ERGO NEXT earned our top spot for the best small business insurer for janitorial companies due to its excellent coverage and affordability. We recommend comparing quotes from our other top picks, including The Hartford, Nationwide, Thimble and Simply Business.

Best Janitorial Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for janitorial companies, with rates starting at $44 monthly.

Get matched with cheap janitorial business insurance below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Janitorial companies need types of business insurance including general liability, workers' comp, professional liability and equipment coverage.

ERGO NEXT is the best business insurance company for janitorial firms with excellent coverage and affordability.

Thimble provides the cheapest overall commercial insurance for commercial janitor businesses at $47 monthly for workers' comp.

Best Business Insurance for Janitorial Companies

| ERGO NEXT | 4.66 | $93 |

| The Hartford | 4.64 | $89 |

| Nationwide | 4.60 | $89 |

| Thimble | 4.50 | $51 |

| Simply Business | 4.50 | $99 |

| Coverdash | 4.50 | $108 |

| Progressive Commercial | 4.40 | $113 |

| biBERK | 4.40 | $128 |

| Chubb | 4.40 | $138 |

| Hiscox | 4.10 | $202 |

*We based all scores on a janitorial business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Janitorial Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your janitorial business, check out the following resources:

1. ERGO NEXT: Best Overall Business Insurance for Janitors

Best customer service experience

Reasonable rates for most coverage types

Large coverage selection

Slower quote times than the competition

Lower financial stability ratings

ERGO NEXT delivers the best combination of comprehensive coverage, competitive pricing and excellent customer service. Over 3,000 customers gave it a 4.7 out of 5 rating.

Commercial janitorial firms employing larger teams will find this company to have the most affordable workers' compensation insurance rates.

2. The Hartford: Best Professional Liability Insurance for Janitors

Lowest professional liability insurance rates

Over 200 years in the insurance industry

AM Best A+ (superior) financial stability rating

Higher workers' comp rates

The Hartford ranks second for janitorial business insurance. Professional liability insurance costs just $44 monthly, the lowest rate among reviewed insurers.

More than 10,000 customers across industries rate The Hartford highly, placing it second for customer experience. AM Best assigns The Hartford an A+ (superior) financial stability rating, reflecting strong claims-paying ability.

3. Thimble: Cheapest for Cleaning Businesses

Lowest rates for overall for janitors

Strong financial stability ratings

Lowest customer service rating

Online-only customer support with no phone representatives

Fewer coverage options than other insurers

Thimble's customer service ratings don't top the charts, but the company is affordable for small commercial janitorial businesses. With this company's competitive rates, your business can save $38 monthly compared to the next most affordable provider.

Customer reviews on platforms like Trustpilot rate Thimble highly, but phone support isn't available, and you have to communicate through the app or email.

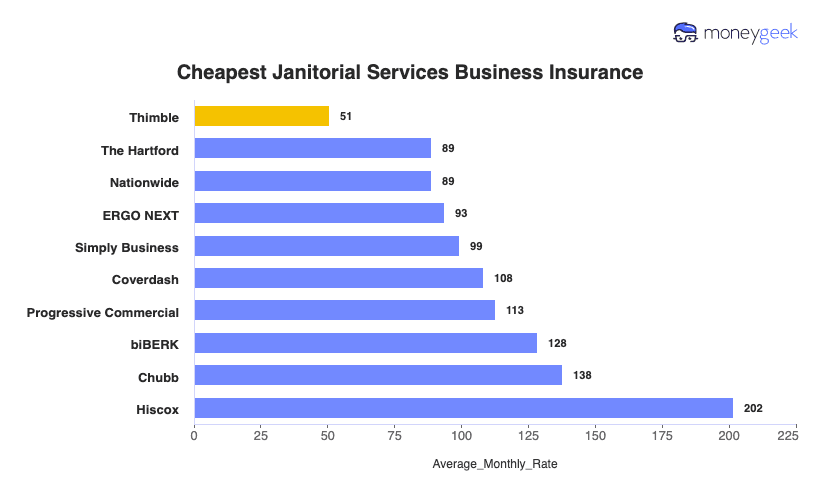

Cheapest Business Insurance for Janitorial Firms

Thimble offers competitive janitorial insurance at an average monthly cost of $51. For specific coverage needs like professional liability and workers' compensation, The Hartford and ERGO NEXT provide more affordable options than Thimble's general rates.

| Thimble | $51 | $609 |

| The Hartford | $89 | $1,064 |

| Nationwide | $89 | $1,066 |

| ERGO NEXT | $93 | $1,122 |

| Simply Business | $99 | $1,190 |

| Coverdash | $108 | $1,301 |

| Progressive Commercial | $113 | $1,352 |

| biBERK | $128 | $1,541 |

| Chubb | $138 | $1,653 |

| Hiscox | $202 | $2,418 |

How Much Does Janitorial Business Insurance Cost?

Janitorial business insurance costs for the four most popular coverage types, depending on the state:

- General liability cost: $138 on average per month, ranging from $111 to $160

- Workers' comp: $49 on average per month, ranging from $42 to $57

- Professional liability (E&O): $50 on average per month, ranging from $42 to $58

- BOP insurance: $202 on average per month, ranging from $166 to $237

| BOP | $202 | $2,426 |

| General Liability | $138 | $1,653 |

| Professional Liability (E&O) | $50 | $597 |

| Workers' Comp | $49 | $585 |

What Type of Insurance Is Best for a Janitorial Company?

