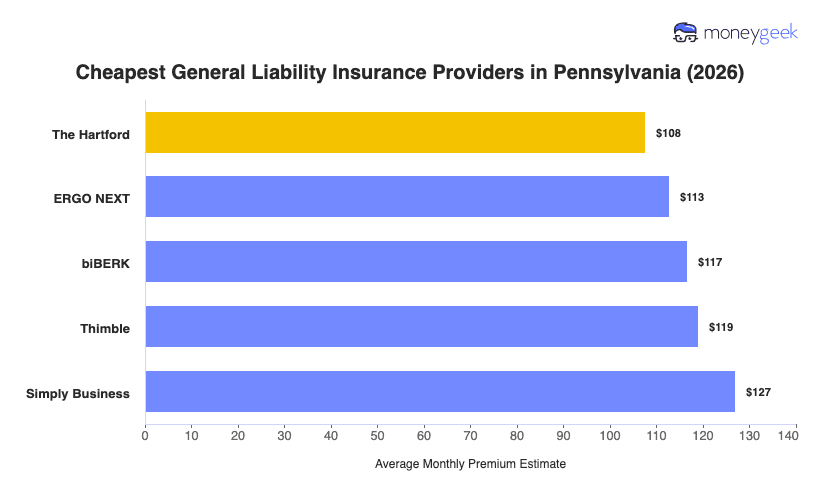

Pennsylvania small businesses, from Philadelphia storefronts to Pittsburgh service providers, can find the cheapest general liability insurance through these four insurers:

- The Hartford: Cheapest for creative professionals and storefront retail (photography, dance studios, physical therapy, clothing stores)

- ERGO NEXT: Most affordable for hands-on trades and personal services (handyman services, painting contractors, massage therapy, catering)

- biBERK: Lowest rates for service-based operations and specialized care (janitorial services, gyms, dental practices, sports coaching)

- Thimble: Cheapest for heavy construction and specialized trades (concrete contractors, HVAC, electrical work, welding)

>> [Click each provider to learn more]

Your actual rate depends on what your business does, where you operate in Pennsylvania, and your coverage limits. A catering company in Harrisburg won't pay the same as an HVAC contractor in Erie. Use these industry patterns as your starting point when comparing quotes.