Yes, several major insurers offer car insurance for $50 or less monthly. These affordable rates apply to minimum coverage that meets your state's legal requirements but won't pay for damage to your own vehicle. Your policy covers injuries and damage you cause to others, though you'll need full coverage to protect your own car.

Car Insurance Under 50 Dollars

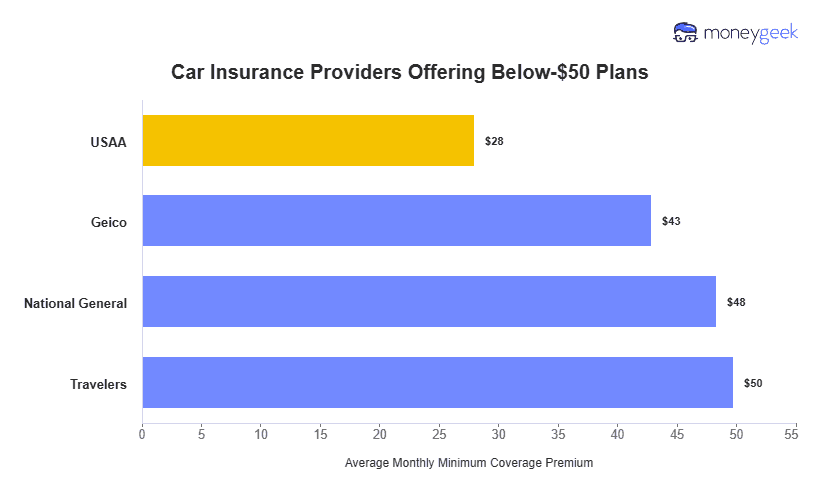

GEICO is the best option for below-$50 car insurance for most drivers at $43 per month. Military families pay even less with USAA.

Compare personalized quotes to see how much the average driver can save on coverage under $50 each month.

Updated: February 9, 2026

Advertising & Editorial Disclosure

Car insurance under $50 usually means minimum coverage that meets your state's legal requirements but won't cover damage to your own vehicle.

GEICO and USAA offer the cheapest minimum coverage options, averaging $28 to $43 monthly.

Compare quotes from multiple insurers, maintain good credit and ask about discounts to find car insurance under $50 monthly.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Can You Get Car Insurance Under $50?

Car Insurance Companies With Rates Under $50 per Month

You'll find minimum coverage under $50 monthly from several major insurers beyond USAA and GEICO. Compare average rates below to identify your cheapest option.

*These rates are based on a 40-year-old male driver with a clean driving record and no traffic violations carrying minimum coverage.

Find Car Insurance Under $50 in Your State

Car insurance costs vary widely by state due to different minimum coverage requirements, local risk factors and the number of insurers competing for your business. States with lower requirements and multiple competing carriers make finding coverage under $50 monthly easier.

Regional insurers often charge less than national carriers, particularly in states with competitive local markets. Check your state below to find insurers offering minimum coverage under $50 monthly in your area.

| AIG | $22 |

| Cincinnati Insurance | $25 |

| Auto Owners | $44 |

| Geico | $44 |

| Travelers | $48 |

*Not all states have minimum coverage options under $50 monthly due to regional pricing differences.

Minimum coverage includes bodily injury liability and property damage liability. Some states also require personal injury protection (PIP) or uninsured/underinsured motorist coverage (UM/UIM).

Minimum coverage satisfies legal requirements but won't pay for damage to your own vehicle. Full coverage adds comprehensive and collision protection, covering your car if it's damaged or stolen. Full coverage costs more than $50 monthly and is required for financed vehicles.

Choose minimum coverage if your car is older or has low market value. Choose full coverage for newer vehicles to protect your investment and satisfy lender requirements.

5 Ways to Lower Your Car Insurance Below $50

Getting car insurance under $50 requires smart coverage choices and strategic shopping. Compare quotes, maximize discounts and maintain good credit to find the cheapest rates in your state. Navigate how to get car insurance with confidence using these tips.

