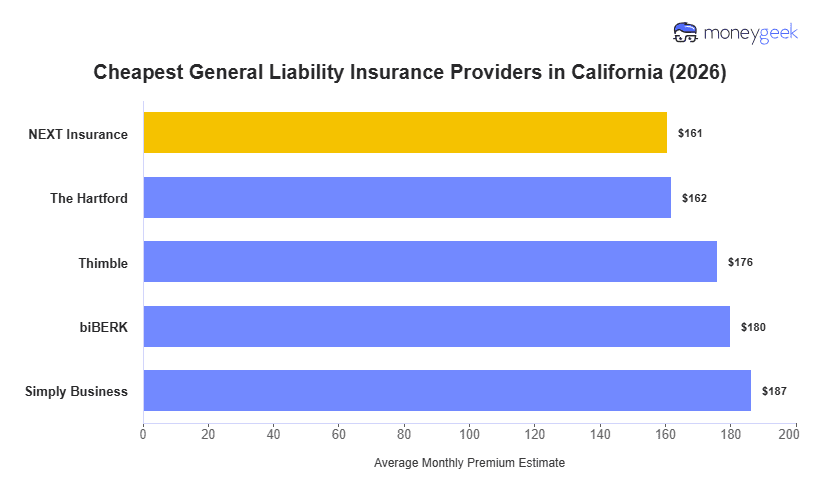

We analyzed quotes from major insurance carriers across over 400 business types in California and found these five providers offer the most affordable general liability rates for small businesses:

- ERGO NEXT: Ranks cheapest across trades and customer-facing operations (construction contractors, beauty and wellness, restaurants and bars, retail shops)

- The Hartford: Offers the lowest rates for healthcare providers and professional service businesses (medical practices, creative professionals, financial services)

- Thimble: Often provides the most affordable coverage for specialty construction and outdoor service businesses (arborists, excavation, pest control, lawn care)

- biBERK: Usually cheapest for recreation (fitness centers, sports teams) and cleaning businesses

- Simply Business: Cheapest for select art, media and entertainment businesses (art galleries, video production/editing,

>> [Click Each Provider To Learn More]

Insurers factor your industry, annual revenue, employee count and specific location when pricing policies. For example, a San Francisco tech startup will pay different rates than a Napa Valley winery or a Los Angeles entertainment production company, even with the same coverage. Use these findings as a starting point, then get quotes tailored to your business.