The Hartford ranks as the best business insurance for courier companies, providing quality service and affordable coverage at $178 monthly.

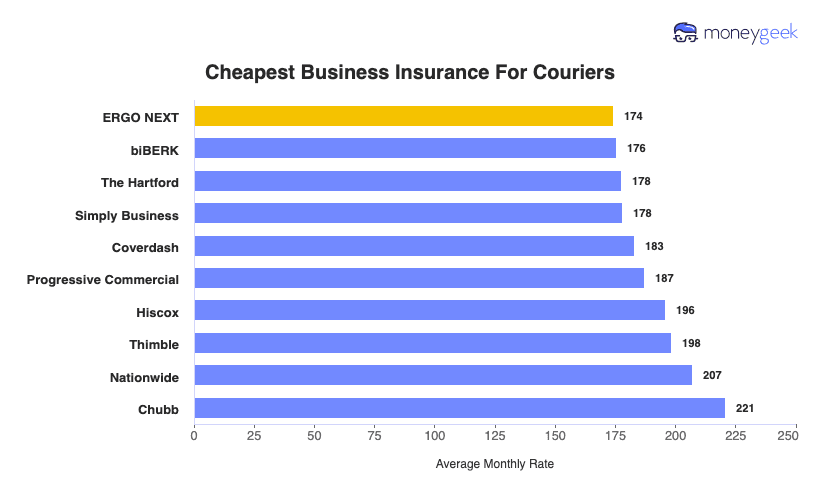

Our analysis of 10 insurers serving courier businesses and delivery services found ERGO NEXT and Simply Business tied for second, followed by biBERK and Coverdash. Compare quotes from these providers to find the right protection for your courier operation.