Finding the right painting business insurance protects your operation from liability claims and property damage. The Hartford earned our top recommendation with a MoneyGeek score of 4.55 out of 5, standing out for quality service and comprehensive coverage options. Thimble and Nationwide also offer strong protection for painting contractors at competitive rates.

Best Painting Contractor Business Insurance

The Hartford, Thimble and Nationwide offer the best cheap business insurance for painting companies, with rates starting at $57 monthly.

Discover the best business insurance provider for painting contractors.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Painting contractors need several types of business insurance, with general liability and workers' compensation being foundational, plus commercial auto and inland marine coverage for equipment protection.

The Hartford ranks as the best business insurance provider for painting companies, earning a MoneyGeek score of 4.55 for its reliable service and comprehensive coverage options.

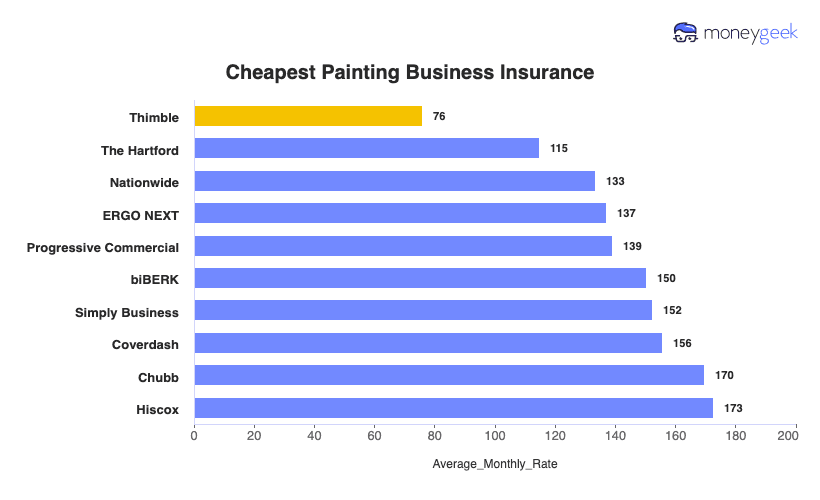

Thimble offers the cheapest business insurance for painters at $76 monthly, with general liability coverage starting at just $43 monthly for basic protection needs.

Best Business Insurance for Painting Contracting Businesses

| The Hartford | 4.55 | $115 |

| Thimble | 4.50 | $76 |

| Nationwide | 4.50 | $133 |

| ERGO NEXT | 4.46 | $137 |

| Simply Business | 4.30 | $152 |

| Chubb | 4.30 | $170 |

| biBERK | 4.30 | $150 |

| Coverdash | 4.20 | $156 |

| Progressive Commercial | 4.20 | $139 |

| Hiscox | 4.10 | $173 |

Note: We based all scores on a painting business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Painting Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your painting business, check out the following resources:

1. The Hartford: Best Overall for Painting Businesses

Leads in claims processing and customer service quality

Comprehensive coverage options tailored for painting contractors

Strong financial stability with A++ AM Best rating

Instant certificate of insurance available online 24/7

Digital experience ranks lower than competitor platforms

Not available in Alaska or Hawaii

Some policies require phone call to finalize

For painting businesses, The Hartford offers the most affordable professional liability coverage we studied at just $57 monthly, protecting you when clients dispute project quality or color choices. General liability costs $113 monthly on average, ranking second cheapest. The company ranks first for customer service and claims processing, essential when your crew member falls off a ladder or accidentally damages a client's hardwood floors during an interior job.

The Hartford understands painter-specific risks. You'll get contractors' equipment coverage for your spray rigs and scaffolding, plus instant certificates of insurance online when commercial clients require proof before you can start their project.

2. Thimble: Cheapest Overall for Painting Services

Cheapest rates for BOP and general liability coverage

Instant policy purchase and certificate of insurance online

Flexible coverage options by job, month or year

Ranks second nationally for digital experience and convenience

Customer service and claims processing rank below competitors

Primarily provides email and online chat support, not phone

Policies underwritten by partners, not Thimble directly

For painting businesses, Thimble offers the most affordable coverage we studied. Business owner's policies cost $67 monthly and general liability averages $43 monthly, both ranking first for affordability. Get insured instantly through their mobile app with immediate certificate access when property managers or homeowners require proof before your crew starts interior work or commercial repaints.

Thimble's flexibility suits painting contractors bidding varied projects, allowing you to buy coverage by job, month or year. The app ranks second nationally, letting you manage policies from job sites. Customer service and claims processing rank seventh and eighth, with limited phone support for complex situations.

