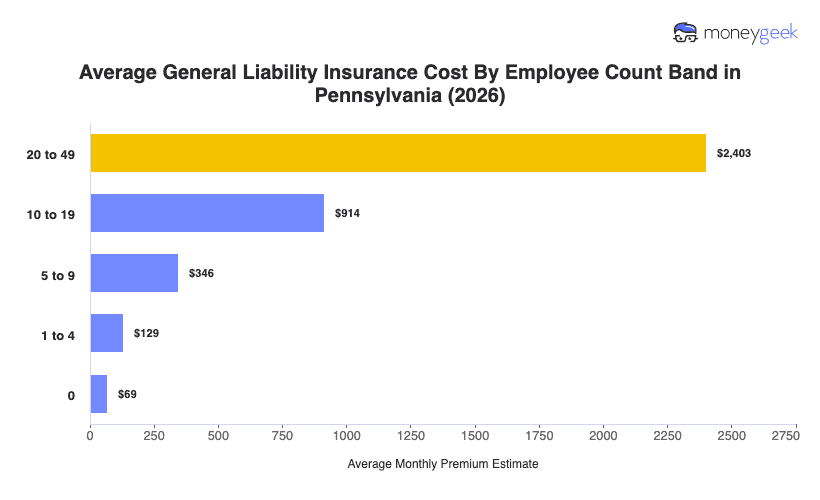

The cost of general liability insurance in Pennsylvania averages $129 monthly ($1,545 annually) for businesses with one to four employees across over 400 business types. That rate places Pennsylvania 31st nationally for affordability, roughly $6 below the U.S. benchmark.

Pennsylvania shares the Mid-Atlantic region with New Jersey and New York, both of which are also geographically adjacent. Pennsylvania sits between these clusters, pricier than Midwestern markets (New Jersey at $160 monthly, New York at $180 monthly), but more affordable than its eastern neighbors (Ohio at $110 monthly). The gap reflects differences in litigation climate and commercial density: New Jersey and New York face higher claim costs from plaintiff-friendly courts and concentrated business districts, while Ohio benefits from different tort structures and lower settlement patterns.

The state average provides a useful reference point, though actual costs shift based on operational factors. That means a contractor with five employees and prior claims will pay considerably more than a consultant with no staff and clean history, even under identical coverage limits. Use the state average as orientation rather than prediction since the variables specific to your business determine where you fall in the distribution.