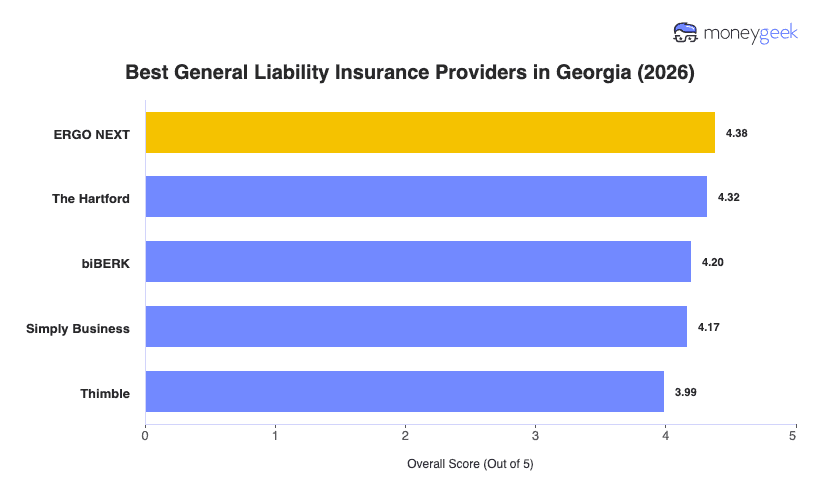

Whether you're operating a landscaping crew in Marietta or running a consulting practice in Buckhead, the best general liability insurance comes down to finding coverage that fits your exposure without overcharging. Our analysis showed these five providers have the best general liability coverage in the state:

- ERGO NEXT: Best Overall, Best for Hands-On and Service Industries

- The Hartford: Best for Professional Services

- biBERK: Best for Service Businesses

- Simply Business: Best for Comparing Carriers

- Thimble: Best for On-Demand Coverage

Each insurer on this list performs well across affordability, customer experience and coverage strength. The breakdowns ahead explain how each insurer earned its ranking and where it fits best for Georgia small business owners.