Commercial janitorial businesses need comprehensive coverage. While general liability and workers' compensation form the basic foundation, tools and equipment insurance protects your valuable assets.

Professional liability, commercial auto insurance (if you operate vehicles) and surety bonds are frequently required to satisfy client contracts and state regulations.

Commercial janitorial businesses need specific insurance coverages for financial protection against industry risks. Coverage amounts vary based on your operation size and client requirements:

- General liability insurance: Janitorial companies face third-party bodily injury and property damage claims regularly. Clients' employees can slip on freshly mopped floors, or cleaning chemicals can damage office furniture. Commercial janitorial operations need $2 million per occurrence with a $4 million aggregate limit to meet most commercial facility contracts.

- Workers' compensation: State law requires this coverage once you hire employees. Janitorial work puts employees at risk for back injuries from lifting, chemical burns from cleaning solutions and slip-and-fall accidents on wet surfaces. Workers' comp covers medical expenses and lost wages for work-related injuries. State requirements and your payroll determine your coverage limits.

- Professional liability insurance: Professional liability (errors and omissions) covers your business when clients claim inadequate cleaning services or negligence-caused damage. If a client alleges your team failed to sanitize a medical office properly or damaged equipment during cleaning, professional liability responds. Commercial janitorial companies need minimum limits of $1 million per claim with a $2 million aggregate for most client contracts.

- Tools and equipment insurance: Vacuum cleaners, floor buffers, carpet extractors and specialized cleaning equipment cost thousands to replace. Equipment breakdowns or theft stop operations immediately. Most commercial janitorial operations need coverage limits between $25,000 and $50,000, depending on equipment inventory value.

- Commercial auto insurance: If your team drives company vehicles or personal vehicles for business, you need commercial auto insurance. A $1 million combined single limit policy with liability, comprehensive and collision coverage meets most client requirements.

- Surety bonds (janitorial bonds): Commercial clients require janitorial bonds before awarding cleaning contracts. Janitorial bonds guarantee service completion and protect clients from employee theft or intentional damage. Commercial janitorial companies face bond requirements between $25,000 and $100,000 for most commercial properties. Larger facilities or government contracts require higher bond amounts.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Janitorial Company

Here's a step-by-step method for finding the best and cheapest business insurance for your janitorial company.

- 1Decide on Coverage Needs Before Buying

Slip-and-fall accidents from wet floors, damage to client property from cleaning chemicals or equipment and employee injuries are all real possibilities. Start by talking with other janitorial business owners about what coverage has protected them and which claims they have filed.

Connect with insurance agents who specialize in commercial cleaning services. They'll understand your specific exposure to risks like client property damage, employee workers' compensation needs and commercial auto coverage.

- 2Research Costs

Janitorial insurance costs vary based on your company size, number of employees, types of facilities you clean and your service area. Before shopping around, research typical premiums for janitorial companies with similar employee counts and revenue.

Factors like whether you clean medical facilities versus office buildings, use subcontractors, or provide specialized services like floor stripping will affect your rates.

- 3Look Into Company Reputations and Coverage Options

Seek out insurers who regularly work with commercial cleaning companies and understand your industry. Check reviews on Trustpilot and Google from other janitorial business owners, or ask for referrals in local cleaning industry associations and online forums.

Pay special attention to how insurers handle common janitorial claims like slip-and-falls, chemical spills or equipment damage. You may need general liability, workers' compensation, commercial property insurance for your equipment and supplies, commercial auto and potentially professional liability or pollution coverage depending on your services.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers who have experience with janitorial businesses. Contact independent agents who specialize in commercial services, use online comparison tools designed for small businesses and call insurers directly.

Don't just compare premiums. Examine deductibles, coverage limits, exclusions and whether policies cover all your cleaning locations and equipment.

- 5Reassess Annually

You might add employees, expand into new facilities like healthcare or industrial cleaning, purchase expensive equipment or take on larger commercial contracts. These changes directly impact your insurance needs and rates.

Review your policy each year before renewal. As your safety record improves and your business matures, you may qualify for better rates or discover you need additional coverage for new service offerings.

Best Insurance for Janitorial Business: Bottom Line

ERGO NEXT is the best insurer for janitorial business insurance, while Thimble offers the cheapest option overall. We also recommend getting quotes from The Hartford, Nationwide and Simply Business. For the best deal, consult agents and similar businesses, research costs and companies and compare multiple quotes.

Janitorial Insurance: FAQ

We answer frequently asked questions about janitorial business insurance:

Who offers the best janitorial business insurance overall?

ERGO NEXT leads janitorial business insurance with a MoneyGeek score of 4.66 out of 5. The Hartford follows closely at 4.64, delivering excellent affordability, customer service and comprehensive coverage options.

Who has the cheapest business insurance for janitorial firms?

Here are the cheapest business insurance companies by coverage type:

- Cheapest general liability insurance: Nationwide at $98 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $46 monthly

- Cheapest professional liability insurance: The Hartford at $44 monthly

- Cheapest BOP insurance: Nationwide at $147 monthly

What business insurance is required for janitorial organizations?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated, though requirements differ by state. General liability insurance and janitorial bonds aren't legally required but most clients demand them.

How much does janitorial business insurance cost?

Janitorial business insurance monthly costs by coverage type:

- General liability: $138

- Workers' comp: $49

- Professional liability: $50

- BOP insurance: $202

How We Chose the Best Janitorial Business Insurance

We selected the best business insurer for janitorial companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed October 17, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 17, 2025.

- Trustpilot. "Thimble." Accessed October 17, 2025.