The Hartford takes the top spot as the best small business insurer for bounce house operations, excelling in both coverage and affordability. However, we recommend comparing quotes from our other top picks, including biBERK, NEXT ERGO, Simply Business and Coverdash.

Best Bounce House Insurance

The Hartford, biBerk and NEXT ERGO offer the best cheap business insurance for bounce house companies, with rates starting at $38 monthly.

Get personalized quotes from the best bounce house business insurer for you.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Bounce house rental companies need several types of coverage, such as general liability for customer injuries, workers' compensation for setup crews, inland marine for equipment and commercial auto for deliveries.

The Hartford is our pick for the best business insurance provider for inflatable rentals, combining the lowest $52 monthly average cost with perfect customer service and claims scores.

The Hartford has the cheapest business insurance for bounce house companies and operators, with the best rates for general and professional liability insurance.

Best Business Insurance for Bounce House Rental Companies

| The Hartford | 4.78 | $57 |

| biBERK | 4.70 | $59 |

| ERGO NEXT | 4.58 | $66 |

| Simply Business | 4.40 | $68 |

| Coverdash | 4.40 | $68 |

| Nationwide | 4.30 | $78 |

| Progressive Commercial | 4.30 | $69 |

| Chubb | 4.30 | $79 |

| Hiscox | 4.20 | $74 |

| Thimble | 4.20 | $74 |

*We based all scores on a bounce-house business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Bounce House Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your bounce house company, check out the following resources:

1. The Hartford: Best Bounce House BOP and Professional Liability Insurance

Lowest rates for general liability and professional liability insurance

Protects inflatables during transport, setup and at customer locations

New bounce houses automatically covered for 45 days after purchase

A+ AM Best financial stability rating ensures reliable claims payments

Flexible replacement cost lets you replace damaged units differently

Digital experience ranks last among providers

Fewer policy customization options than top competitors

Not available in Alaska or Hawaii

Limited BOP availability in Michigan

The Hartford offers the best combination of affordability and service for bounce house rental companies. It earned perfect scores in customer service and claims processing, both ranking first nationally.

The Hartford's inland marine coverage protects inflatables during transport, setup and at customer locations. Flexible replacement cost lets you swap damaged units for different equipment, and new purchases receive automatic 45-day coverage. XactPAY bases workers' comp on actual monthly payroll, helping smooth cash flow during slower months.

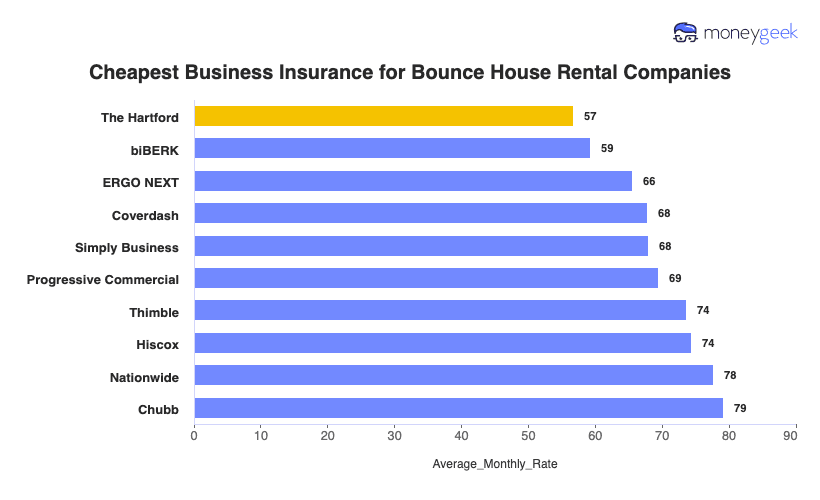

Cheapest Business Insurance for Bounce House Rental Businesses

The Hartford offers the cheapest bounce house insurance at $57 monthly on average, ranking first for general liability at $56 monthly ($674 annually) and professional liability at $52 monthly ($631 annually). It's the second-cheapest option for workers' compensation and business owners' policies (BOP). NEXT ERGO and biBerk offer the lowest rates for those coverage types, respectively.

| The Hartford | $57 | $680 |

| biBERK | $59 | $712 |

| ERGO NEXT | $66 | $786 |

| Coverdash | $68 | $814 |

| Simply Business | $68 | $816 |

| Progressive Commercial | $69 | $834 |

| Thimble | $74 | $883 |

| Hiscox | $74 | $893 |

| Nationwide | $78 | $931 |

| Chubb | $79 | $951 |

What Does Bounce House Business Insurance Cost?

