Running a handyman business means you need insurance that protects your tools, liability and income without breaking the bank. The Hartford tops our rankings with a MoneyGeek score of 4.75 out of 5, earning first place for its competitive rates, quality customer service and comprehensive coverage options for home repair businesses. Compare quotes from biBerk and Simply Business to find the best rates for your handyman service.

Best Handyman Business Insurance

The Hartford, biBerk and Simply Business offer the best cheap business insurance for handyman companies, with rates starting at $48 monthly.

Discover the best business insurance provider for your handyman services.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Handyman businesses need multiple types of coverage, including general liability, professional liability, workers' compensation and commercial auto insurance to protect against property damage and injury claims.

The Hartford offers the best business insurance for handyman services with a MoneyGeek score of 4.75, combining affordable rates with strong customer service for home repair contractors.

biBERK provides the cheapest business insurance at $139 monthly, with The Hartford providing the cheapest professional liability coverage starting at just $48 monthly for handyman contractors handling repair and installation work.

Best Business Insurance for Handyman Companies

| The Hartford | 4.75 | $144 |

| biBERK | 4.70 | $139 |

| Simply Business | 4.60 | $169 |

| Nationwide | 4.60 | $184 |

| Coverdash | 4.50 | $203 |

| Chubb | 4.50 | $224 |

| Thimble | 4.40 | $165 |

| Progressive Commercial | 4.40 | $182 |

| Hiscox | 4.40 | $198 |

| ERGO NEXT | 4.37 | $302 |

Note: We based all scores on a handyman business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Handyman Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your handyman business, check out the following resources:

1. The Hartford: Best Overall for Handyman Business

Best claims processing and customer service scores nationwide

Lowest professional liability rates at $48 monthly

Top scores across affordability, coverage and financial stability

A+ financial rating guarantees your claims get paid

Digital experience ranks last among business insurers

Not cheapest for general liability or workers' comp

For handyman services, The Hartford covers you when a client claims your repair work caused damage or didn't meet expectations. It helps you when you need quick answers about covering a damaged hardwood floor or a client's injury from tripping over your tools.

The Hartford's business owner's policy bundles general liability, tool coverage and income protection at $250 monthly. It covers everything from basic repairs to plumbing and electrical work. With an A+ AM Best financial rating and a MoneyGeek score of 4.75 out of 5, it ranks first for handyman insurance across every category we measured.

2. biBerk: Cheapest Overall for Handyman Services

Cheapest general liability and business owner's policy rates

Get quotes and buy coverage online in minutes

Berkshire Hathaway backing with A++ financial ratings

Professional liability and workers' comp insurance cost more than other carriers

For handyman businesses keeping costs low, biBerk ranks third nationally for overall satisfaction, which matters when you need to file claims for scratched floors, broken fixtures or client injuries from your work. It offers handyman-specific add-ons for tool theft, equipment damage and hired vehicle coverage.

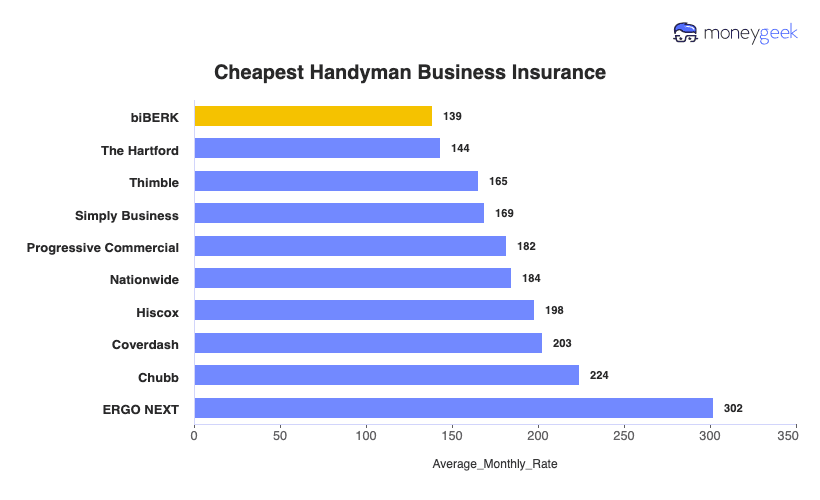

Cheapest Business Insurance for Handyman Services

For handyman businesses looking to minimize insurance costs, biBerk offers the most affordable rates at $139 monthly or $1,666 annually. biBerk ranks first for general liability ($175 monthly) and business owner's policies ($226 monthly), making it the best choice for handyman coverage. For workers' compensation and professional liability, The Hartford ($45 monthly for workers' comp, $48 monthly for professional liability) and ERGO NEXT ($44 monthly for workers' comp) offer better rates for home repair businesses with employees.

| biBERK | $139 | $1,666 |

| The Hartford | $144 | $1,722 |

| Thimble | $165 | $1,983 |

| Simply Business | $169 | $2,026 |

| Progressive Commercial | $182 | $2,183 |

| Nationwide | $184 | $2,214 |

| Hiscox | $198 | $2,373 |

| Coverdash | $203 | $2,434 |

| Chubb | $224 | $2,687 |

| ERGO NEXT | $302 | $3,624 |

What Does Handyman Business Insurance Cost?

