ERGO NEXT | 4.67 | $133 |

| The Hartford | 4.65 | $130 |

| Thimble | 4.60 | $100 |

| Nationwide | 4.60 | $133 |

| biBERK | 4.60 | $136 |

| Coverdash | 4.40 | $170 |

| Progressive Commercial | 4.40 | $153 |

| Chubb | 4.40 | $186 |

| Hiscox | 4.30 | $162 |

| Simply Business | 4.30 | $232 |

Note: We based all scores on a tree service business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Tree Service Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your tree service business, check out the following resources:

1. NEXT ERGO: Best Overall for Tree Service Businesses

Top affordability for workers' comp and general liability coverage

Best-in-class digital experience with 24/7 certificate access

Get covered in 10 minutes with instant online quotes

Digital-first platform lacks local agent offices for tree services

Claims processing scored lower than other carriers

NEXT ERGO earned top rankings across affordability, customer service, coverage and financial stability categories, making it the best overall choice for tree service business insurance. The company serves nearly 750,000 small businesses nationwide and holds an A+ Superior financial strength rating from AM Best through its parent company Munich Re Group.

Tree service companies and arborists get quotes tailored to their specific operations, whether you run a tree removal business, tree trimming service or full-service tree care company.

2. Thimble: Cheapest Overall for Tree Service Business

Lowest rates for BOP and general liability coverage nationwide

Flexible coverage options by job, month or year

Second-best digital experience with instant certificates of insurance

Strong financial backing from A-rated carriers like Markel

Claims processing ranked seventh nationally

Customer service scored lower than other tree service insurers

It is an affordable option for arborists and tree care businesses with smaller crews.

What sets Thimble apart from tree service companies is its flexible options. You can purchase insurance by the hour, day, month or year, which works well for seasonal tree trimming operations or arborists handling project-based tree removal work.

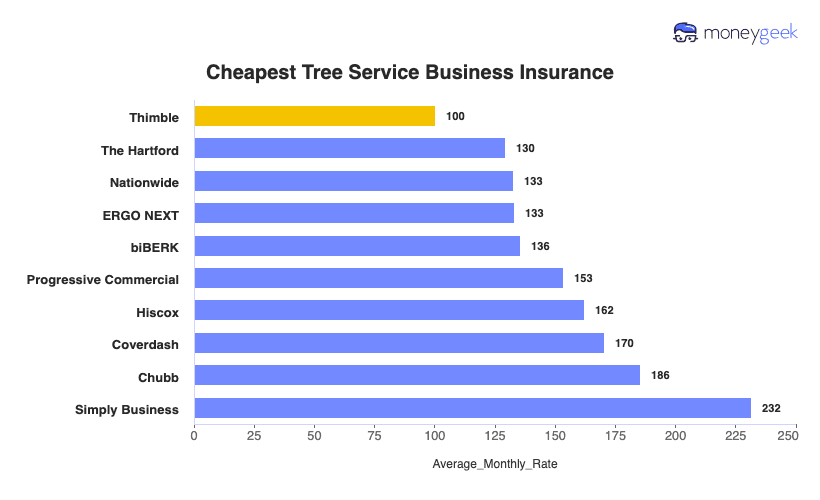

Cheapest Business Insurance for Tree Services

Based on our study of business insurance pricing, Thimble offers the cheapest overall coverage for tree service companies at $100 monthly or $1,203 annually. It ranks first for BOP and general liability insurance, making it the most affordable choice for arborists and tree care businesses. For workers' compensation and professional liability coverage, consider comparing quotes from NEXT ERGO, The Hartford and Progressive Commercial to find the best rates for your tree removal business.

| Thimble | $100 | $1,203 |

| The Hartford | $130 | $1,554 |

| Nationwide | $133 | $1,592 |

| ERGO NEXT | $133 | $1,599 |

| biBERK | $136 | $1,629 |

| Progressive Commercial | $153 | $1,841 |

| Hiscox | $162 | $1,947 |

| Coverdash | $170 | $2,045 |

| Chubb | $186 | $2,226 |

| Simply Business | $232 | $2,780 |

What Does Tree Service Business Insurance Cost?

In general, business insurance costs for tree service companies are as follows for the four most popular coverage types:

- General Liability: $131 on average per month, ranging from $49 to $255, depending on the state

- Workers' Comp: $221 on average per month, ranging from $207 to $256, depending on the state

- Professional Liability (E&O): $75 on average per month, ranging from $68 to $88, depending on the state

- BOP Insurance: $192 on average per month, ranging from $76 to $381, depending on the state

| Workers' Comp | $221 | $2,658 |

| BOP | $192 | $2,306 |

| General Liability | $131 | $1,567 |

| Professional Liability (E&O) | $75 | $906 |

What Type of Coverage Do You Need for a Tree Service Business?

