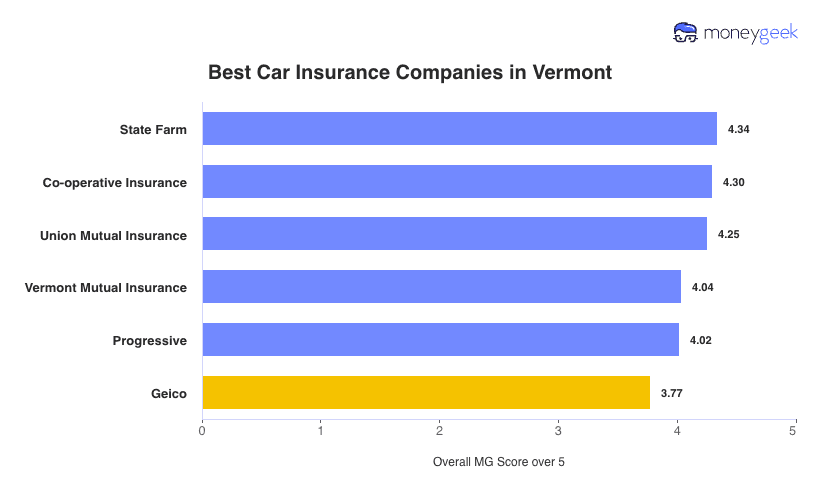

MoneyGeek evaluated all auto insurance providers in Vermont, scoring each company on affordability, customer service quality and coverage variety throughout the state's residential areas. These companies offer the best car insurance in Vermont. (Click each category to learn more about the winners):

Best by Rating:

- Best Cheap Overall: State Farm

- Customer Service: None

- Coverage Options: Progressive

Best by Driver and Coverage:

- Minimum Coverage Car Insurance: Co-operative Insurance

- Full Coverage: Co-operative Insurance

- Seniors (65+): Co-operative Insurance

- Young Drivers (16 to 25): Auto-Owners

- Adults (26 to 64): State Farm

- Drivers With Violations: Union

- Those With Bad Credit: Auto-Owners

To ensure you get a good deal on Vermont auto insurance, we also provided answers to common questions about the topic (Click to learn more).