The Hartford has the best business insurance for window cleaning services with an overall score of 4.6 out of 5. At $140 monthly ($1,679 annually), The Hartford provides comprehensive financial protection at competitive rates for your window cleaning business. We also recommend comparing quotes from our other top picks, such as Coverdash, Thimble, Nationwide and Simply Business, to see all your options for the best window cleaning insurance.

Best Window Cleaning Business Insurance

The Hartford, Coverdash and Thimble offer the best cheap business insurance for window cleaning companies, with rates starting at $42 monthly.

Get personalized quotes for the best business insurance for window cleaning businesses.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Professional window cleaners need several types of coverage, including workers' compensation for employees, commercial auto for vehicles, general liability for property damage claims and professional liability for work quality disputes.

The Hartford is the best business insurance provider for window cleaning businesses, ranking first in different categories and scoring a 4.6 out of 5.

Thimble offers the cheapest business insurance for window cleaning services at $90 monthly, with general liability coverage starting at $42 monthly.

Best Business Insurance for Window Cleaning Services

| The Hartford | 4.60 | $140 |

| Coverdash | 4.50 | $149 |

| Thimble | 4.50 | $90 |

| Nationwide | 4.50 | $161 |

| Simply Business | 4.50 | $149 |

| biBERK | 4.40 | $181 |

| Chubb | 4.40 | $191 |

| NEXT Insurance | 4.37 | $244 |

| Progressive Commercial | 4.30 | $168 |

| Hiscox | 4.30 | $184 |

Note: We based all scores on a window-cleaning business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Window Cleaning Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

Find the best protection for your window cleaning business with these resources:

1. The Hartford: Best Overall for Window Cleaning Businesses

Top scores in affordability, service, coverage and stability

Lowest professional liability rates at $56 monthly for window cleaners

Ranks first for claims satisfaction and overall customer experience

A+ financial rating ensures claims get paid when needed

22% fewer complaints than similarly sized insurance companies

Digital tools score lower than other providers

Higher costs for business owner's policies and workers' comp

Not available in Alaska or Hawaii

For window cleaning services, The Hartford offers coverage for claims when ladders damage gutters or cleaning solutions streak expensive glass.

The Hartford earned perfect scores across all categories and holds an A+ rating from AM Best. This insurer gives your window cleaning business excellent cover and service.

2. Thimble: Cheapest Overall for Window Cleaning Businesses

Lowest general liability rates at $42 monthly for window cleaners

Cheapest BOP coverage at $64 monthly protects equipment and property

Digital experience ranks second nationally

Policies backed by A-rated carriers including Markel and National Specialty

Claims process and customer service ranks seventh and eighth, respectively

No phone support available, online only

For window cleaning businesses, Thimble ranks second for digital experience, which matters when you need instant certificates of insurance for commercial contracts.

Trustpilot users give Thimble overwhelmingly positive reviews, with window cleaners praising how it makes insurance "easy for new business owners to get started" compared to traditional insurers that are "pricey" and "a hassle". Its flexible coverage options (hourly, daily, or monthly) suit independent window cleaners who don't need year-round policies.

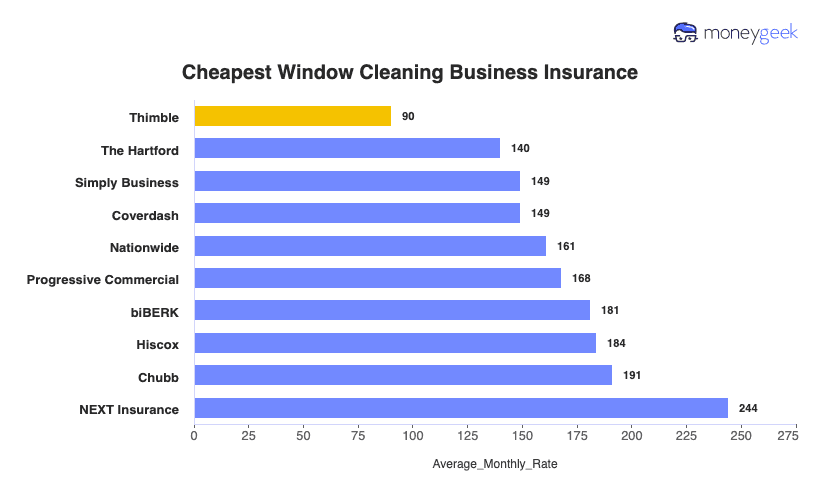

Cheapest Business Insurance for Window Cleaning Services

Thimble offers the most affordable insurance for window cleaning services at $90 monthly ($1,079 annually). It ranks first for general liability at $42 monthly and BOP coverage at $64 monthly. Professional window cleaners shopping for workers' compensation will find better rates with NEXT and The Hartford. For professional liability, The Hartford leads at $56 monthly, with NEXT close behind at $57 monthly.

| Thimble | $90 | $1,079 |

| The Hartford | $140 | $1,679 |

| Simply Business | $149 | $1,782 |

| Coverdash | $149 | $1,788 |

| Nationwide | $161 | $1,938 |

| Progressive Commercial | $168 | $2,019 |

| biBERK | $181 | $2,174 |

| Hiscox | $184 | $2,203 |

| Chubb | $191 | $2,294 |

| NEXT Insurance | $244 | $2,932 |

What Does Window Cleaning Business Insurance Cost?

In general, window cleaning business insurance costs are the following for the four most popular coverage types:

- General Liability Costt: $160 on average per month, ranging from $139 to $186, depending on the state

- Workers' Comp: $210 on average per month, ranging from $179 to $244, depending on the state

- Professional Liability (E&O): $62 on average per month, ranging from $54 to $73, depending on the state

- BOP Insurance: $234 on average per month, ranging from $200 to $273, depending on the state

| BOP | $234 | $2,813 |

| Workers' Comp | $210 | $2,514 |

| General Liability | $160 | $1,919 |

| Professional Liability (E&O) | $62 | $748 |

What Type of Insurance Is Best for a Window Cleaning Business?

