The Hartford earns the top spot for pet care business insurance with a MoneyGeek score of 4.74. We found The Hartford offers the most comprehensive coverage options at competitive rates, with monthly premiums starting around $43 for pet sitters and dog walkers. However, we recommend comparing quotes other top-rated carriers for pet sitting businesses and pet care services to help you find the right coverage at the best price for your operation.

Best Pet Care Business Insurance

The Hartford, biBerk and ERGO NEXT offer the best cheap business insurance for pet care companies, with rates starting at $30 monthly.

Get personalized quotes from the best pet care business insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Pet care businesses need multiple coverage types to protect against daily risks of caring for clients' pets, including general liability, animal bailee and workers' compensation.

The best business insurance for pet care professionals comes from The Hartford, which ranks first for customer service, claims processing and offers comprehensive animal bailee coverage at competitive rates.

Thimble offers the cheapest business insurance for pet care businesses at $42 monthly, with the lowest rates for workers' compensation averaging $30 monthly.

Best Business Insurance for Pet Care Companies

| The Hartford | 4.74 | $43 |

| biBERK | 4.60 | $49 |

| ERGO NEXT | 4.57 | $52 |

| Thimble | 4.50 | $42 |

| Nationwide | 4.40 | $59 |

| Progressive Commercial | 4.40 | $52 |

| Hiscox | 4.30 | $56 |

| Chubb | 4.30 | $64 |

| Simply Business | 4.30 | $67 |

| Coverdash | 4.20 | $63 |

Note: We based all scores on a pet business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Pet Care Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your pet care business, explore these resources:

1. The Hartford: Best Overall for Pet Care Businesses

Leads in claims processing and customer service for pet businesses

Offers animal bailee coverage protecting pets in your care

Charges lowest rates for professional liability at $41 monthly

Maintains A+ financial rating for reliable claim payments

Digital experience score lags behind competitors

Requires phone calls for business insurance quotes

For pet sitters, dog walkers and pet care providers, The Hartford delivers the best balance of affordability and service. What sets Hartford apart is its animal bailee coverage, which covers veterinary bills and advertising costs to recover missing pets.

2. Thimble: Cheapest Overall for Pet Care Businesses

Charges lowest rates for general liability and BOP coverage

Ranks second for digital experience among the providers in our study

Offers flexible hourly or daily policies for pet sitters

Delivers instant certificates of insurance through mobile app

Claims processing ranks seventh

Customer service scores lower than competitors

For pet sitters and dog walkers who work part-time or seasonally, Thimble delivers the cheapest coverage with flexible payment options.

Thimble's key advantage for pet care providers is on-demand coverage by the hour, day or month. You pay only when working, making it ideal for side businesses. Its policies include animal bailee coverage, which protects you if a pet in your care gets injured or lost.

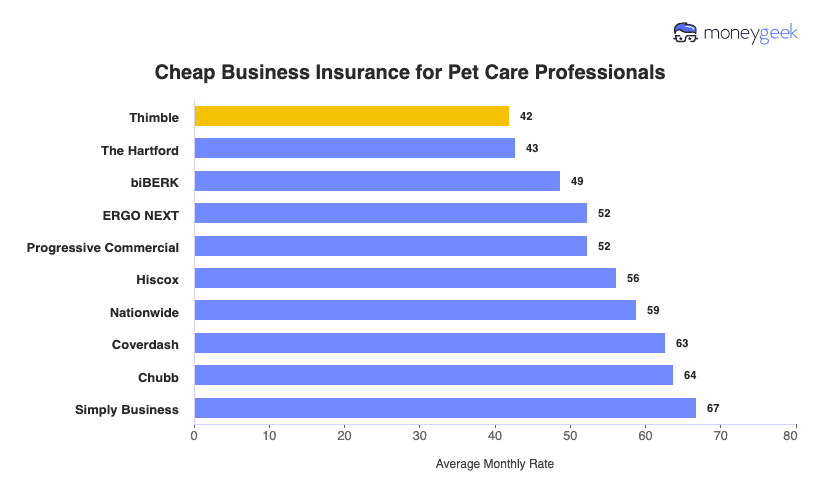

Cheapest Business Insurance for Pet Care Companies

Thimble offers the cheapest pet care business insurance at $42 monthly or $503 annually. Pet sitters and dog walkers get the lowest rates with Thimble for general liability ($36 monthly) and BOP coverage ($56 monthly). For workers' compensation, ERGO NEXT and The Hartford charge less at $29 monthly. The Hartford also has the most affordable professional liability at $41 monthly for pet care services.

| Thimble | $42 | $503 |

| The Hartford | $43 | $513 |

| biBERK | $49 | $584 |

| ERGO NEXT | $52 | $627 |

| Progressive Commercial | $52 | $627 |

| Hiscox | $56 | $674 |

| Nationwide | $59 | $705 |

| Coverdash | $63 | $751 |

| Chubb | $64 | $765 |

| Simply Business | $67 | $802 |

What Does Pet Care Business Insurance Cost?

