To calculate how much renters insurance you need, set enough coverage limits to fully compensate for the loss of your personal belongings and cover any liabilities you may face in case of a covered peril. This way, in the event of incidents like theft or damage, you're financially protected without overpaying premiums.

How much coverage you get directly influences your costs. For instance, the average cost of renters insurance for $20,000 in personal property coverage is $15 per month or $182 per year, while $100,000 in coverage is $43 per month or $517 per year.

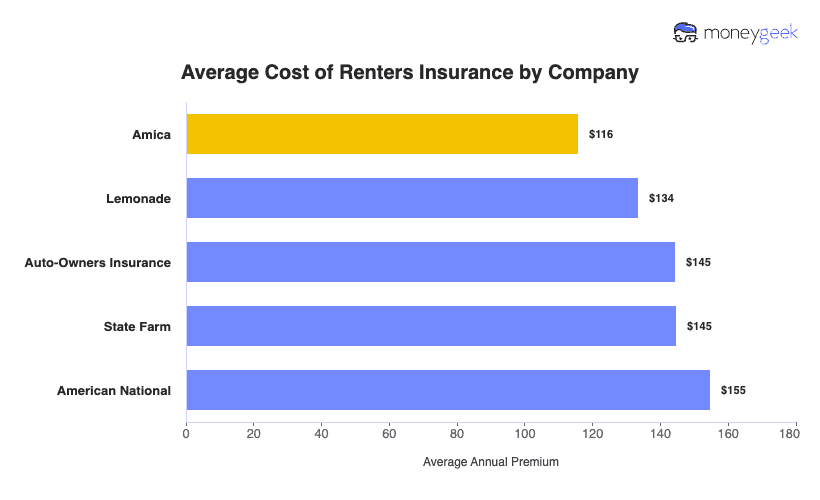

While setting low limits may be tempting to get cheap renters insurance, remember there is no one-size-fits-all renters insurance policy; you'll need to determine your coverage limits and compare renters insurance quotes to find the best policy for your needs.