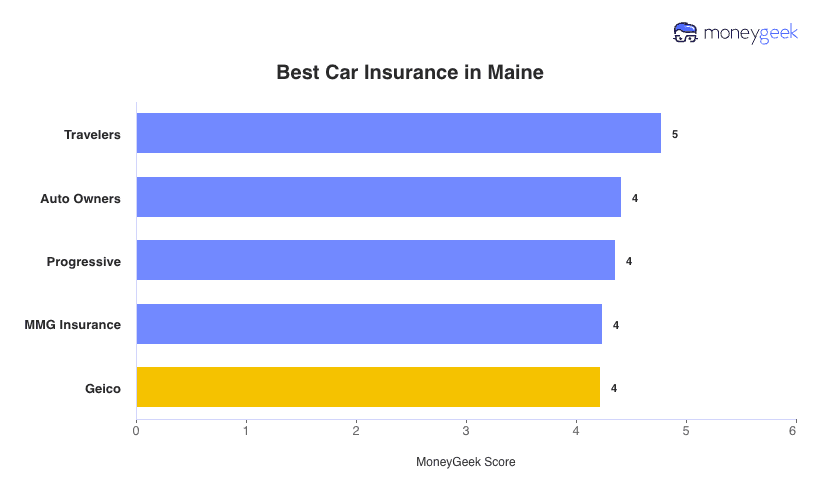

Travelers is the best car insurance company in Maine, with a 4.8 out of 5 MoneyGeek score. It excels in affordability, customer service and coverage options.

Travelers offers Maine's most affordable rates. Drivers with clean records pay $54 monthly for full coverage, which runs 14% below state averages.

MMG earns top marks for drivers with low income or bad credit, combining competitive affordability with strong local presence. Progressive leads in coverage options with a 4.9 score, providing the state's most extensive policy customization.

Our recommendations provide a starting point, but your age, driving record and coverage needs determine which provider offers the best value. Compare these top companies to find the insurer that best fits your profile.