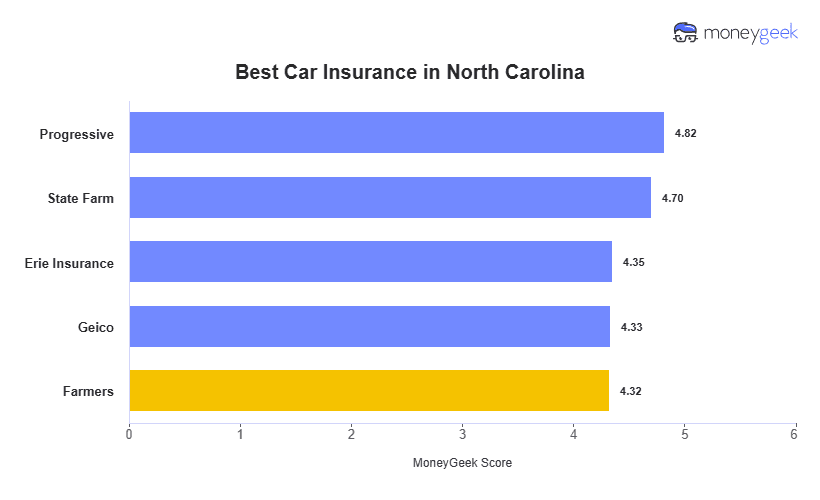

Progressive is the best car insurance company in North Carolina, with a 4.4 out of 5 MoneyGeek score. It excels in affordability, customer service and coverage options.

State Farm leads in affordability with North Carolina's best car insurance rates. The company offers the lowest premiums for most driver profiles, with a $56 monthly premium that's 50% below state averages for adults with clean driving records.

Farmers earns top marks for coverage options with a 4.8 out of 5 score. It provides the state's most extensive coverage customization while maintaining competitive rates for young adults.

Our recommendations provide a starting point, but your age, driving record and coverage needs determine which provider offers the best value. Compare these top companies to find the insurer that best fits your profile.