In general, bounce house business insurance costs are the following for the four most popular coverage types:

- General Liability Cost: $70 on average per month, ranging from $61 to $82, depending on the state

- Workers' Comp: $40 on average per month, ranging from $35 to $47, depending on the state

- Professional Liability (E&O): $59 on average per month, ranging from $51 to $69, depending on the state

- BOP Insurance: $104 on average per month, ranging from $89 to $123, depending on the state

| BOP | $104 | $1,249 |

| General Liability | $70 | $846 |

| Professional Liability (E&O) | $59 | $709 |

| Workers' Comp | $40 | $483 |

What Type of Insurance Is Best for a Bounce House Rental Company?

Bounce house rental businesses need comprehensive insurance to protect against customer injuries and equipment damage. Workers' compensation and commercial auto represent required coverages for bounce house businesses in most states, while general liability and equipment protection prove equally critical for your inflatable rental operation.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Bounce House Rental Service

Follow these steps for getting business insurance that provides your bounce house company with financial protection without overspending.

- 1Decide on Coverage Needs Before Buying

Think about situations unique to your bounce house business: a thunderstorm warning mid-event requiring emergency takedowns, a renter's sprinkler system puncturing your water slide or a blower motor failing during peak season. Talk with other inflatable rental operators about unexpected claims they've faced. Understanding these real-world risks helps you avoid coverage gaps that could cost thousands out of pocket.

- 2Research Costs

Compare what similar-sized bounce house companies pay before requesting quotes. A solo operator with three units pays differently than an operation running ten inflatables with two employees. Factor in your annual revenue, monthly rental volume and whether you offer delivery-only or full-service setups. These details directly impact your premiums and help you budget accurately for coverage.

- 3Look Into Company Reputations and Coverage Options

Ask other party rental owners which insurers actually understand your business. Some carriers treat bounce houses like standard equipment rentals and miss risks like wind damage protection or coverage during off-season storage. Check whether providers offer certificates of insurance within hours for last-minute bookings at schools or parks requiring proof of coverage.

- 4Compare Multiple Quotes Through Different Means

Request quotes specifying your actual operation: weekend-only rentals versus year-round availability, residential parties versus large public events, indoor facility versus mobile service. Independent agents familiar with bounce house rental businesses often negotiate better terms than going directly to insurers. Ask about discounts for owning commercial-grade inflatables, completing safety certifications or maintaining clean driving records for delivery vehicles.

- 5Reassess Annually

Business changes affect your business insurance costs. Adding water slides increases liability exposure differently than adding standard bounce houses. Expanding into corporate events or school carnivals changes your risk profile. Moving from residential driveways to public park setups requires different coverage limits. Review your policy each renewal to match your current operation and stop paying for outdated coverage.

Bounce House Business Insurance: Bottom Line

The Hartford is the best business insurance provider for bounce house rental companies, offering the lowest rates with perfect customer service scores. Your inflatable rental business needs general liability for customer injuries, workers' compensation for setup crews, inland marine for equipment protection and commercial auto for deliveries.

Insurance for Bounce House Business: FAQ

We answer frequently asked questions about bounce house business insurance:

Who offers the best bounce house business insurance overall?

The Hartford delivers the best overall business insurance for bounce house companies, earning a MoneyGeek score of 4.78 out of 5. biBERK follows closely behind with a score of 4.70, offering competitive pricing and solid coverage options.

Who has the cheapest business insurance for bounce house firms?

Here are the cheapest business insurance companies for Bounce House businesses by coverage type:

- Cheapest general liability insurance: The Hartford at $56 monthly

- Cheapest workers' comp insurance: NEXT ERGO at $38 monthly

- Cheapest professional liability insurance: The Hartford at $53 monthly

- Cheapest BOP insurance: Coverdash at $100 monthly

What business insurance is required for bounce house organizations?

Bounce house businesses must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements vary by state. General liability insurance isn't legally mandated but most clients require it.

How much does bounce house business insurance cost?

Bounce house business insurance costs by coverage type are as follows:

- General Liability: $70/mo

- Workers' Comp: $40/mo

- Professional Liability: $59/mo

- BOP Insurance: $104/mo

How We Chose the Best Bounce House Business Insurance

We selected the best business insurer for bounce-house companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 30, 2025.

- NEXT ERGO. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.