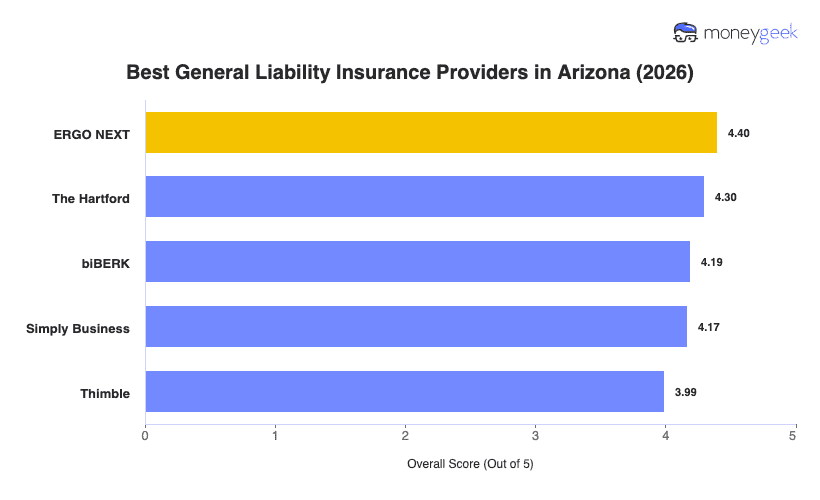

The best general liability insurance for Arizona small businesses depends on your industry, team size and location. No single provider works best across all business types, but these five earned top marks for their combination of competitive pricing, service quality and coverage options:

- ERGO NEXT: Best Overall, Best for Hands-on Service Businesses

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best for Active Service Businesses

- Simply Business: Best for Small Retail and Food Businesses

- Thimble: Best for Project-based Trades

Each of these insurers earned its ranking by meeting the needs of Arizona's wide range of small businesses, from construction contractors in Phoenix to event coordinators in Tucson. The table that follows break down what makes each provider worth considering and which business profiles benefit most from its approach.