Erie leads Ohio's renters insurance market with a MoneyGeek score of 4.9 out of 5, earning the No. 1 rank in the customer experience and coverage categories. State Farm follows closely with an overall score of 4.6, excelling in affordability and customer service. The other companies that round out the top five according to our research are Auto-Owners, Lemonade and Nationwide.

Best Renters Insurance in Ohio (2026)

Erie, State Farm and Auto-Owners are the top-rated renters insurance companies in Ohio based on their affordability, coverage and customer experience scores.

Find out if you're overpaying for renters insurance below.

Updated: February 5, 2026

Advertising & Editorial Disclosure

Erie is Ohio's best overall renters insurance company, earning a 4.9 out of 5 MoneyGeek score.

Grange offers the lowest renters insurance premiums in the state at $110 per year on average.

Compare quotes from at least three insurers to find the best rates for your coverage needs.

5 Best Renters Insurance Companies in Ohio

| Erie Insurance | 4.9 | 7 | 1 | 1 |

| State Farm | 4.69 | 3 | 3 | 5 |

| Auto-Owners Insurance | 4.56 | 5 | 2 | 11 |

| Lemonade | 4.46 | 8 | 8 | 3 |

| Nationwide | 4.44 | 4 | 7 | 7 |

*Our ratings consider different combinations of coverage levels and renter details to identify the best overall options. Rankings may differ based on your profile.

Top Choice for Ohio Renters

Average Annual Premium

$158Based on our methodology's base profile of a policy with $20K in personal property coverage and $100K in liability coverage with a $500 deductibleAverage Monthly Premium

$13Based on our methodology's base profile of a policy with $20K in personal property coverage and $100K in liability coverage with a $500 deductibleJ.D. Power Renters Insurance Customer Satisfaction Score

705/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average renters insurance score is 668/1,000.

- pros

Top customer experience ratings among Ohio insurers

Strong coverage options

Local agent support for claims and policy questions

consFewer digital tools compared to national insurers

Requires working with an agent rather than buying coverage online

Erie is our top recommendation for Ohio renters with a 4.9 out of 5 MoneyGeek score. The company ranks first for customer experience and coverage while charging rates below the state average. Its local agent network gives you personalized support when you file claims or adjust your policy.

Compare the Cheapest Renters Insurance Companies in Ohio

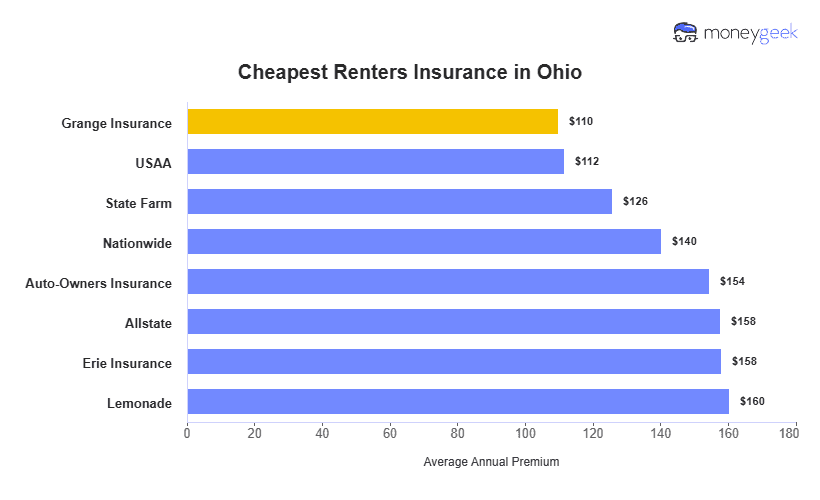

Grange offers the cheapest renters insurance in Ohio at $110 per year for $20,000 in personal property coverage. That's $82 less than the Ohio state average of $192 annually. USAA follows at $112 per year, though coverage is limited to military members, veterans and their families. State Farm charges $126 annually and is available statewide. The eight most affordable insurers all charge less than the state average, with rates ranging from $110 to $160 per year.

Average Cost of Renters Insurance in Ohio

The average cost of renters insurance in Ohio is $192 per year, $4 less than the national average of $196. These rates reflect a policy with $20,000 in personal property coverage, $100,000 in liability limits and a $500 deductible.

Your actual premium depends on your coverage limits, deductible choice and location within Ohio.

| OH | $192 | $-4 |

Renters insurance costs vary by up to $81 across Ohio cities. Toledo has the highest average premium at $245 per year, $53 above the state average. Bolivar has the lowest rates at $164 annually, $28 less than the state average of $192.

