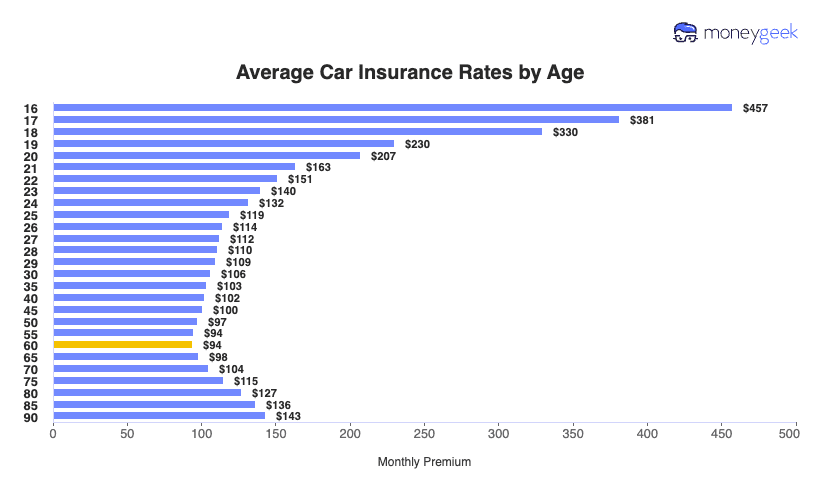

Car insurance rates vary widely by age. Sixteen-year-olds pay the highest premiums at $457 monthly, while drivers in their 50s and early 60s pay the lowest rates at $94 to $97 monthly. Teen drivers ages 16 to 19 average $230 to $457 monthly. Young adults ages 20 to 25 see rates drop to $152 monthly as they gain experience. Middle-aged drivers ages 40 to 60 pay around $94 to $102 monthly. Senior drivers ages 65 and older pay $98 to $143 monthly, with rates increasing as age advances.

Average Car Insurance Rates by Age and Gender

Car insurance costs vary by age and gender, with teens paying the highest rates at $230 to $457 monthly and male teens paying much more than female teens.

Find out if you're overpaying for car insurance below.

Updated: February 4, 2026

Advertising & Editorial Disclosure

Sixteen-year-olds pay the highest monthly premiums at $436 for girls and $478 for boys, and MoneyGeek's car insurance age chart shows how steeply rates decline each year for teen drivers. Read more.

Gender affects rates most for teens. Sixteen-year-old boys pay $504 more yearly than girls due to higher accident frequency. The difference decreases to only $33 per year after drivers turn 25.

Younger drivers pay more for car insurance because crash statistics show they are much more likely to get into accidents. And male teens pay more than female teens because their driving behavior is even more risky, on average.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Average Car Insurance Rates by Age

| 16 | $457 | $5,486 |

| 17 | $381 | $4,578 |

| 18 | $330 | $3,956 |

| 19 | $230 | $2,761 |

| 20 | $207 | $2,481 |

| 21 | $163 | $1,958 |

| 22 | $151 | $1,810 |

| 23 | $139 | $1,674 |

| 24 | $132 | $1,582 |

| 25 | $119 | $1,426 |

| 26 | $114 | $1,367 |

| 27 | $112 | $1,343 |

| 28 | $110 | $1,326 |

| 29 | $109 | $1,311 |

| 30 | $106 | $1,268 |

| 35 | $103 | $1,240 |

| 40 | $102 | $1,220 |

| 45 | $100 | $1,204 |

| 50 | $97 | $1,165 |

| 55 | $94 | $1,131 |

| 60 | $94 | $1,125 |

| 65 | $98 | $1,175 |

| 70 | $104 | $1,252 |

| 75 | $115 | $1,380 |

| 80 | $127 | $1,525 |

| 85 | $136 | $1,637 |

| 90 | $143 | $1,718 |

*Rates shown are national averages for state minimum liability only and full coverage with 100/300/100 limits and a $ 1,000 deductible, insuring a 2012 Toyota Camry.

