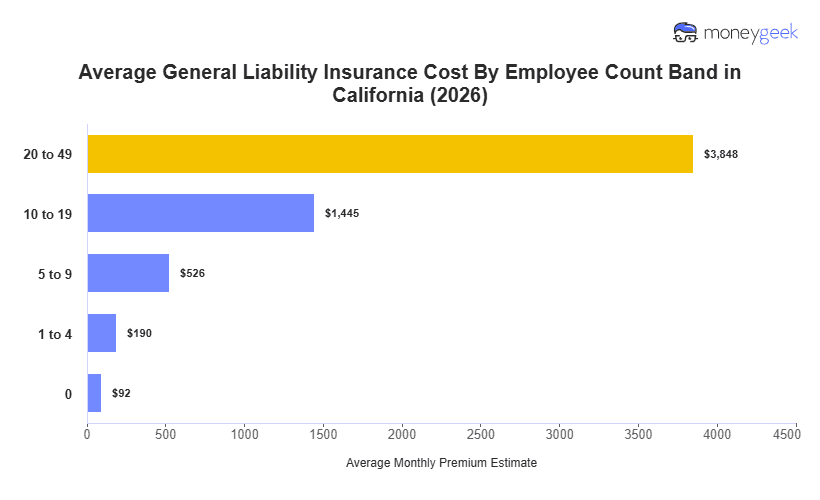

For most California small businesses, their general liability insurance rates will be the most expensive in the United States at an average of $190 monthly ($2,285 annually) sitting at 54% higher than national benchmarks. This represents small companies with 1 to 4 employees and limits of $1 million per occurrence/$2 million aggregate.

Even states neighboring or in the same region as California do not stack up even close to this figure, with Washington being the closest to this average price point at $152/mo. Its closest comparison is with states on the opposite end of the country with it's closest pricing neighbors being Washington D.C., New York, Massachusetts and New Jersey.

Keep in mind that our pricing is only a state benchmark and should not be treated as a quote you'll receive. Your actual pricing will mostly depend on your industry area and your business size among other factors within your operating location to consider.