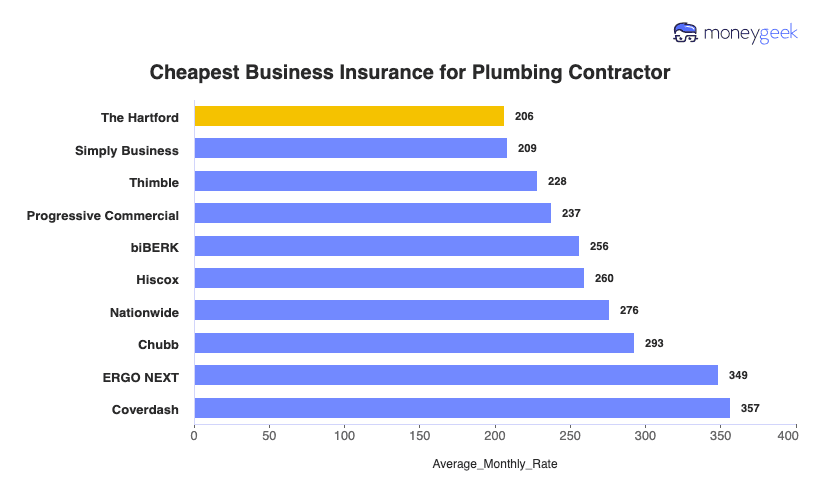

The Hartford leads our rankings for plumbing contractor insurance with a MoneyGeek score of 4.78 out of 5, with perfect scores across all categories we analyzed: affordability, customer service and coverage options. It balances comprehensive protection with competitive pricing at $206 monthly ($2,477 annually).

We recommend comparing quotes from Simply Business, Thimble, Progressive Commercial and biBerk to find the best coverage for your plumbing service.