Average Car Insurance Rates by Gender and Age

Teen boys pay $42 more monthly than teen girls at age 16, which adds up to $504 annually. This difference stems from higher accident rates among young male drivers. At 19, men pay $241 versus $219 for women, but by age 25, the gap shrinks to just $2 monthly.

Gender differences nearly disappear by age 30, with rates stabilizing around $106 monthly for both men and women. Women briefly pay $1 to $2 more monthly during middle age, but men pay more again as senior drivers. By age 90, the gap reaches $12 monthly. Men pay more annually than women when averaged across all ages because of higher teen and senior premiums.

| 16 | $478 | $436 | $41 |

| 17 | $401 | $362 | $39 |

| 18 | $345 | $314 | $31 |

| 19 | $241 | $219 | $22 |

| 20 | $216 | $198 | $18 |

| 21 | $170 | $157 | $13 |

| 22 | $156 | $146 | $9 |

| 23 | $143 | $136 | $8 |

| 24 | $135 | $129 | $6 |

| 25 | $120 | $118 | $3 |

| 26 | $115 | $113 | $2 |

| 27 | $113 | $111 | $2 |

| 28 | $111 | $110 | $1 |

| 29 | $110 | $109 | $1 |

| 30 | $105 | $106 | $-1 |

| 35 | $102 | $104 | $-2 |

| 40 | $101 | $103 | $-2 |

| 45 | $99 | $101 | $-2 |

| 50 | $97 | $98 | $-1 |

| 55 | $94 | $94 | $0 |

| 60 | $94 | $94 | $0 |

| 65 | $98 | $97 | $1 |

| 70 | $106 | $103 | $2 |

| 75 | $118 | $112 | $5 |

| 80 | $132 | $122 | $9 |

| 85 | $142 | $131 | $11 |

| 90 | $149 | $137 | $12 |

Average Car Insurance Cost Per Month by Age and State

State location affects insurance costs across all age groups. Teens might pay $30 monthly for minimum coverage in Indiana versus over $100 in Louisiana, with full coverage gaps widening further. Young drivers ages 20 to 25 pay $25 to $40 monthly in low-cost states versus $70 to $90 in expensive markets.

Middle-aged drivers still see three to four times higher costs in expensive states. States with higher minimum requirements have smaller minimum-to-full coverage gaps, so consider location and coverage choices to save. Read our guide on the cost of car insurance in different states if you are considering a move in the near future.

