You can absolutely get a quick car insurance quote with limited personal information, but the less information you fill out, the less accurate that quote will be. MoneyGeek's car insurance calculator will help you get a quick estimate using just your ZIP code, 100% anonymously. But you will only get the most accurate rates by filling out the needed personal information with an insurance company.

How to Get a Car Insurance Quote Without Submitting Personal Information

MoneyGeek's car insurance quote tool can get you a free, accurate rate estimate without submitting personal information, but if you want to get a final, binding auto insurance quote you'll need to submit more personal information.

Get your quick anonymous car insurance quote below by only submitting your ZIP code.

Updated: January 8, 2026

Advertising & Editorial Disclosure

Anonymous car insurance quotes let you shop around without giving every company your personal details. MoneyGeek's calculator tool will help you get a better sense of pricing before deciding which insurers deserve your phone number, email and other sensitive information.

Start with comparison tools using basic details, then share complete information only with companies you're seriously considering.

The General, GEICO and Progressive ask for the least personal information when you're getting quotes.

Can You Really Get a Quick Car Insurance Quote Without Personal Information?

Anonymous Car Insurance Estimator

MoneyGeek's calculator analyzes real estimated quote data from insurer filings, covering all U.S. ZIP codes and updated monthly. We normalize pricing against our competitors to ensure you receive an accurate and updated rate estimate as possible with the limited personal information required.

Enter your zip code below to calculate your car insurance premium.

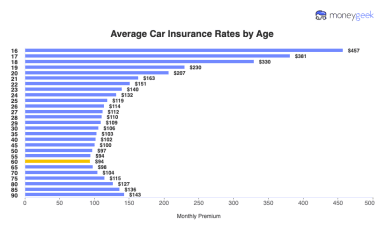

The cost of car insurance for you will depend greatly on a variety of personal factors. Factors as specific as where you live, the age of drivers in your household, your driving history, your vehicle type and even your credit score can greatly affect your car insurance rates.

Insurers use these factors to calculate your risk and determine the cost of car insurance, so they can't give you a binding, accurate rate until they've collected that information.

At MoneyGeek, we've collected data on a variety of driver types to help you compare car insurance without giving up your personal information to multiple insurers. And our quote tool can get you a simple estimate just by entering your ZIP code.

Unfortunately, when you're ready to buy car insurance for real, you will have to drop your anonymity and provide personal data to at least one insurer.

How to Get Car Insurance Estimates Without Personal Information

Getting a car insurance quote without sharing an email address or phone number can be tricky, but you do not need to hand over your contact details to every insurer just to check prices. These steps can help you compare rates while keeping your information limited:

- 1Use an Anonymous Quote Comparison Tool

Start with MoneyGeek's anonymous calculator. Enter your ZIP code, car details, age range and driving history (no name, phone, email or Social Security number needed). Multiple insurer estimates appear in minutes without follow-up calls or emails.

You'll need to provide more detailed information later to get binding quotes. Try other anonymous quote tools to compare results. Check privacy policies on any tool you use to see how they handle your data.

- 2Narrow Down Your Options

Pick three to five companies with competitive rates and strong reviews from your anonymous results. Focus on the most promising options rather than requesting quotes from every insurer. Compare premiums alongside MoneyGeek scores before deciding.

- 3Create a Dedicated Email Address

Getting car insurance quotes without an email address is rarely possible. One option is to create a separate email account just for insurance quotes, then stop using it after you purchase a policy.

Free email services like Gmail or Proton make this easy and help keep marketing messages out of your main inbox. Disposable email addresses can work for short-term use, but you may miss important updates about your quote.

- 4Opt Out of Phone Marketing and Use Temporary Phone Numbers

Get car insurance quotes without unwanted calls or number sharing. Minimize phone contact by explicitly opting out of marketing calls, selecting "email only" preferences, using temporary phone numbers when required and trying tools like Google Voice for better control.

- 5Use Minimal Information for More Accurate Quotes

Stick to required fields only when getting more accurate quotes. The General, Progressive and GEICO demand the least upfront information. Skip optional fields, use initials when possible and always opt out of marketing calls. Required fields need accurate information since inaccuracies will change your actual rates.

- 6Compare Final Quotes and Coverage Options

When reviewing final quotes, look beyond the monthly price. Check coverage limits, deductibles, available discounts and customer service ratings. At this stage, your full information only goes to the insurer you choose, which helps keep your personal data exposure limited.

