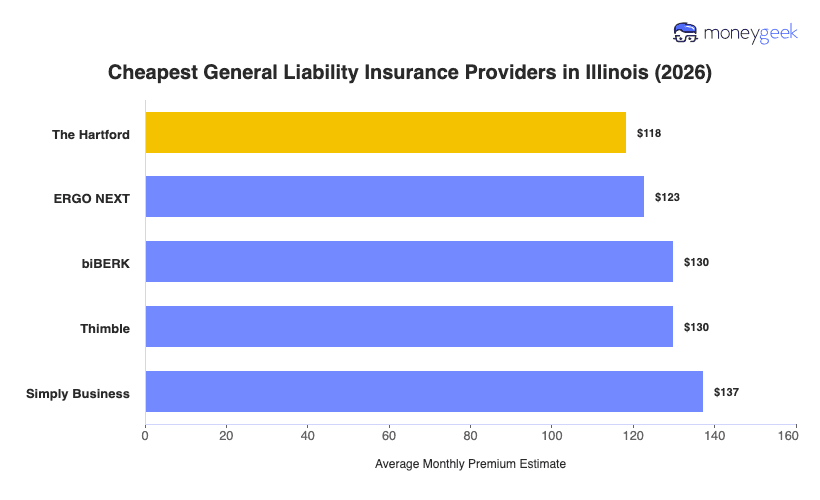

The Hartford, NEXT, biBerk and Simply Business most consistently deliver the lowest general liability rates across different business types in Illinois.

- The Hartford: Best for professional services and creative businesses (photography, financial advisors, accountants, chiropractors)

- ERGO NEXT: Best for hands-on trades and food service operations (electrical contractors, plumbing, food trucks, catering)

- biBERK: Best for fitness facilities and cleaning services (gyms, personal training, janitorial services, carpet cleaning)

- Simply Business: Best for retail shops and food service establishments (bookstores, gift shops, bakeries, delis)

>> Click Each Provider To Learn More

Your actual rate depends on your specific industry, business size, revenue and location within Illinois. Use these providers as a starting point, then compare quotes based on your business details.