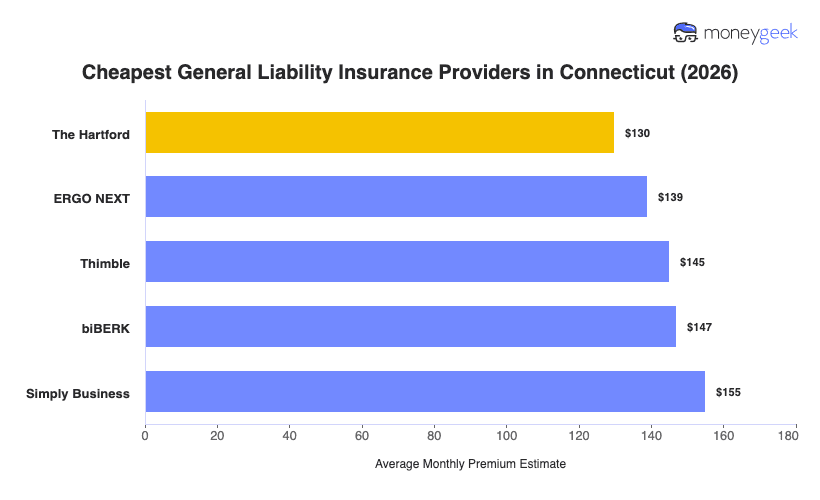

The Hartford, NEXT Insurance, Thimble and biBERK rank as the cheapest general liability insurance providers across over 400 business types in Connecticut based on our analysis.

- The Hartford: Offers the lowest rates for healthcare providers, professional services, creative businesses, tech companies and restaurants (medical practices, consulting firms, photography studios, web development, full-service dining).

- ERGO NEXT: Ranks cheapest across construction trades, agriculture operations, personal services, food vendors and transportation (electrical contractors, plant nurseries, beauty salons, food trucks, towing services).

- Thimble: Often provides the most affordable coverage for general contractors, specialty trades, outdoor services and property maintenance (carpentry, masonry, lawn care, handyman services).

- biBERK: Usually cheapest for cleaning operations, fitness businesses, medical specialists, hospitality and repair shops (janitorial services, gyms, urgent care clinics, hotels, auto repair).

>> [Click each provider to learn more about each provider]

Rates vary based on your specific business type, revenue, location within Connecticut, and claims history. Use these providers as a starting point, then compare quotes based on your business details.