Nationwide earned our top ranking for lawn care business insurance with a MoneyGeek score of 4.70 out of 5. It stands out for competitive rates and quality customer service, making it ideal for landscaping contractors managing equipment, crews and client properties. We also recommend comparing quotes from The Hartford and Simply Business to find the best coverage for your operation.

Best Lawn Care Business Insurance

Nationwide, The Hartford and Simply Business offer the best cheap business insurance for landscaping companies, with rates starting at $36 monthly.

Get matched to the best business insurance provider for lawn care contractors.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Landscaping businesses need types of business insurance like general liability, workers' comp, commercial auto and inland marine coverage.

Nationwide is the best business insurance for landscapers with a 4.70 MoneyGeek score, competitive rates and quality customer service.

Thimble offers the cheapest business insurance at $54 monthly, with workers' compensation the most affordable coverage at $36 per month.

Best Business Insurance for Landscaping Companies

| Nationwide | 4.70 | $71 |

| The Hartford | 4.63 | $80 |

| Simply Business | 4.60 | $73 |

| Thimble | 4.50 | $54 |

| Coverdash | 4.50 | $82 |

| Chubb | 4.50 | $103 |

| Progressive Commercial | 4.40 | $82 |

| ERGO NEXT | 4.37 | $146 |

| biBERK | 4.30 | $131 |

| Hiscox | 4.10 | $157 |

Note: We based all scores on a lawn/landscaping business with two employees across professional liability, general liability, workers' comp and BOP policies.

To find the right coverage for landscaping contractors, check out the following resources:

Best Lawn Care Business Insurance Providers by Specific Industry

While Nationwide ranks as our top overall pick with a MoneyGeek score of 4.70, different providers excel for specific landscaping business models: ERGO NEXT leads specifically for gardening business insurance and lawn care services with a MoneyGeek score of 4.82 out of 5.

Get Matched to the Best Lawn Care Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

1. Nationwide: Best Business Insurance for Lawn Care Businesses

Competitive rates for liability and BOP coverage

Equipment breakdown coverage included in BOP

Strong customer service with responsive claims handling

A+ financial strength rating ensures reliable claims payment

Digital tools lag behind competitors

Professional liability insurance costs more than other providers

For lawn care businesses and landscaping contractors, Nationwide offers the right mix of affordable rates and responsive service. It has the second-cheapest rates for BOP and general liability insurance. We found Nationwide ranks third for customer service in our study.

Nationwide's BOP automatically includes equipment breakdown coverage at no extra cost, protecting the mowers, trimmers and blowers that keep operations running. It also offers accounts receivable coverage, which protects landscaping contractors when clients fail to pay for completed work.

2. Thimble: Cheapest Overall for Landscaping Businesses

Lowest rates for BOP and general liability coverage

Flexible coverage by hour, day, month or year

Top-ranked digital experience makes buying coverage fast

Free additional insureds at no extra cost

Claims process ranks seventh

Customer service response times can be slow

For seasonal lawn care businesses and landscaping contractors, Thimble offers the most affordable rates and flexible coverage options. It ranks first for both BOP and general liability insurance.

Thimble's flexibility matches how lawn care businesses actually operate.

You can purchase coverage by the hour, day, month or year, so you only pay for insurance when you're actively working. It also includes blanket equipment coverage for tools under $2,500 at no extra cost, protecting your mowers, trimmers and blowers without itemizing each piece.

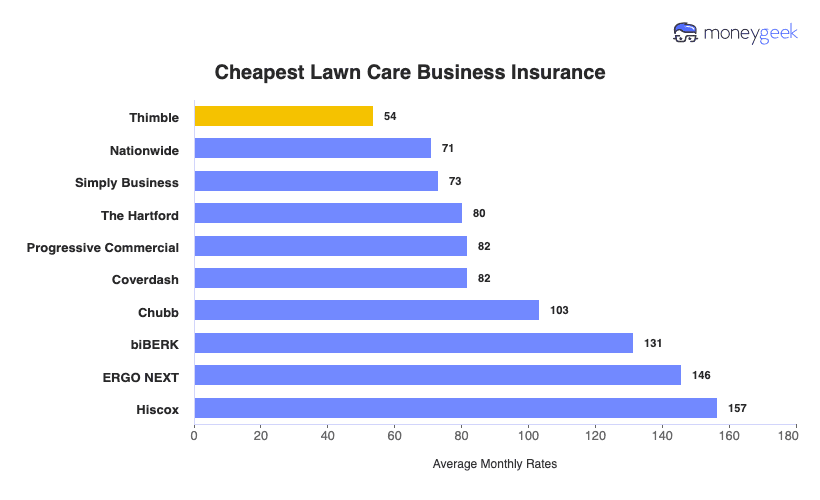

Cheapest Business Insurance for Lawn Care Companies

Thimble offers the cheapest lawn care business insurance at $54 monthly or $643 annually on average. It ranks first for both general liability and BOP coverage, making Thimble the most affordable option for landscaping contractors. For workers' compensation, ERGO NEXT and The Hartford offer better rates. Professional liability is most affordable through The Hartford at $46 monthly.

