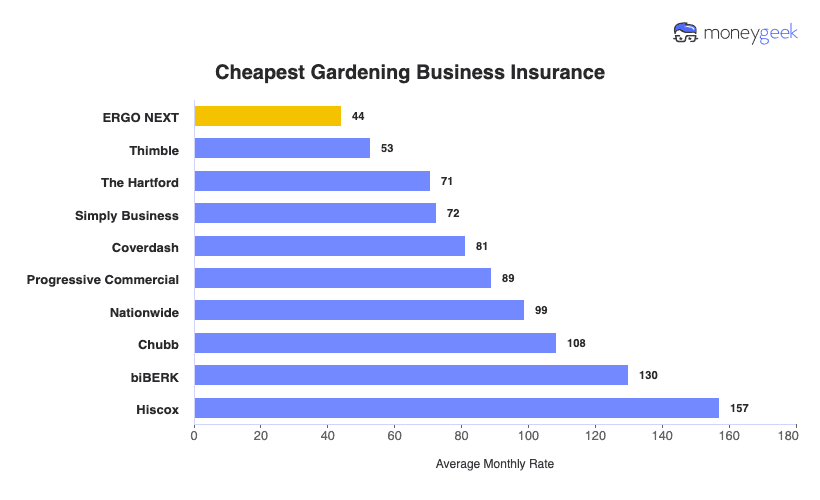

ERGO NEXT earned the top ranking for gardening businesses with a MoneyGeek score of 4.82 out of 5. It excels across all categories and offers comprehensive protection starting at $44 monthly or $531 annually.

We recommend comparing quotes from our other top picks, such as The Hartford, Thimble, Simply Business and Coverdash, to find the best fit for your gardening service.