The Hartford earned our top spot as the best business insurance for advertising agencies with a MoneyGeek score of 4.78. It ranks first for affordability, customer service and coverage options, making it an excellent choice for protecting your agency. You'll also want to compare quotes from ERGO NEXT, Coverdash, Progressive Commercial and Simply Business for your advertising firm.

Best Ad Agency Business Insurance

ERGO NEXT, The Hartford and Coverdash offer the best cheap business insurance for ad-agency companies, with rates starting at $15 monthly.

Get personalized quotes from the best ad agency business insurer for you.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Advertising agencies need several types of business insurance to protect against client lawsuits and data breaches, such as professional liability, general liability, workers' compensation and cyber insurance.

The Hartford offers the best business insurance for ad agencies with a 4.78 MoneyGeek score, ranking first for affordability, customer service and coverage options.

Nationwide provides the cheapest business insurance for advertising firms, with workers' compensation insurance starting at just $18 monthly.

Best Business Insurance for Advertising Agency Companies

| The Hartford | 4.78 |

| ERGO NEXT | 4.76 |

| Coverdash | 4.50 |

| Progressive Commercial | 4.50 |

| Simply Business | 4.50 |

| Nationwide | 4.40 |

| biBERK | 4.40 |

| Thimble | 4.40 |

| Hiscox | 4.40 |

| Chubb | 4.30 |

Note: We based all scores on an ad-agency business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Advertising Agency Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your advertising agency, check out the following resources:

1. The Hartford: Best Overall for Advertising Agencies

Ranks first for affordability, customer service and coverage options for advertising agencies

Leads nationally in claims processing

Offers specialized professional liability (E&O) coverage tailored for ad agencies

Strong financial stability with an A+ (Superior) AM Best rating

Professional liability coverage costs more than other coverage types

Digital experience ranks 10th nationally

Business owner's policies unavailable in Michigan due to state regulations

Not available in Alaska and Hawaii

For advertising agencies, The Hartford offers the most balanced experience. It offers competitive rates for BOP and general liability, even ranking second for workers' compensation.

The Hartford provides coverage for your agency for claims like missed campaign deadlines, copyright infringement in your creative work, defamation in ad copy and campaigns that fail to deliver promised ROI. This coverage addresses the unique risks your ad agency faces when managing client relationships and creative deliverables.

2. Nationwide: Cheapest Overall for Advertising Firms

Cheapest professional liability (E&O) coverage for advertising agencies at $47 monthly

Second-most affordable for BOP ($30 monthly) and general liability ($20 monthly)

Ranks second nationally for customer service and policy management

Comprehensive coverage options including specialized policies for ad agencies

Workers' compensation ranks ninth for affordability at $18 monthly

Claims processing ranks fifth nationally

Digital experience ranks eighth, lower than other providers

Nationwide covers copyright infringement claims, missed deadlines and campaign performance disputes. It is a budget-friendly choice for advertising firms looking for comprehensive financial protection.

It is a Fortune 100 company with nearly 100 years of experience and offers free business resources to help your ad firm grow. Its perfect score for financial stability rating ensures it can pay claims when you need it most.

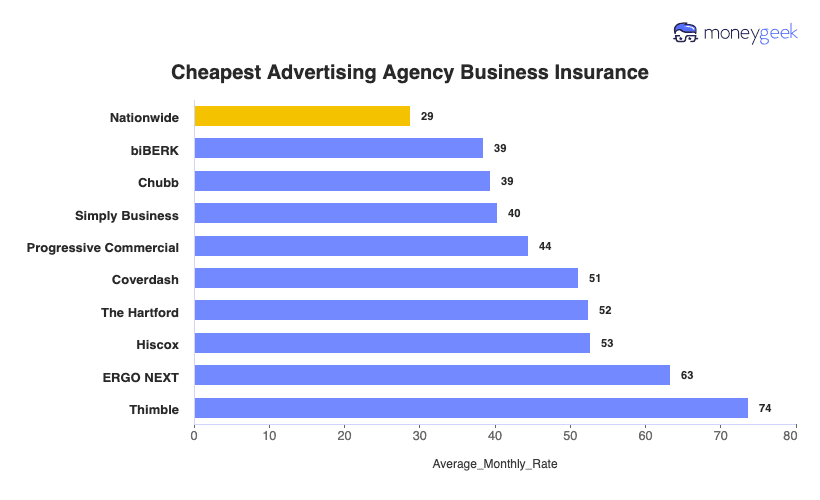

Cheapest Business Insurance for Advertising Agency Firms

We found that Nationwide has the most affordable business insurance for your advertising agency at $29 monthly ($346 annually). It's cheapest for professional liability and second-cheapest for BOP and general liability, making it the most cost-effective option for your ad agency. If you need workers' compensation coverage, ERGO NEXT and The Hartford offer more competitive monthly rates for your advertising firm at $7 and $8 per employee, respectively.

| Nationwide | $29 | $346 |

| biBERK | $39 | $462 |

| Chubb | $39 | $472 |

| Simply Business | $40 | $483 |

| Progressive Commercial | $44 | $533 |

| Coverdash | $51 | $613 |

| The Hartford | $52 | $629 |

| Hiscox | $53 | $633 |

| ERGO NEXT | $63 | $760 |

| Thimble | $74 | $885 |

What Does Advertising Agency Business Insurance Cost?