Best Anonymous Car Insurance Quotes: Companies Requiring the Least Personal Information

We checked how much personal information different car insurance companies need for quotes. In this context, "anonymous" means providing minimal personal details initially, like your ZIP code, to get an estimate before revealing your name, address and driving history. Most companies require your ZIP code and basic vehicle details to estimate potential costs.

Review each company's privacy policy for details on data retention and security practices. These companies use encryption and regular security audits to protect your information.

We focused on The General, GEICO and Progressive because they ask for the fewest details upfront. For instance, many of GEICO's additional information fields are optional. Here's how the most privacy-friendly companies stack up:

Company | Best For | Privacy Tips |

|---|---|---|

The General | Maximum privacy protection | Use its website instead of the phone for fewer information requests. Its streamlined process maximizes privacy protection. |

Balance of privacy and name recognition | Create a dedicated email address before using the system. Most "additional information" fields appear required but are optional. | |

Comparison shopping anonymously | Use "skip this step" for SSN prompts and find the "communication preferences" link to manage marketing. Consider a secondary email address. | |

Selective information sharing | When prompted, use your driver's license instead of your SSN. Uncheck all marketing boxes on the quote summary page. | |

Privacy-conscious initial research | Use its general rate calculator for initial research instead of the full quote system. Uncheck all marketing permission boxes before proceeding. |

Anonymous vs. Binding Car Insurance Quotes

Anonymous quotes give you ballpark pricing without sharing contact details. You can get these estimates through online comparison tools or directly from some insurers, especially direct writers who don't use agents. Binding quotes lock in actual rates but require your full personal information and often trigger marketing calls.

A binding quote becomes active when you formally accept it. While rare, some companies impose cancellation fees if you back out after accepting.

Feature | Anonymous Quotes | Binding Quotes |

|---|---|---|

Purpose | Initial research and comparison | Final offer ready for purchase |

Information required | Minimal (ZIP code, vehicle type, basic driver details) | Detailed (full name, address, SSN, driving history, VIN) |

Commitment | None, no obligation to purchase | Ready to purchase if you choose to accept |

Privacy protection | High, limited personal information shared | Low, requires sharing personal information |

Expiration | Don't expire | Valid for 30 days |

Discounts | May not include all available discounts | Includes all applicable discounts |

Best used for | Preliminary research and company shortlisting | Final decision-making and purchase |

When shopping for car insurance, use anonymous and binding quotes sequentially. Start with anonymous estimates to identify two or three promising companies. Then request binding quotes only from the finalists. This approach provides the most accurate rates while sharing the least personal information.

What Information Is Needed for a Car Insurance Quote?

You'll always need your ZIP code, car details (year, make and model) and basic information about yourself and your driving history. Everything else, like your phone number, email and Social Security number, is often optional for estimates, even though companies make these fields seem required.

Here's what you can expect companies to ask for and what you can skip:

Information Type | Required for Estimate? | Required for Binding Quote? | Privacy Impact |

|---|---|---|---|

ZIP code | Yes | Yes | Low |

Vehicle year/make/model | Yes | Yes | Low |

Age | Yes | Yes | Low |

Gender | In most states | Yes | Low |

Marital status | No | Yes | Medium |

Full name | No | Yes | High |

Address | No | Yes | High |

No | Yes | High | |

Phone number | No | Yes | High |

Social Security Number | No | Yes, in most cases | Very high |

Driver's license | No | Yes | High |

VIN | No | Yes | Medium |

Driving history | For accurate quotes | Yes | Medium |

Current insurance | No | No | Medium |

How Vehicle Details Affect Your Rate

Vehicle make influences premiums through repair costs, theft rates and safety ratings. Model specifics matter too since insurers weigh safety features, body type (sedan, SUV or truck), engine size and theft statistics. A Honda Civic and Honda Accord carry different rates despite sharing a manufacturer.

How to Get a Free Car Insurance Quote With No Personal Information: Bottom Line

Shop for car insurance without receiving excessive sales calls. Use MoneyGeek's anonymous calculator or other comparison tools first to see which companies offer good rates, then share your real contact info with only your top two or three picks.