Cheapest Business Insurance for Painting Services

Thimble offers the cheapest painting contractor insurance for most coverage types. General liability costs just $43 monthly, and business owner's policies run $67 monthly. Both coverage types rank first among providers we studied. For workers' compensation, ERGO NEXT Insurance leads at $66 monthly, with Thimble close behind at $67. The Hartford offers the most affordable professional liability coverage at $57 monthly, protecting you from client disputes over project quality.

| Thimble | $76 | $910 |

| The Hartford | $115 | $1,376 |

| Nationwide | $133 | $1,600 |

| ERGO NEXT | $137 | $1,646 |

| Progressive Commercial | $139 | $1,670 |

| biBERK | $150 | $1,805 |

| Simply Business | $152 | $1,829 |

| Coverdash | $156 | $1,867 |

| Chubb | $170 | $2,034 |

| Hiscox | $173 | $2,072 |

What Does Painting Business Insurance Cost?

In general, business insurance costs for painting contractors are the following for the four most popular coverage types:

- General Liability Cost: $144 on average per month, ranging from $43 to $194, depending on the state

- Workers' Comp: $140 on average per month, ranging from $132 to $162, depending on the state

- Professional Liability (E&O): $64 on average per month, ranging from $57 to $74, depending on the state

- BOP Insurance: $211 on average per month, ranging from $67 to $293, depending on the state

| BOP | $211 | $2,536 |

| General Liability | $144 | $1,733 |

| Workers' Comp | $140 | $1,686 |

| Professional Liability (E&O) | $64 | $765 |

What Type of Coverage Do You Need for a Painting Service Business?

Most states require painting business insurance policies including workers' compensation if you have employees, and general liability insurance is essential since clients and general contractors demand proof before letting you on-site. Beyond these required coverages for painting contractors, you'll want commercial auto to protect work vehicles and additional policies depending on your specific operations and risk exposure.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Painting Contractor Services

Finding the best and cheapest business insurance for your painting company takes a systematic approach. Getting business insurance doesn't need to be overwhelming when you compare coverage options and find the right protection at rates that fit your budget.

- 1Decide on Coverage Needs Before Buying

Think about what actually puts your painting business at risk: a painter falling off a ladder, overspray damaging a neighbor's car or someone tripping over your equipment. Talk to other painting contractors and experienced agents who work with trades to keep you from buying coverage you don't need while making sure you're protected when a client's hardwood floor gets ruined by spilled primer.

- 2Research Costs

Look up what other painting contractors pay for insurance in your state to know what's realistic. General liability usually costs $500 to $1,500 annually for smaller operations, while workers' comp depends on your payroll and state rates. Knowing these numbers helps you recognize a good deal and spot which insurers actually offer competitive rates for painting businesses.

- 3Look Into Company Reputations and Coverage Options

Read reviews from other contractors to see which insurers pay claims quickly when your equipment gets stolen or a homeowner sues over damaged property. Check whether insurers offer inland marine coverage for tools and equipment that travel between job sites, and ask how they handle common painting scenarios like overspray claims or injuries from chemical exposure.

- 4Compare Multiple Quotes Through Different Means

Get quotes from several sources since rates for painting contractors vary significantly between insurers. Independent agents compare multiple companies at once, saving you time. Going directly to websites like Progressive or The Hartford lets you control the process.

- 5Reassess Annually

Your painting operation evolves as you hire more crew members, invest in better sprayers and scaffolding, or start bidding commercial jobs. Check your coverage every year to confirm your policy limits reflect your current equipment value and employee count. Shop around to make sure you're still getting the best rates available for a painting business your size.

Best Painting Business Insurance: Bottom Line

Painting businesses need general liability and workers' compensation as essential protection, plus commercial auto and inland marine insurance to cover equipment moving between job sites. The Hartford offers the best overall coverage for painting contractors with reliable service and comprehensive options. Professional painters on a budget can get solid protection through Thimble, which starts at $43 monthly for general liability coverage.

Painting Business Insurance: FAQ

We answer frequently asked questions about painting business insurance:

Who offers the best painting business insurance overall?

The Hartford delivers the best overall business insurance for painting companies, earning a MoneyGeek score of 4.55 out of 5. Thimble and Nationwide tie for second place, both achieving solid 4.50 scores with competitive coverage options.

Who has the cheapest business insurance for painting firms?

Here are the cheapest business insurance companies for painting businesses by coverage type:

- Cheapest general liability insurance: Thimble at $43 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $132 monthly

- Cheapest professional liability insurance: The Hartford at $57 monthly

- Cheapest BOP insurance: Thimble at $67 monthly

What business insurance is required for painting organizations?

Painting businesses must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability insurance, while not legally mandated, is essential since most commercial clients and property managers require coverage before approving contracts.

How much does painting business insurance cost?

Painting business insurance costs by coverage type are as follows:

- General Liability: $144/mo

- Workers' Comp: $140/mo

- Professional Liability: $64/mo

- BOP Insurance: $211/mo

How We Chose the Best Painting Business Insurance

We selected the best business insurer for painting companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 13, 2025.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.