| 25 | Alabama | $38 | $454 |

| 25 | Alaska | $42 | $501 |

| 25 | Arizona | $55 | $662 |

| 25 | Arkansas | $39 | $471 |

| 25 | California | $61 | $738 |

| 25 | Colorado | $47 | $565 |

| 25 | Connecticut | $76 | $915 |

| 25 | Delaware | $97 | $1,164 |

| 25 | District of Columbia | $54 | $654 |

| 25 | Florida | $78 | $931 |

| 25 | Georgia | $49 | $589 |

| 25 | Hawaii | $30 | $363 |

| 25 | Idaho | $32 | $381 |

| 25 | Illinois | $39 | $468 |

| 25 | Indiana | $35 | $416 |

| 25 | Iowa | $27 | $321 |

| 25 | Kansas | $42 | $503 |

| 25 | Kentucky | $47 | $569 |

| 25 | Louisiana | $67 | $803 |

| 25 | Maine | $38 | $460 |

| 25 | Maryland | $65 | $777 |

| 25 | Massachusetts | $42 | $504 |

| 25 | Michigan | $85 | $1,018 |

| 25 | Minnesota | $48 | $580 |

| 25 | Mississippi | $43 | $515 |

| 25 | Missouri | $60 | $726 |

| 25 | Montana | $31 | $366 |

| 25 | Nebraska | $40 | $478 |

| 25 | Nevada | $84 | $1,003 |

| 25 | New Hampshire | $63 | $759 |

| 25 | New Jersey | $73 | $874 |

| 25 | New Mexico | $40 | $486 |

| 25 | New York | $111 | $1,338 |

| 25 | North Carolina | $38 | $460 |

| 25 | North Dakota | $31 | $372 |

| 25 | Ohio | $40 | $484 |

| 25 | Oklahoma | $41 | $492 |

| 25 | Oregon | $59 | $711 |

| 25 | Pennsylvania | $39 | $463 |

| 25 | Rhode Island | $58 | $696 |

| 25 | South Carolina | $69 | $827 |

| 25 | South Dakota | $30 | $366 |

| 25 | Tennessee | $36 | $436 |

| 25 | Texas | $61 | $737 |

| 25 | Utah | $53 | $642 |

| 25 | Vermont | $30 | $356 |

| 25 | Virginia | $46 | $552 |

| 25 | Washington | $63 | $761 |

| 25 | West Virginia | $45 | $545 |

| 25 | Wisconsin | $42 | $499 |

| 25 | Wyoming | $24 | $288 |

How and Why Age and Gender Affect Car Insurance Rates

Age determines car insurance costs more than any other factor. Insurers use crash statistics, driving behavior patterns and age-related risk factors to set rates. Teen drivers ages 16 to 17 experience 1,432 crashes per 100 million miles driven according to AAA Foundation data, which drops to 730 crashes for 18- to 19-year-olds and 572 for drivers aged 20 to 24. These accident rates, combined with risky driving behaviors like speeding and distracted driving, explain why 16-year-olds pay $457 monthly while drivers in their 50s pay just $94 monthly. The chart below illustrates the full pricing curve across all ages.

Explanation of Age Related Crash Statistics and Costs

Teen Drivers (Ages 16-19)

Teen drivers pay the highest insurance rates due to inexperience and the highest crash rates of any age group. A driver aging from 16 to 20 years old saves $250 per month on average as they gain experience and their crash risk decreases. Sixteen- to 17-year-olds experience 1,432 crashes per 100 million miles driven, which drops to 730 crashes for 18- to 19-year-olds.

Young Adults (Ages 20-25)

Young adult drivers continue to see rate decreases as they build driving experience. Between ages 20 and 25, drivers save an additional $88 per month on average. Crash rates drop to 572 per 100 million miles for this age group. At age 25, most insurers consider drivers fully mature for risk assessment purposes, bringing the biggest single-year rate drop.

Middle-Aged Drivers (Ages 26-60)

Middle-aged drivers pay the lowest rates due to strong safety records and decades of experience. Crash rates fall to 328 per 100 million miles for drivers in their 30s and 314 for those in their 40s. From age 25 onward, monthly rate decreases slow to just a few dollars per year as drivers maintain consistently low accident rates.

Senior Drivers (Ages 65+)

Senior rates begin to increase at age 65 despite continued driving experience. Age-related risk factors including slower reflexes, vision changes and increased severity of injuries in accidents lead insurers to raise premiums. Rates increase gradually, with drivers ages 65 to 90 paying $98 to $143 monthly.

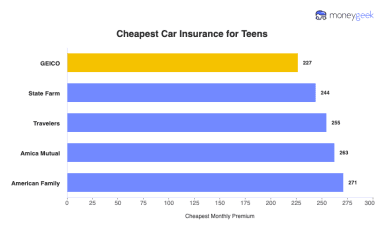

How to Save on Car Insurance Based on Age

The most effective savings strategy changes as you age. Teens save the most by staying on a parent's policy and earning good student discounts. Young adults should delay independent coverage and focus on establishing a strong credit history. Middle-aged drivers benefit most from annual comparison shopping, as rates between insurers vary by 400% for identical coverage. Seniors offset rising rates with mature driver courses and low-mileage discounts.

Teen drivers pay $230 to $457 monthly, more than triple adult rates. Good student discounts (typically 15% to 25% off) provide the biggest savings for teens maintaining a B average or better. Defensive driving courses reduce premiums by 5% to 15% in most states. Staying on a parent's policy costs significantly less than buying standalone coverage. Choosing safer vehicles with high safety ratings and avoiding sports cars also reduces premiums.