In general, pet care business insurance costs are the following for the four most popular coverage types:

- General Liability: $56 on average per month, ranging from $49 to $66, depending on the state

- Workers' Comp: $31 on average per month, ranging from $27 to $36, depending on the state

- Professional Liability (E&O): $46 on average per month, ranging from $39 to $53, depending on the state

- BOP Insurance: $83 on average per month, ranging from $72 to $96, depending on the state

| BOP | $83 | $997 |

| General Liability | $56 | $675 |

| Professional Liability (E&O) | $46 | $553 |

| Workers' Comp | $31 | $370 |

What Type of Insurance Is Best for a Pet Care Company?

Workers' compensation becomes legally required once you hire employees for your dog walking or pet sitting business. Beyond required coverages for pet care professionals, general liability and animal bailee insurance protect you from the daily risks of caring for pets and working in clients' homes.

- Workers' Compensation Insurance: Required by law in most states once you hire employees for your dog walking or pet daycare business. Covers medical bills and lost wages when staff get bitten, injure their backs lifting dogs, or slip on wet kennel floors at your facility.

- Commercial Auto Insurance: Covers accidents when transporting pets to grooming appointments, vet visits, or dog parks in your vehicle. Required if your pet care service uses vehicles for business purposes, protecting against damage and injury claims during pet transportation.

- General Liability Insurance: Protects your pet care business when a dog bites someone during a walk or destroys a client's couch while you're pet sitting. Most clients require proof of coverage with $1 million to $2 million limits before hiring you for dog walking or pet sitting services.

- Animal Bailee Coverage: Protects your pet sitting business when animals in your care get injured, become ill, or go missing during walks or overnight stays. Covers veterinary bills and search costs that standard general liability policies exclude for pets under your direct supervision.

- Professional Liability Insurance: Covers your pet care service if clients claim your grooming damaged their show dog's coat or your training failed to correct behavioral problems. Pet sitters and dog walkers typically carry $1 million in coverage for professional mistakes and negligence claims.

- Commercial Property Insurance: Protects equipment your pet care business uses daily, from leashes and crates to grooming tools and computers. Critical if you operate a physical location like a pet daycare, boarding facility, or grooming salon where you store valuable supplies and equipment.

- Business Owner's Policy: Bundles general liability and property insurance at lower rates for pet care businesses operating from home or renting space. Dog walkers and pet sitters save 15% to 25% buying coverages together rather than separately, with typical limits around $1 million.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Pet Care Company

Here's our step-by-step guide to getting business insurance for your pet care business at the best rates.

- 1Decide on Coverage Needs Before Buying

Consider risks your pet care business faces: dogs biting clients during walks, pets destroying furniture while you're sitting or animals escaping from your care. Talk with other dog walkers and pet sitters about their claims experiences to learn which coverages protect you best.

- 2Research Costs

Compare what pet sitting and dog walking businesses typically pay for insurance in your area. Check rates for general liability, animal bailee coverage and workers' compensation if you employ staff. Knowing average costs helps you identify competitive pricing and avoid overpaying for coverage.

- 3Look Into Company Reputations and Coverage Options

Read reviews from other pet care professionals about their claims experiences, particularly for animal-related incidents. Verify insurers offer animal bailee coverage for pets in your care and cover the specific services your business provides like dog walking, pet sitting, grooming or training.

- 4Compare Multiple Quotes Through Different Means

Request quotes from at least three insurers for your dog walking or pet sitting business using online tools, independent agents and direct calls. Some carriers offer discounts for pet care professionals or bundle savings when you combine general liability with animal bailee coverage.

- 5Reassess Annually

Your pet care business evolves as you add services like grooming or training, hire staff or grow your client base. Review your coverage yearly to maintain adequate protection for new risks while keeping competitive rates for your pet sitting or dog walking business.

Pet Care Business Insurance: Bottom Line

Pet sitters and dog walkers need specialized coverage for risks like pet injuries and employee accidents. The Hartford offers the strongest combination of animal bailee protection and claims processing for pet care businesses. Budget-focused providers save most with Thimble at $42 monthly, including workers' compensation coverage at $30 monthly.

Pet Care Insurance: FAQ

We answer frequently asked questions about pet business insurance:

Who offers the best pet care business insurance overall?

The Hartford delivers the best overall business insurance for pet companies, earning a MoneyGeek score of 4.74 out of 5. biBERK ranks second with excellent affordability and customer service, scoring 4.60 overall.

Who has the cheapest business insurance for pet care firms?

Here are the cheapest business insurance companies for pet care businesses by coverage type:

- Cheapest general liability insurance: Thimble at $36 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $29 monthly

- Cheapest professional liability insurance: The Hartford at $41 monthly

- Cheapest BOP insurance: Thimble at $56 monthly

What business insurance is required for pet care organizations?

Pet businesses must carry workers' compensation insurance if they have employees and commercial auto insurance for business vehicles, with specific requirements differing by state. General liability coverage is essential for client contracts and property leases.

How much does pet business insurance cost?

Pet business insurance costs by coverage type are as follows:

- General Liability: $56/mo

- Workers' Comp: $31/mo

- Professional Liability: $46/mo

- BOP Insurance: $83/mo

How We Chose the Best Pet Care Business Insurance

We selected the best business insurer for pet companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed February 7, 2026.