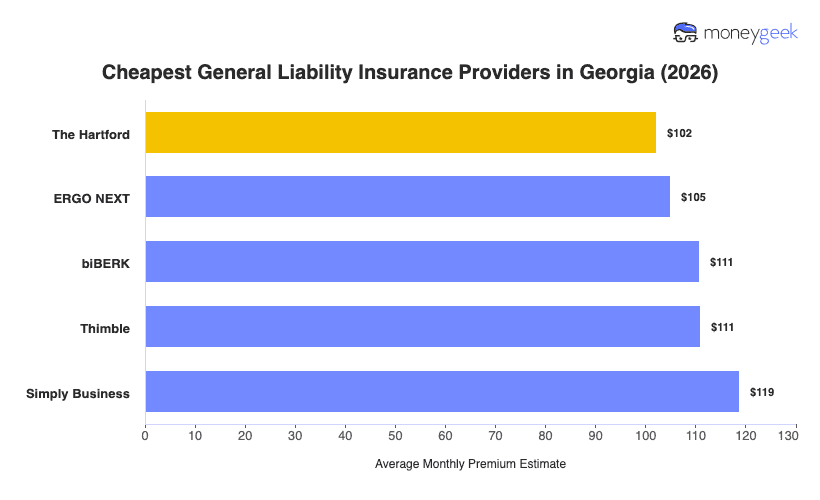

After analyzing top insurers in Georgia, we found these three carriers consistently offer the cheapest general liability insurance across different business types in the state.

- The Hartford: Best for creative professionals and retail operations (photography services, graphic design, auto parts shops, clothing stores)

- ERGO NEXT: Best for hands-on service businesses and food establishments (barber shops, electrical contractors, food trucks, restaurants)

- biBERK: Best for wellness services and cleaning operations (massage therapy, yoga studios, carpet cleaning, janitorial services)

>> [Click each provider to learn more]

Your actual premium depends on factors like your business activities, annual revenue and location within Georgia. These three providers offer a reliable starting point for your quote comparisons.