Akron $194 $2 Bolivar $164 $-28 Cincinnati $176 $-16 Cleveland $198 $6 Columbus $183 $-10 Dayton $196 $4 Dillonvale $175 $-17 Grove City $179 $-13 Toledo $245 $53 Higher coverage limits increase your renters insurance premium in Ohio. A basic policy with $20,000 in personal property coverage and $100,000 in liability costs $192 per year, while a policy with $50,000 in personal property costs $322 annually. Comprehensive coverage with $250,000 in personal property and $300,000 in liability costs $1,169 per year.

$20K Personal Property / $100K Liability $16 $192 $50K Personal Property / $100K Liability $27 $322 $100K Personal Property / $100K Liability $42 $501 $250K Personal Property / $300K Liability $97 $1,169 Your credit score affects renters insurance rates in Ohio. Renters with excellent credit pay $127 per year, while those with good credit pay $192 annually. Poor credit increases costs to $933 per year, more than seven times the rate for excellent credit.

Excellent $11 $127 Good $16 $192 Fair $23 $275 Below Fair $38 $451 Poor $78 $933

Do You Need Renters Insurance in Ohio?

Ohio doesn't require renters insurance by law, but your landlord can require coverage as part of your lease agreement. Many property managers and landlords mandate renters insurance to protect themselves from liability claims. Some landlords require specific liability coverage amounts, often $100,000 or more. Check your lease to see if you need coverage before moving in.

Calculate your personal property coverage by adding up what it would cost to replace your belongings. Walk through your apartment and estimate replacement costs for furniture, electronics, clothing and other items. Most renters need $20,000 to $50,000 in personal property coverage. Choose liability limits of at least $100,000 to protect yourself if someone gets injured in your rental unit.

How to Find the Best Cheap Renters Insurance in Ohio

Compare quotes from multiple insurers to find affordable renters insurance in Ohio. Follow these steps to get the best rates:

- 1Compare quotes from at least three companies

Rates vary by up to $50 or more between insurers for identical coverage. Request quotes from both national carriers and regional providers like Erie and Grange.

- 2Check customer satisfaction ratings and reviews

Low premiums don't help if your insurer denies valid claims or takes weeks to respond. Review J.D. Power ratings and customer complaints filed with the Ohio Department of Insurance before buying.

- 3Bundle renters and auto insurance

Most insurers offer 10% to 25% discounts when you combine policies. State Farm and Allstate have some of the largest bundling discounts in Ohio.

- 4Ask about available discounts

Insurers give discounts for security systems, smoke detectors and claims-free history. Ask your agent which discounts you qualify for to maximize your savings.

Best Cheap Renters Insurance in Ohio: Bottom Line

Erie, State Farm, Auto-Owners, Lemonade and Nationwide are Ohio's best renters insurance companies. Compare quotes from multiple insurers to find the best rates for your coverage needs. Use the renters insurance calculator below to get personalized rate estimates based on your coverage level, deductible and credit score.

Get free renters insurance rate estimates for Ohio based on your coverage needs. Rates reflect a profile of renters aged 21 to 64 with no prior claims.

Renters Insurance in Ohio: FAQ

Common questions about Ohio renters insurance:

Does renters insurance cover roommates in Ohio?

Renters insurance covers only the policyholder and their relatives living in the unit. Your roommate needs their own policy to protect their belongings and get liability coverage. Each roommate should buy separate renters insurance with at least $20,000 in personal property coverage.

How much renters insurance do I need in Ohio?

Most Ohio renters need $20,000 to $50,000 in personal property coverage and $100,000 in liability protection. Add up replacement costs for your furniture, electronics, clothing and other belongings to calculate your needs. Your landlord may require specific coverage amounts, so check your lease before buying a policy.

How do I file a renters insurance claim in Ohio?

Contact your insurer immediately after damage occurs or items get stolen. Document the damage with photos and videos before cleaning up. Provide a list of damaged or stolen items with purchase dates and estimated values. Your insurer will assign a claims adjuster to review your case. Most claims get processed within two to four weeks.

Does renters insurance cover hotel stays if my apartment becomes unlivable?

Renters insurance covers temporary housing costs through loss of use coverage if covered damage like fire makes your apartment unlivable. This pays for hotel rooms and restaurant meals while repairs happen. Most policies limit loss of use to 20% to 30% of your personal property coverage amount. Floods and earthquakes aren't covered.

How We Found the Best Cheap Renters Insurance Companies in Ohio

We analyzed Ohio renters insurance companies to identify insurers with low rates and reliable service.

We collected quotes for renters aged 26 to 64 with good credit and no claims history. The profile included $20,000 in personal property coverage, $100,000 in liability protection and a $500 deductible.

Affordability determined 50% of each company's score. Customer satisfaction from industry research made up 40%. Add-on coverage options contributed 10%. Companies with the highest combined scores across all factors made our list of Ohio's best renters insurance providers.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.