Your tree service company's insurance needs begin with workers' compensation when you employ a crew, then add general liability and commercial auto to protect against the industry's most frequent claims. Don't skip tools and equipment coverage, professional liability or cyber insurance if you collect customer information digitally.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Tree Service Company

Finding the best and cheapest business insurance for your tree service company requires a strategic approach. Follow our step-by-step method for getting business insurance that balances comprehensive coverage with affordable rates.

- 1Decide on Coverage Needs Before Buying

Tree service work involves serious risks: workers climbing 50-foot trees, chainsaws near power lines, heavy branches falling toward houses. Ask experienced arborists which policies saved them money during claims. Consult independent agents specializing in tree care operations. Research protection types matching your actual risks, not generic small business packages.

- 2Research Costs

Crew size, equipment value and services offered drive your insurance costs. Look up typical rates for similar-sized arborist operations in your area. Target insurers experienced with tree care claims, not general small business carriers. You'll spot overpriced quotes immediately with benchmark data.

- 3Look Into Company Reputations and Coverage Options

Read tree service contractor reviews focusing on claims experiences with equipment damage, property damage and worker injuries. Confirm coverage extends to specialized arborist equipment: stump grinders, chippers, bucket trucks and climbing gear your crews depend on daily. Generic equipment policies often exclude tree care machinery.

- 4Compare Multiple Quotes Through Different Means

Tree trimming insurance rates vary between sources. Request quotes from captive agents, independent brokers specializing in contractor risks, online platforms and insurers directly. Match identical coverage limits across at least three providers. You'll often find 40% to 50% price differences for the same protection.

- 5Reassess Annually

Your tree care company changes constantly: new bucket trucks, additional climbers, storm cleanup expansion, municipal contracts. Annual coverage reviews catch gaps before they cost you. Equipment additions, crew growth and revenue increases demand policy adjustments. Compare fresh quotes yearly because insurers regularly adjust tree service rates.

Best Business Insurance for Tree Service: Bottom Line

Tree service companies need solid protection: general liability, workers' compensation, commercial auto and equipment coverage. NEXT ERGO is as the best business insurance for arborists, balancing strong customer service with comprehensive coverage options. Tree care businesses watching costs can get general liability through Thimble for $49 monthly.

Tree Service Business Insurance: FAQ

We answer common questions about tree service business insurance:

Who offers the best tree service business insurance overall?

NEXT ERGO delivers the top business insurance for tree service companies, earning a MoneyGeek score of 4.67 out of 5. The Hartford follows as runner-up with 4.65, delivering excellent affordability and comprehensive coverage options.

Who has the cheapest business insurance for tree service firms?

Here are the cheapest business insurance companies for Tree Service businesses by coverage type:

- Cheapest general liability insurance: Thimble at $49 monthly

- Cheapest workers' comp insurance: NEXT ERGO at $207 monthly

- Cheapest professional liability insurance: The Hartford at $68 monthly

- Cheapest BOP insurance: Thimble at $76 monthly

What business insurance is required for tree service organizations?

You'll need workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability coverage becomes essential for securing commercial contracts.

How much does tree service business insurance cost?

Tree Service business insurance costs by coverage type are as follows:

- General Liability: $131/mo

- Workers' Comp: $221/mo

- Professional Liability: $75/mo

- BOP Insurance: $192/mo

How We Chose the Best Tree Service Business Insurance

Tree service companies encounter unique risks that generic small business rankings can't address. Workers climb trees near power lines, operate dangerous equipment and handle emergency storm cleanup. Our analysis focused specifically on which insurers understand these arborist-specific dangers and price their policies accordingly.

Our scoring system weighs four factors:

Affordability (50%): Premium costs determine whether tree service businesses can maintain coverage long term. We gathered quotes for four core coverage types using a standardized three-person business profile and compared each insurer's pricing against competitors. Lower costs relative to competition earned higher scores.

Customer service (30%): Claims experiences matter most when a climber gets injured or your bucket truck damages a customer's property. Our analysis combined industry studies, customer review forums and Reddit discussions to gauge how tree service contractors rate their insurers' responsiveness and claims handling.

Coverage (15%): Tree care operations need specialized protection for climbing gear, chippers, stump grinders and bucket trucks. We scored insurers on coverage flexibility, payment options and whether their policies actually protect the equipment arborists use daily.

Financial stability (5%): AM Best and Moody's ratings reveal which insurers can pay claims when your crew damages expensive property or a worker needs long-term care. We created composite ratings showing relative claim-paying reliability across competitors.

Base profile details: All pricing reflects a three-person tree service business with two employees, $150,000 payroll and $300,000 annual revenue. Coverage includes $1 million per occurrence and $2 million aggregate annually (BOP policies add $5,000 business property coverage). This profile represents typical small tree care operations across all states.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Removes From Under Review With Positive Implications and Upgrades Credit Ratings of Next Insurance US Company." Accessed October 13, 2025.