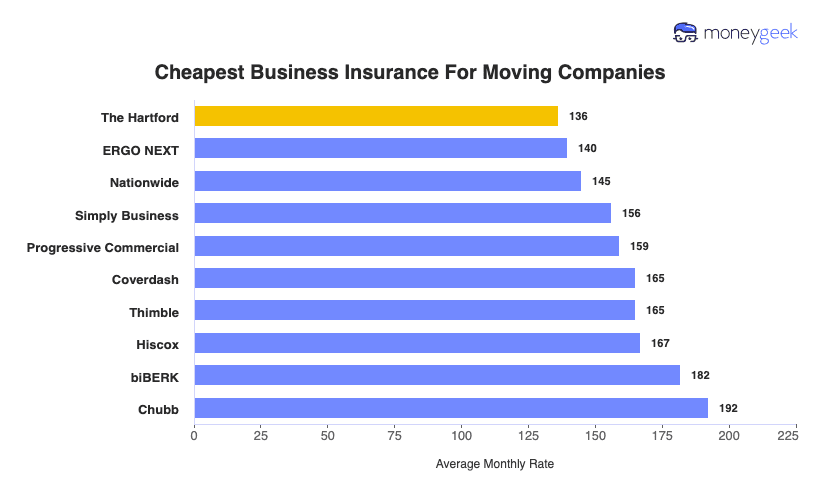

The Hartford ranks as our top choice for moving companies, earning a MoneyGeek score of 96 out of 100. At approximately $136 monthly, it delivers the comprehensive coverage, responsive customer service and financial stability your moving business needs to protect against liability claims, property damage and other risks movers face daily.

We recommend comparing quotes from our other top picks: ERGO NEXT, Nationwide, Simply Business and Coverdash. Each provider offers advantages that would better suit your operation's needs and budget.