- 1Choose Minimum Coverage

Minimum coverage offers the lowest rates since it includes only liability protection required by your state. This type of car insurance coverage works best for older vehicles with low market value. You'll save money on premiums but won't get reimbursed for damage to your own car.

- 2Maximize Available Discounts

Ask insurers about all available discounts before buying. Bundle your auto and home or renters policies, maintain a clean driving record and complete a defensive driving course. Low-mileage discounts apply if you drive fewer than 7,500 miles annually.

- 3Compare Quotes Every Six Months

Compare quotes from at least three insurers at each renewal period to find your lowest rate. Switching car insurance companies when you find better rates ensures you don't overpay as your circumstances or market conditions change.

- 4Consider Pay-per-Mile Insurance

Pay-per-mile policies charge based on actual miles driven. If you drive fewer than 8,000 miles yearly, you'll pay less than traditional policies. This works well for remote workers or students who rarely drive.

- 5Improve Your Credit Score

Most states allow insurers to use credit scores when setting rates. Pay bills on time and reduce debt to improve your score and lower your premiums over time.

Compare customer service ratings and claims satisfaction scores alongside price. The cheapest insurer won't help you if it denies valid claims or makes you wait months for payment.

The best way to find $50 car insurance is to get quotes from the cheapest car insurance companies first. Compare these quotes to rates from the best car insurance companies to see which option offers the most value for your needs. Free tools like the one below can help.

Auto Insurance Under $50: Bottom Line

Finding car insurance under $50 monthly is possible with minimum coverage from the best car insurance companies. GEICO and USAA offer the lowest rates, and you'll cut costs further by maintaining good credit, driving safely and maximizing discounts.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Under $50 Car Insurance: FAQ

Finding car insurance for $50 or less is possible. Here are answers to common questions about $50 car insurance.

Is it possible to have car insurance under $50?

Yes, you can find car insurance under $50 monthly with minimum coverage. USAA charges $28 and GEICO charges $43 on average for drivers with clean records. Your rate depends on your state's coverage requirements, driving history and vehicle type.

Which insurers offer car insurance under $50?

USAA, GEICO, National General and Travelers offer minimum coverage under $50 monthly. USAA charges the least at $28 for military families, followed by GEICO at $43. These rates reflect a 40-year-old driver with a clean record. Your actual rate varies by state, driving record and available discounts.

What can I do to get my car insurance under $50?

To get your car insurance under $50, maintain a clean driving record, compare quotes from multiple insurers and apply all available discounts. Ask about safe-driver, bundling and low-mileage discounts. Shopping around every six months helps you find affordable rates while meeting your state's minimum coverage requirements.

What factors affect car insurance rates the most?

Your driving record, credit score, age, location and vehicle type affect rates most. Coverage level, deductibles and available discounts also influence your premium. Good credit and safe driving habits lower your monthly costs for minimum coverage.

Is minimum coverage car insurance worth it?

Minimum coverage meets legal requirements and works well for older vehicles or cars with low market value you can afford to replace. It won't pay for damage to your own vehicle or theft, so evaluate your car's value and your savings before choosing minimum coverage.

Can you get full coverage car insurance for $50?

Full coverage adds comprehensive and collision protection to your liability policy, which raises premiums above $50 monthly. Most drivers pay $100 to $200 monthly for full coverage. Only minimum coverage policies qualify for rates under $50.

Can high-risk or ticketed drivers get car insurance under $50?

High-risk drivers with tickets or accidents pay more than $50 monthly for minimum coverage. Complete a defensive driving course and compare quotes from multiple insurers to find your lowest rate. A clean record for three to five years restores your eligibility for cheaper rates.

Best Car Insurance Rates Below $50: Our Methodology

Finding car insurance under $50 monthly sounds too good to be true, and for most drivers, it is. We designed this research to show you which drivers actually qualify for these ultra-low rates and what coverage trade-offs you'll face.

Using data from Quadrant Information Services and state insurance departments, we analyzed 83,056 quotes from 46 companies in 473 ZIP codes.

Below $50 Car Insurance: Related Articles

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.