In general, ad agency business insurance costs are the following for the four most popular coverage types:

- General Liability Cost: $36 on average per month, ranging from $31 to $44, depending on the state

- Workers' Comp Cost: $16 on average per month, ranging from $14 to $18, depending on the state

- Professional Liability (E&O Cost): $99 on average per month, ranging from $85 to $127, depending on the state

- BOP Insurance Cost: $41 on average per month, ranging from $36 to $48, depending on the state

| Professional Liability (E&O) | $99 | $1,188 |

| BOP | $41 | $496 |

| General Liability | $36 | $429 |

| Workers' Comp | $16 | $191 |

What Type of Insurance Is Best for a Advertising Agency Company?

Your advertising agency needs workers' compensation if you have employees, and you'll want professional liability insurance to protect against client lawsuits. General liability, cyber insurance and a business owner's policy round out the essential coverages, with commercial auto required only if you own vehicles.

- Workers' Compensation Insurance: You need workers' comp if your ad agency has employees, since nearly every state mandates it. This coverage protects your team from work-related injuries like carpal tunnel from design work or accidents during client visits, paying medical bills and replacing lost wages while shielding you from lawsuits. Most agencies carry coverage that matches their state's requirements based on payroll size.

- Professional Liability Insurance (E&O): Your agency faces constant risk of client lawsuits over missed deadlines, copyright infringement in creative work or campaigns that don't deliver promised results. Professional liability insurance covers legal defense costs, settlements and judgments when clients claim your work caused financial harm. Most advertising firms carry $1 million per claim and $1 million total coverage limits, though larger clients often require $2 to $10 million in coverage.

- General Liability Insurance: This protects your advertising firm when clients or visitors get injured at your office or you damage client property during meetings. General liability covers medical bills, legal fees and property damage claims from third parties, and most commercial leases require this coverage. Standard limits are $1 million per occurrence and $2 million aggregate.

- Business Owner's Policy (BOP): A BOP bundles general liability, commercial property and business interruption insurance at a lower cost than buying them separately. It protects your agency's office space, computers and equipment from fire or theft, covers client injuries and property damage, and replaces lost income if you temporarily close due to covered events. Typical coverage includes $1 million per occurrence and $2 million aggregate for liability, property limits based on your asset values, and business interruption coverage for three to six months of operating expenses.

- Cyber Liability Insurance: Your ad agency handles sensitive client data, campaign strategies and creative assets, making cyber insurance critical. It pays for data breach costs including client notification, legal fees, credit monitoring and regulatory fines. Most agencies start with $1 million in coverage, though you'll need more if you handle extensive client databases.

- Commercial Auto Insurance: If your agency owns vehicles for client meetings or photo shoots, commercial auto insurance is required by law and covers property damage and medical costs from accidents. Personal auto policies won't cover business use. You'll need to meet your state's minimum requirements at a minimum, with higher limits based on your vehicle values.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Advertising Agency Company

Our guide on how to get business insurance for your advertising firm help you find the best and cheapest coverage available.

- 1Decide on Coverage Needs Before Buying

Think about what keeps you up at night: a client suing because their campaign flopped, getting hit with copyright claims over stock photos in your ads or your designers dealing with carpal tunnel. Talk with other agency owners about claims they've actually filed and find an insurance agent who gets the creative business.

- 2Research Costs

Know what agencies your size actually pay before you start shopping. Look up average rates for professional liability based on your revenue, general liability for your office and workers' comp for your creative team. You'll know a good deal when you see one and can push back on inflated quotes.

- 3Look Into Company Reputations and Coverage Options

See what other creative agencies say about each insurer, especially how they handle claims. Check Google and Better Business Bureau reviews, focusing on stories about campaign disputes or copyright issues. Make sure each company actually understands what ad agencies do and the risks you face creating client content.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers and try different ways to buy. An independent agent might find specialized programs for creative businesses that beat online rates, or calling direct could unlock bundle discounts. Watch those professional liability limits closely since big clients often want $2 million or higher.

- 5Reassess Annually

Your agency changes every year, from new clients to bigger billings to more staff. Review your coverage when you land a major account that bumps up your liability needs or hire more creatives that increase your workers' comp costs. Shop around annually because rates shift and you might find better deals as your agency grows.

Best Insurance for Advertising Agency Businesses: Bottom Line

Your advertising agency needs multiple coverage types to stay protected, including professional liability, general liability, workers' compensation and cyber insurance. The Hartford leads our rankings with a 4.78 score, excelling in affordability, customer service and coverage. For budget-conscious agencies, Nationwide offers workers' comp starting at just $18 monthly, making comprehensive protection accessible for your firm.

Advertising Agency Insurance: FAQ

We answer frequently asked questions about ad agency business insurance:

Who offers the best ad agency business insurance overall?

The Hartford delivers the best overall business insurance for ad agencies,

earning a MoneyGeek score of 4.78 out of 5. ERGO NEXT follows closely

with a score of 4.76, offering competitive pricing and comprehensive

coverage options for advertising firms.

Who has the cheapest business insurance for ad agency firms?

Here are the cheapest business insurance companies for ad agency businesses by coverage type:

- Cheapest general liability insurance: Simply Business at $20 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $15 monthly

- Cheapest professional liability insurance: Nationwide at $47 monthly

- Cheapest BOP insurance: Simply Business at $30 monthly

What business insurance is required for ad agency organizations?

Ad agencies must carry workers' compensation insurance with employees and commercial auto insurance for business vehicles, with state-specific requirements. Most clients and landlords also require general liability coverage despite no legal mandate.

How much does ad agency business insurance cost?

Ad agency business insurance costs by coverage type are as follows:

- General Liability: $36/mo

- Workers' Comp: $16/mo

- Professional Liability: $99/mo

- BOP Insurance: $41/mo

How We Chose the Best Advertising Agency Business Insurance

We selected the best business insurer for ad-agency companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.