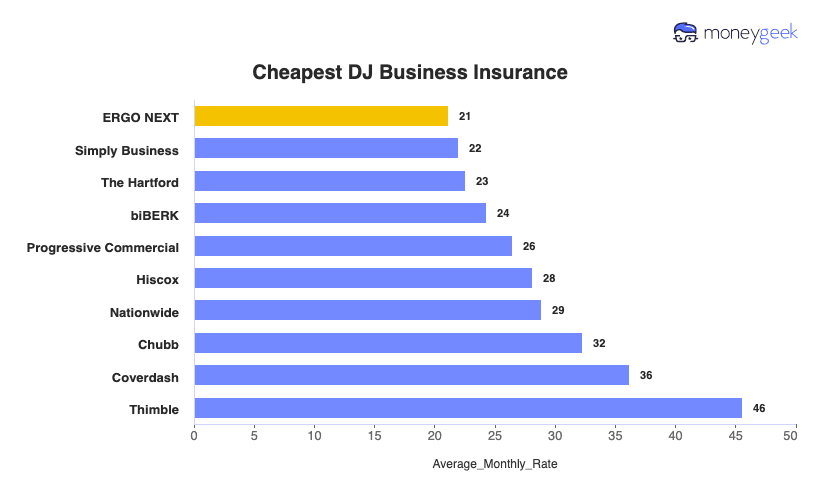

ERGO NEXT leads our rankings for DJ business insurance with a MoneyGeek score of 4.82 out of 5, earning top marks across all categories we evaluated. At $21 monthly, ERGO NEXT combines comprehensive coverage options with competitive rates for mobile DJ businesses and professional DJs.

Compare quotes from our other top picks, including The Hartford, Simply Business, biBerk and Nationwide, to find the best fit for your DJ service.