You'll still need to provide full details to get an actual quote you can buy, but this approach lets you narrow down your options without 20 different companies having your contact information. The General asks for the least information upfront, while companies like Allstate want more details right away.

Start with anonymous quotes, identify your top choices, then provide complete information to only the most promising companies. You'll get competitive rates without constant marketing calls.

Ensure you are getting the best rate for your car insurance. Compare quotes from the top insurance companies.

Anonymous Quotes for Car Insurance: FAQ

We gathered common questions about anonymous quotes to simplify your car insurance shopping experience:

Is getting a car insurance quote online safe?

Yes, getting car insurance quotes online is safe when you use legitimate insurance sites. Look for the padlock icon and "https" in the web address, which shows the site encrypts your data during transmission.

Read the privacy policy to understand how your information will be used and whether it'll be shared with third parties. Check customer reviews and financial ratings to verify the company's reputation.

Avoid phishing scams. Don't click links in unsolicited emails or provide information on sites with suspicious URLs. Companies like The General and GEICO ask for minimal personal details during the initial quote process.

Do I Need to Give My Social Security Number for a Car Insurance Quote?

No, not for initial quotes. Many insurance companies use your Social Security number to check your credit score, which affects your rate. But companies like The General and GEICO make it optional for estimates. Without your Social Security number, your quote will be less precise but still gives you a ballpark cost. You'll need to provide it later for a binding quote, when insurers verify your driving record and finalize your rate.

What do you need to get a car insurance quote?

What you need for a car insurance quote depends on the type. For anonymous quotes: just your ZIP code and car details. For real quotes you can actually buy: contact info, driver's license, birthdate, and sometimes your SSN. Start with the basics, then share the sensitive stuff only with companies you're seriously considering.

Why do car insurance companies need personal information for a quote?

Insurance companies need your personal information to assess your risk and price your policy. They consider your driving history (accidents, violations), age, location, vehicle details (make, model, year) and in most states, your credit score.

A driver with a clean record often pays less than someone with speeding tickets because they're seen as lower risk. Start with basic information when shopping, then share complete details only with your top choice.

Are anonymous insurance quotes accurate?

Anonymous quotes using minimal information usually fall within 15% to 30% of your final price. Binding quotes with complete personal details are highly accurate unless your circumstances change. Quote accuracy depends on what you provide. Your driving record, vehicle details, coverage choices and credit score (in most states) all affect the final price. The more complete your information, the more accurate your quote.

Can I get an insurance quote before buying a car?

You can get insurance quotes before buying a car, and it's smart to do so. Plug in the year, make and model of cars you're considering to see insurance costs. Some cars cost much more to insure than others, so find out before you buy.

What do I need to get car insurance over the phone?

When getting car insurance quotes over the phone, have this information ready:

Personal Details

- Full name and date of birth

- Current address (include previous address if you've moved within six months)

- Driver's license number

- Social Security number (for discount verification)

- Marital status

Vehicle Information

- Year, make, model

- Vehicle identification number

- Annual mileage

- Safety features

Insurance History

- Driving record (accidents, violations)

- Current insurance coverage

Phone quotes require more information than online anonymous quotes, so consider getting estimates online first to narrow your choices.

Best Companies Offering Anonymous Car Insurance Quotes: Our Methodology

Getting car insurance quotes shouldn't mean surrendering your personal information to dozens of companies. We designed our research to identify which insurers let you compare rates anonymously, so you can shop smart without spam calls, emails or unwanted marketing.

Our Research Approach

We tested 46 car insurance companies to find which ones respect your privacy during the quote process. For each insurer, we measured how much personal information they require upfront, whether they demand sensitive data like your Social Security number or driver's license before showing prices, and how long the quote process takes with minimal data sharing.

What We Measured

MoneyGeek gathered 83,056 anonymous quotes from 46 companies across 473 ZIP codes using state insurance department data and Quadrant Information Services pricing analytics.

What Makes Our Analysis Unique

Most car insurance comparisons focus only on final prices after you've shared all your information. Our approach reveals which companies give you accurate estimates before you provide sensitive details, helping you narrow your options without privacy trade-offs. We ranked insurers by quote accuracy, data requirements and user experience to show you the best starting points for anonymous rate shopping.

Auto Insurance Quotes: Related Articles

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Office of Public Insurance Counsel. "What Is a Dec Page?." Accessed August 8, 2025.