| Thimble | $54 | $643 |

| Nationwide | $71 | $852 |

| Simply Business | $73 | $876 |

| The Hartford | $80 | $963 |

| Progressive Commercial | $82 | $980 |

| Coverdash | $82 | $983 |

| Chubb | $103 | $1,238 |

| biBERK | $131 | $1,578 |

| ERGO NEXT | $146 | $1,748 |

| Hiscox | $157 | $1,880 |

Cheapest General Liability Insurance for Landscapers

Thimble offers the cheapest general liability insurance for lawn care businesses at $49 monthly or $590 annually. Landscaping contractors save $72 monthly compared to the $121 industry average, cutting costs by nearly 60%. This affordable coverage protects landscapers from common risks like property damage from flying debris or client injuries on job sites.

| Thimble | $49 | $590 |

| Nationwide | $74 | $886 |

| Simply Business | $81 | $972 |

| Progressive Commercial | $96 | $1,148 |

| Coverdash | $96 | $1,153 |

Cheapest Workers' Comp Insurance for Landscapers

ERGO NEXT provides the most affordable workers' compensation for landscaping companies at $36 monthly or $426 annually. Lawn care business owners save $2 monthly versus the $38 industry average. The Hartford and Progressive Commercial match ERGO NEXT's competitive rates, giving landscapers multiple budget-friendly options for covering crew injuries and meeting state requirements.

| ERGO NEXT | $36 | $426 |

| The Hartford | $36 | $430 |

| Progressive Commercial | $36 | $434 |

| Thimble | $36 | $434 |

| Simply Business | $37 | $438 |

Cheapest Professional Liability Insurance for Landscapers

Lawn care companies needing errors and omissions coverage will find The Hartford offers the cheapest professional liability insurance at $46 monthly or $552 annually. That's $5 below the $51 industry average, saving landscaping businesses 10% on coverage that protects against claims of poor workmanship or design errors. ERGO NEXT and Progressive Commercial are close alternatives.

| The Hartford | $46 | $552 |

| ERGO NEXT | $48 | $573 |

| Progressive Commercial | $49 | $585 |

| Simply Business | $51 | $608 |

| Hiscox | $51 | $609 |

Cheapest BOP Insurance for Landscapers

Landscaping contractors can secure the most affordable BOP insurance from Thimble at $76 monthly or $912 annually. That represents a 57% savings compared to the $177 monthly industry average, helping lawn care business owners save $101 each month. Nationwide and Simply Business offer competitive alternatives for landscapers wanting comprehensive coverage.

| Thimble | $76 | $912 |

| Nationwide | $111 | $1,331 |

| Simply Business | $121 | $1,452 |

| The Hartford | $137 | $1,641 |

| Coverdash | $139 | $1,669 |

What Does Lawn Care Business Insurance Cost?

Business insurance costs for lawn and landscaping companies depend on which coverage you need. Here are the rates for the four most popular types:

- General Liability Cost: $121 on average per month, ranging from $105 to $146, depending on the state

- Workers' Comp: $38 on average per month, ranging from $33 to $43, depending on the state

- Professional Liability (E&O): $51 on average per month, ranging from $45 to $61, depending on the state

- BOP Insurance: $177 on average per month, ranging from $153 to $214, depending on the state

| BOP | $177 | $2,124 |

| General Liability | $121 | $1,453 |

| Professional Liability (E&O) | $51 | $616 |

| Workers' Comp | $38 | $452 |

What Type of Insurance Is Best for a Landscaping Business?

Required coverage for landscaping contractors varies by state, but most mandate workers' compensation if you have employees and commercial auto insurance for business-owned vehicles. Beyond legal requirements, a lawn care business's insurance needs depend on your services, equipment and risk exposure.

- Workers' Compensation Insurance: Your employees experience real risks: back strains from hauling materials, lacerations from mower blades, or heat exhaustion during summer. Workers' comp provides unlimited medical coverage and partial wage replacement as mandated by your state.

