The best general liability insurance companies in Illinois offer more than standard coverage. They understand the risks facing a Naperville contractor, a Chicago food truck operator or a Bloomington retail shop. These five providers rank highest for small businesses across the state, balancing affordable rates with responsive service and policy flexibility that fits how Illinois businesses actually operate.

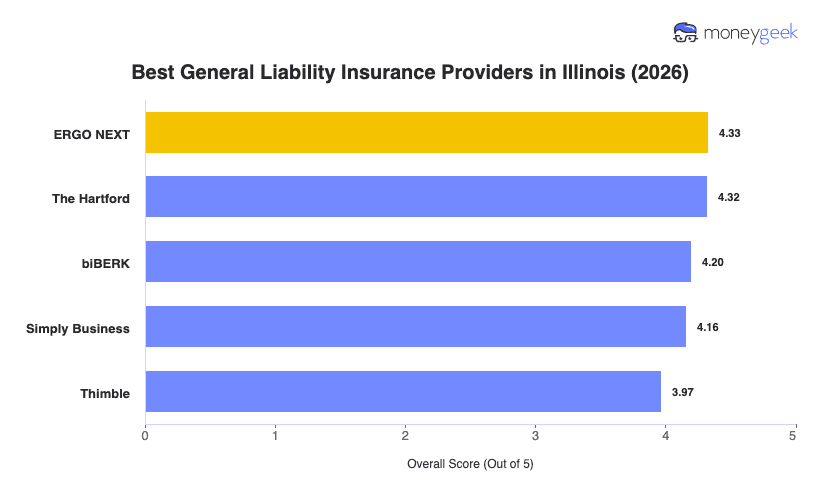

- ERGO NEXT: Best Overall, Best for Customer-Facing Businesses

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best for Service-Based Businesses with Straightforward GL Needs

- Simply Business: Best for Multi-Carrier Quotes

- Thimble: Best for Flexible Coverage Terms

These companies balance competitive pricing with reliable claims handling and flexible policy options. The detailed profiles below explain where each provider excels and how they compare across key factors that matter to Illinois small business owners.