ERGO NEXT leads our rankings for engineering business insurance with a 4.75 out of 5 MoneyGeek score, providing affordable coverage with quality service at $53 monthly. The Hartford follows closely as our second-best choice for engineering firms, while biBERK offers the most budget-friendly option at $42 per month. Compare quotes from all three to find the right coverage for your engineering company.

Best Engineering Business Insurance

ERGO NEXT, The Hartford and biBerk offer the best cheap business insurance for engineering firms, with rates starting at $17 monthly.

Get matched to the best business insurance for engineering companies.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Engineering firms need several types of business insurance, including general liability, professional liability, commercial property and workers' compensation coverage.

ERGO NEXT ranks as the best business insurance provider for engineering businesses with a MoneyGeek score of 4.75 out of 5, balancing affordability, customer service and coverage options.

biBERK offers the cheapest business insurance for engineers at $42 monthly, with general liability coverage starting at just $17 per month.

Best Business Insurance for Engineering Companies

| ERGO NEXT | 4.75 | $53 |

| The Hartford | 4.73 | $53 |

| biBERK | 4.70 | $42 |

| Nationwide | 4.50 | $58 |

| Thimble | 4.40 | $66 |

| Progressive Commercial | 4.40 | $63 |

| Chubb | 4.30 | $68 |

| Simply Business | 4.30 | $65 |

| Coverdash | 4.20 | $56 |

| Hiscox | 4.20 | $58 |

Note: We based all scores on a engineering business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Engineering Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your engineering business, see the following resources:

1. ERGO NEXT: Best Overall for Engineering Businesses

Best digital experience and highest recommendation rate among engineering business insurers

Lowest workers' compensation costs for engineering firms

Instant online quotes and 24/7 policy management through mobile app

Bundle discount saves up to 10% when combining multiple coverage types

Certificates of insurance are available instantly at no extra fee

General liability ranks eighth in affordability

Claims process scores lower than overall customer satisfaction

Newer company founded in 2016 with less industry history than competitors

ERGO NEXT's professional liability coverage addresses engineering-specific risks like design errors and miscalculations that cause financial losses. It also ranks first for digital experience in our customer survey, making it good for consulting engineers managing multiple projects who can't wait days for traditional agents to process paperwork.

2. biBERK: Cheapest Overall for Engineering Companies

Cheapest general liability and BOP for engineering firms

Part of Berkshire Hathaway with A++ AM Best rating for financial stability

Ranks third for claims processing (4) and overall satisfaction (4.3) nationally

Easy online certificate generation without waiting for agents

Lets you buy directly online without paying extra broker or agent fees

Workers' compensation ranks 8th in affordability

Fewer policy customization choices than competitors

Some customers report long wait times for phone support

Backed by Berkshire Hathaway's A++ rating, the low costs of this insurer give engineering business owners savings without compromising financial protection.

Engineering professionals praise the instant online certificate generation, which is crucial when clients or general contractors require proof of insurance before project kickoff.

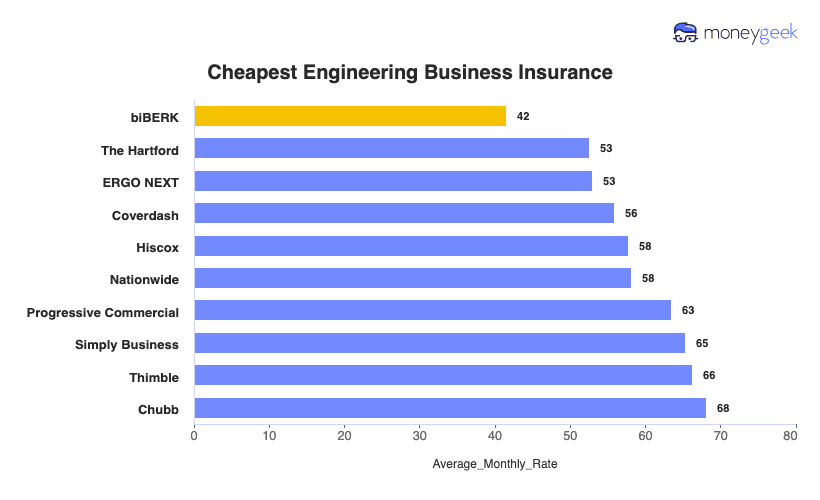

Cheapest Business Insurance for Engineering Firms

Based on our analysis of engineering business insurance costs, biBERK offers the most affordable coverage at $42 monthly ($498 annually) for engineering firms. biBERK ranks first for general liability at $17 monthly and business owner's policies at $22 monthly.