The required coverage for professional window cleaners include workers' compensation if you have employees and commercial auto insurance for business vehicles. Beyond these mandates, general liability and professional liability insurance protect window cleaning businesses from common financial risks they face daily.

- Workers' Compensation Insurance: Window cleaning businesses with employees must carry workers' comp in almost every state. Your window cleaner working 20 stories up falls from scaffolding and sustains serious injuries requiring surgery and months of recovery. This coverage pays medical bills and lost wages while protecting you from employee lawsuits. State requirements vary, but expect minimum limits around $100,000 per accident.

- Commercial Auto Insurance: Required in all states except New Hampshire for business-owned vehicles. Your employee backing out of a commercial property parking lot collides with a client's luxury sedan. Coverage handles property damage, medical bills and legal fees from vehicle accidents. While state minimums run around $25,000/$50,000/$25,000, commercial window cleaners benefit from higher limits of $500,000 to $1 million given the value of client properties.

- General Liability Insurance: While cleaning storefront windows, your ladder tips and shatters a display case worth $5,000 or a pedestrian slips on soapy water from your squeegee runoff. This protects window cleaning services against third-party bodily injury and property damage claims. Most commercial contracts require $1 million per occurrence and $2 million aggregate, which are standard limits for the industry.

- Professional Liability Insurance (E&O): A harsh cleaning chemical you used leaves permanent cloudiness on expensive specialty glass at a medical office. The client demands $15,000 in replacement costs. This covers claims that your window washing work was inadequate or caused financial loss to clients. Commercial window cleaning businesses typically carry $500,000 to $1 million in coverage.

- Inland Marine (Tools and Equipment) Insurance: Your $8,000 worth of water-fed poles, squeegees and specialized high-rise equipment gets stolen from your van overnight at a job site. This protects window cleaning gear in transit, at client properties, or in storage. Base your coverage on actual replacement value, typically $5,000 to $15,000 depending on your equipment inventory.

- Commercial Property Insurance: Fire damages your storage facility destroying $20,000 in inventory and window cleaning equipment. This covers your building, contents, and business property from fires, storms, theft and vandalism at your business location. Choose replacement cost coverage matching the full value of your property and contents.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Window Cleaning Service

Here's our step-by-step guide to getting business insurance for your window cleaning business at the best rates.

- 1Decide on Coverage Needs Before Buying

Consider what happens when your squeegee scratches a $10,000 storefront window or your ladder falls onto a parked Mercedes. Talk with other window cleaners about actual claims they've filed and which coverage saved them money. Understanding these real scenarios helps you avoid coverage gaps.

- 2Research Costs

Window cleaning businesses with ground-level residential work pay different rates than those cleaning 20-story office buildings. Research what companies your size pay for workers' comp and liability coverage. Knowing these benchmarks prevents overpaying and helps you spot unrealistic quotes.

- 3Look Into Company Reputations and Coverage Options

Read what window cleaners say about insurers who paid claims for broken glass, slip-and-fall accidents, or equipment theft from vans. Some insurers exclude work above certain heights or won't cover water-fed pole systems. Verify coverage includes the window cleaning work you perform.

- 4Compare Multiple Quotes Through Different Means

Request quotes from three insurers who understand window cleaning risks like scaffold work and chemical exposure. Independent agents know which carriers accept high-rise contracts and rope descent work. Direct calls sometimes unlock discounts for harness systems, safety training or ladder stabilizers.

- 5Reassess Annually

Adding a second crew, buying a $15,000 water-fed pole system or landing your first hospital contract changes your insurance needs. Window cleaning services expanding into commercial high-rises need higher liability limits than residential-only operations. Review coverage when your business capabilities grow.

Window Cleaning Business Insurance: Bottom Line

Window cleaning businesses face serious risks from working at heights and handling client property, making proper insurance protection essential. The Hartford leads our rankings with a 4.6 out of 5 score, covering professional window cleaners across workers' compensation, commercial auto, general liability and professional liability needs. Budget-focused window cleaning services can start with Thimble at $42 monthly for general liability or $90 monthly for complete coverage.

Window Cleaning Liability Insurance: FAQ

We answer frequently asked questions about window cleaning business insurance:

Who offers the best window cleaning business insurance overall?

The Hartford offers the best overall business insurance for window cleaning firms, with a MoneyGeek score of 4.6 out of 5. Coverdash, Thimble, Nationwide and Simply Business tie for second place, each earning solid 4.5 scores with competitive coverage options.

Who has the cheapest business insurance for window cleaning firms?

Here are the cheapest business insurance companies for window cleaning businesses by coverage type:

- Cheapest general liability insurance: Thimble at $42 monthly

- Cheapest workers' comp insurance: NEXT at $197 monthly

- Cheapest professional liability insurance: The Hartford at $56 monthly

- Cheapest BOP insurance: Thimble at $64 monthly

What business insurance is required for window cleaning organizations?

Workers' compensation insurance (with employees) and commercial auto insurance (with business vehicles) are legally mandated for window cleaning companies, though requirements differ by state. General liability insurance and janitorial bonds aren't legally required but most commercial clients and property leases demand them.

How much does window cleaning business insurance cost?

Window cleaning business insurance costs by coverage type are as follows:

- General Liability: $160/mo

- Workers' Comp: $210/mo

- Professional Liability: $62/mo

- BOP Insurance: $234/mo

How We Chose the Best Window Cleaning Business Insurance

We selected the best business insurer for window-cleaning companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 10, 2025.