- Commercial Auto Insurance: Required by most states for business-owned vehicles, this covers accidents involving your work trucks and trailers. Every drive between job sites puts you at risk, like when your trailer gets rear-ended at a stoplight, or your crew backs into a client's car. Most landscaping businesses carry $500,000 to $1 million in liability limits to adequately protect against accidents while transporting expensive equipment.

- General Liability Insurance: Protects against property damage and injury claims from your daily operations. Your mower throws a rock through a client's window, equipment gouges their driveway, or someone trips over your tools. Industry standard is $1 million per occurrence and $2 million aggregate, the limits that most commercial clients and HOAs require before hiring you.

- Inland Marine Insurance: Covers your mowers, trimmers and equipment wherever you take them, such as at job sites, in transit or temporarily stored. That protects against theft, damage in accidents or fire at a client's property. Set your limit to match total equipment replacement value, $20,000 to $50,000 for most landscaping operations, including both owned and financed items.

- Professional Liability Insurance: Essential if you offer landscape design or irrigation services beyond basic maintenance. Protects you when recommendations go wrong, like regrading that causes basement flooding, plants with roots that crack foundations, or drainage systems that fail. General liability excludes these professional mistakes. Most landscape designers carry $1 million in errors and omissions coverage matching their general liability limits.

- Commercial Umbrella Insurance: Extra protection when major claims exceed your primary limits. Your trailer detaches on the highway causing a multi-car pileup, or a tree falls on a neighbor's house causing extensive damage. Most landscaping businesses add $1 million to $2 million in umbrella coverage, particularly for high-end residential work or commercial contracts requiring higher limits.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Lawn Care Company

Getting business insurance for your landscaping company means comparing quotes from multiple carriers to find the best coverage at the lowest price.

- 1Decide on Coverage Needs Before Buying

Start by thinking through what could actually hurt your business. Your mower throws a rock through a $5,000 window. Someone steals your trailer full of equipment overnight. A crew member falls off a retaining wall and breaks an ankle.

- 2Research Costs

Know what landscaping businesses like yours pay for insurance before you start shopping. A solo operator mowing lawns needs different coverage than a crew doing tree removal and hardscaping.

- 3Look Into Company Reputations and Coverage Options

Read what other landscaping contractors say about their claims experiences. Make sure the company offers what you actually need, like pesticide application coverage or protection for seasonal workers.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers and mix up how you do it. Independent agents can access specialty landscaping insurers you won't find online.

- 5Reassess Annually

Your business changes. You add irrigation services. Buy another truck. Grow from two employees to six. Each renewal, make sure your coverage still matches what you're actually doing.

Best Insurance for Lawn Care Business: Bottom Line

Lawn care businesses need multiple types of business insurance to protect against daily risks. General liability, workers' compensation, commercial auto and inland marine coverage form your foundation. Nationwide earns our top recommendation for landscaping contractors with competitive rates and strong customer service. For budget-conscious operators, Thimble offers the cheapest business insurance at $54 monthly, with workers' comp starting at just $36.

Landscaping Business Insurance: FAQ

We answer frequently asked questions about lawn and landscaping business insurance:

Who offers the best lawn care business insurance overall?

Nationwide leads the pack for lawn and landscaping business insurance, earning an impressive MoneyGeek score of 4.7 out of 5. The Hartford follows closely as runner-up with a solid 4.63 rating, delivering excellent value through competitive pricing and comprehensive protection.

Who has the cheapest business insurance for lawn care and landscaping companies?

Here are the cheapest business insurance companies for landscapers by coverage type:

- Cheapest general liability insurance: Thimble at $49 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $36 monthly

- Cheapest professional liability insurance: The Hartford at $46 monthly

- Cheapest BOP insurance: Thimble at $76 monthly

What business insurance is required for lawn care and landscaping companies?

Workers' compensation (for employees) and commercial auto coverage (for business vehicles) are legally mandated, though requirements differ by state. General liability insurance remains essential for securing most commercial contracts.

How much does lawn care business insurance cost?

Lawn/Landscaping business insurance costs by coverage type are as follows:

- General Liability: $121/mo

- Workers' Comp: $38/mo

- Professional Liability: $51/mo

- BOP Insurance: $177/mo

How We Chose the Best Lawn/Landscaping Business Insurance

We selected the best business insurer for lawn care or landscaping companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Nationwide. "Company Ratings." Accessed February 7, 2026.