For workers' compensation, ERGO NEXT ($18 monthly) and The Hartford ($18 monthly) provide cheaper options than biBERK's monthly rate.

| biBERK | $42 | $498 |

| The Hartford | $53 | $631 |

| ERGO NEXT | $53 | $636 |

| Coverdash | $56 | $670 |

| Hiscox | $58 | $693 |

| Nationwide | $58 | $698 |

| Progressive Commercial | $63 | $761 |

| Simply Business | $65 | $783 |

| Thimble | $66 | $795 |

| Chubb | $68 | $816 |

What Does Engineering Business Insurance Cost?

In general, business insurance costs for engineering companies are the following for the four most popular coverage types:

- General Liability Cost: $40 on average per month, ranging from $17 to $72, depending on the state

- Workers' Comp: $38 on average per month, ranging from $36 to $44, depending on the state

- Professional Liability (E&O): $104 on average per month, ranging from $72 to $132, depending on the state

- BOP Insurance: $49 on average per month, ranging from $22 to $73, depending on the state

| Professional Liability (E&O) | $104 | $1,248 |

| BOP | $49 | $583 |

| General Liability | $40 | $482 |

| Workers' Comp | $38 | $459 |

What Type of Coverage Do You Need for a Engineering Business?

Business insurance requirements for engineers include workers' compensation in most states, but professional liability (errors and omissions) insurance is equally important since clients won't sign contracts without proof of coverage. Beyond these, engineering firms should add general liability, commercial auto and business owner's policies depending on whether they maintain physical offices, employ staff or travel to job sites regularly.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Engineering Company

Follow our step-by-step method for getting business insurance that protects your engineering firm without overpaying.

- 1Decide on Coverage Needs Before Buying

What happens if your structural calculations cause a building defect or your CAD designs lead to construction errors? Engineering mistakes can cost millions. Talk to engineers in your specialty about claims they've seen, then match coverage to your actual project risks.

- 2Research Costs

A solo mechanical engineer pays vastly different rates than a 10-person civil engineering firm doing municipal projects. Research costs specific to your engineering discipline and project types. Knowing typical rates for firms like yours prevents overpaying or buying inadequate coverage.

- 3Look Into Company Reputations and Coverage Options

Read reviews from engineering firms that filed professional liability claims, not just routine property damage. Does the insurer understand engineering E&O claims? Can they cover you if you expand from residential to commercial projects or add new engineering services?

- 4Compare Multiple Quotes Through Different Means

Get quotes from insurers who understand engineering, not just generic business insurance. Independent agents access specialty carriers covering niche engineering work. Call directly to ask about discounts for PE licensure, continuing education or professional association memberships.

- 5Reassess Annually

Hiring another licensed engineer, using drones for site surveys or switching from consulting to design-build projects changes your liability exposure. Review coverage each renewal, especially after expanding services or increasing project values. Your business evolves, and your insurance should too.

Best Insurance for Engineering Business: Bottom Line

Finding affordable business insurance for your engineering firm starts with understanding what coverage you need. General liability, professional liability, commercial property and workers' compensation protect against your biggest risks. ERGO NEXT earned our top rating with a 4.75 MoneyGeek score, while biBERK offers the most budget-friendly rates at $42 monthly.

Engineering Insurance: FAQ

Common questions about engineering business insurance:

Who offers the best engineering business insurance overall?

ERGO NEXT leads engineering business insurance with an impressive MoneyGeek score of 4.75 out of 5. The Hartford follows closely behind at 4.73, delivering excellent value through competitive pricing and comprehensive coverage options.

Who has the cheapest business insurance for engineering firms?

Here are the cheapest business insurance companies for Engineering businesses by coverage type:

- Cheapest general liability insurance: biBERK at $17 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $36 monthly

- Cheapest professional liability insurance: Coverdash at $15 monthly

- Cheapest BOP insurance: biBERK at $22 monthly

What business insurance is required for engineering organizations?

Engineering businesses must carry workers' compensation insurance for employees and commercial auto insurance for company vehicles, with specific requirements varying by state. General liability insurance and professional liability coverage are also essential for client contracts.

How much does engineering business insurance cost?

Engineering business insurance costs by coverage type are as follows:

- General Liability: $40/mo

- Workers' Comp: $38/mo

- Professional Liability: $104/mo

- BOP Insurance: $49/mo

How We Chose the Best Engineering Business Insurance

We selected the best business insurer for engineering companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.