In general, business insurance costs for handyman contractor services are the following for the four most popular coverage types:

- General Liability Cost: $245 on average per month, ranging from $175 to $416, depending on the state

- Workers' Comp: $94 on average per month, ranging from $88 to $103, depending on the state

- Professional Liability (E&O): $54 on average per month, ranging from $48 to $63, depending on the state

- BOP Insurance: $363 on average per month, ranging from $226 to $636, depending on the state

| BOP | $363 | $4,353 |

| General Liability | $245 | $2,943 |

| Workers' Comp | $94 | $1,125 |

| Professional Liability (E&O) | $54 | $651 |

What Type of Coverage Do You Need for a Handyman Business?

The required coverage for handyman businesses vary by state, but you'll need workers' compensation if you hire helpers and commercial auto insurance when driving your work truck to job sites. Most clients also demand proof of general liability before you start fixing their cabinets or repairing their plumbing, while professional liability protects you when customers claim your work caused them financial harm.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Handyman Company

Finding the best and cheapest business insurance for your handyman company starts with getting business insurance quotes from at least three carriers and comparing coverage limits alongside premiums.

- 1Decide on Coverage Needs Before Buying

Consider risks like accidentally damaging a client's newly installed cabinets, your drill puncturing a hidden water line or a homeowner tripping over your tools. Talk to other handyman contractors about claims they've faced to avoid overbuying coverage for unlikely scenarios.

- 2Research Costs

Compare what handyman services with similar revenue and employee counts pay in your state. Contractors who handle basic repairs pay less than those doing electrical or plumbing work, which helps you spot overpriced quotes and identify competitive carriers.

- 3Look Into Company Reputations and Coverage Options

Check reviews about property damage claims and how quickly insurers reimburse stolen tools. Verify coverage includes your services like deck repairs, drywall installation, fixture replacements and any electrical or plumbing work requiring licenses in your area.

- 4Compare Multiple Quotes Through Different Means

Independent agents understand handyman risks better than online-only quotes that may underprice your actual exposure. Compare identical liability limits and tool coverage amounts, since your $12,000 tool collection and occasional subcontractors impact premiums.

- 5Reassess Annually

Adding a work van, hiring your first employee or expanding from basic repairs to bathroom remodels changes your insurance needs. Review coverage when you buy expensive equipment, increase your service radius or take on higher-value renovation projects.

Best Business Insurance for a Handyman: Bottom Line

Handyman businesses need several coverage types, such as general liability, professional liability, workers' compensation and commercial auto coverage, to cover client property damage and injury claims. The Hartford offers the best small business insurance for handyman services, balancing affordable rates with strong customer service.

Handyman Insurance: FAQ

We answer frequently asked questions about handyman business insurance:

Who offers the best handyman business insurance overall?

The Hartford delivers the best business insurance for handyman firms, earning a MoneyGeek score of 4.75 out of 5. biBERK follows closely with a score of 4.70, offering competitive rates and solid coverage options.

Who has the cheapest business insurance for handyman firms?

Here are the cheapest business insurance companies for Handyman companies by coverage type:

- Cheapest workers' comp insurance: ERGO NEXT at $88 monthly

- Cheapest general liability insurance: biBERK at $175 monthly

- Cheapest professional liability insurance: The Hartford at $48 monthly

- Cheapest BOP insurance: biBERK at $226 monthly

What business insurance is required for handyman organizations?

Workers' compensation (for employees) and commercial auto insurance (for business vehicles) are legally mandated for handyman businesses, though requirements differ by state. General liability insurance and surety bonds are practically essential since most clients and property managers require them.

How much does handyman business insurance cost?

Handyman business insurance costs by coverage type are as follows:

- General Liability: $245/mo

- Workers' Comp: $94/mo

- Professional Liability: $54/mo

- BOP Insurance: $363/mo

How We Chose the Best Handyman Business Insurance

We selected the best business insurer for handyman companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.