Stay on your family's policy as long as possible. Young adults moving to independent coverage pay 30% to 50% more than remaining on a parent's plan. Build your credit score, as good credit (700+) can lower rates by 20% to 30% in states that allow credit-based pricing. Choose reliable vehicles over new or luxury models. Ask about low-mileage discounts if you drive fewer than 7,500 miles annually.

Compare quotes from at least three insurers annually. Identical coverage varies by 400% or more between providers. Shop after major life changes like marriage, moving, buying a home or adding vehicles, as these trigger rate adjustments. Bundle auto and home insurance for 15% to 25% savings. Raise your deductible from $500 to $1,000 to save 15% to 30% on comprehensive and collision coverage.

Rates increase at age 65, with drivers 65 and older paying $98 to $143 monthly, 4% to 52% more than middle-aged drivers. Stack senior-specific discounts like mature driver courses approved by your state to receive discounts of 5% to 15%. Ask about low-mileage discounts if you're retired and driving less. Join AARP or AAA for member-exclusive rates. Consider usage-based insurance programs that track actual driving behavior rather than relying on age-based pricing.

Car Insurance by Age: Bottom Line

Age affects car insurance rates most, with 16-year-olds paying the highest monthly premiums of $436 for girls and $478 for boys. The biggest rate difference between genders occurs among teenagers. Due to higher accident rates, 16-year-old boys pay $504 more annually than girls their age. This premium gap between genders narrows as drivers age.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Car Insurance Rates by Age: FAQ

We answered common questions about how age and gender affect car insurance costs.

At what age is car insurance the cheapest?

Car insurance rates begin to decline when a driver turns 25, but drivers with clean records enjoy the lowest rates at age 60.

Which age group pays the most for car insurance?

Car insurance rates for young drivers are much higher than other age groups. A teen with an individual policy pays over $4,000 more than a 50-year-old driver for the same coverage. Premiums drop as drivers age.

At what age do car insurance rates decrease the most?

Car insurance rates drop most between ages 16 to 25, with major decreases occurring at ages 18, 21 and 25 when insurers reassess risk profiles and driving maturity.

Why do teen boys pay more than teen girls for car insurance?

Teen boys have statistically higher accident rates and more severe crashes than teen girls, leading insurers to charge higher premiums to offset this increased risk.

Which states have the biggest car insurance rate differences by age?

States with higher overall rates like New York, Florida and Michigan show larger dollar differences between age groups, but percentage differences remain similar across states.

When do gender differences in car insurance rates disappear?

Gender gaps in car insurance rates narrow by age 25 and become minimal throughout most adult years, with differences of less than $2 monthly for drivers ages 30 to 60.

Which states don't allow gender-based car insurance pricing?

Seven states prohibit gender-based pricing: California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania.

Car Insurance Rates by Age Charts: Our Review Methodology

Age and gender affect your car insurance costs, but most drivers don't know exactly how much these factors matter or when rates finally drop. This nationwide rate data across all age groups and genders shows you what to expect at each life stage and helps you identify the best times to compare rates.

We gathered data from Quadrant Information Services and state insurance departments, analyzing thousands of quotes across all 50 states to isolate how age and gender affect pricing independently of other factors like location and coverage choices.

Our standardized driver profile: We collected nationwide car insurance data for different age and gender groups driving a 2012 Toyota Camry. We analyzed rates by the driver's age and gender while controlling for all other variables to show the pure impact of these demographic factors on your premiums. This approach reveals the true cost of age and gender factors across your driving life, helping you understand when rates will decrease and how much you can save as you age.

Car Insurance Cost: Related Pages

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AAA Foundation for Traffic Safety. "Rates of Motor Vehicle Crashes, Injuries, and Deaths in Relation to Driver Age, United States, 2014 – 2015." Accessed June 30, 2025.

- CDC. "Teen Drivers: Get the Facts." Accessed June 30, 2025.

- IIHS HLDI. "Older Drivers." Accessed June 30, 2025.