Get fast answers to some of your most frequently asked questions about commercial auto insurance below:

Commercial Auto Insurance

Compare cheap commercial auto insurance quotes starting at $21/mo from top carriers including NEXT (Progressive), The Hartford and Nationwide.

Get matched with the best commercial auto insurance provider for you below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

Commercial Car Insurance: FAQ Fast Answers

Who offers the best commercial auto insurance?

Overall, the following companies offer best commercial auto insurance:

- NEXT (Progressive): Best Commercial Auto Insurance For Most Businesses

- The Hartford: Best Commercial Auto Insurance Customer Experience

- Nationwide: Best Commercial Auto Insurance For Agriculture

What does commercial auto insurance cover?

Commercial auto insurance covers vehicles used for business purposes and standard policies can include these types of car insurance coverages:

- Liability coverage for bodily injury and property damage if your driver causes an accident.

- Collision coverage for repairs after a crash, regardless of fault.

- Comprehensive coverage for theft, fire, vandalism, or weather damage.

- Medical payments or personal injury protection (PIP) for injuries to you or your passengers.

- Uninsured/underinsured motorist coverage if you’re hit by someone without proper insurance.

Who needs commercial auto insurance?

If you use your vehicles for any type of commercial related work or operations for your businesses, you'll be required to get coverage by all states. Commercial auto insurance requirements vary widely by location, industry, business use case and vehicle types.

What does commercial auto insurance cost on average?

On average you can expect commercial auto insurance to cost $385 per month or $4,619 per year across all general industries, vehicle types and states. These figures represent recommended coverage level of 100/300/100 liability coverage with a $1,000 deductible for comprehensive and collision coverage.

What’s the difference between personal and commercial auto insurance?

In general personal and commercial auto insurance is just split by the use of a vehicle. If your car is used for commercial activites other than commutes, you need a business auto policy. If you only use your vehicle for commuting purposes to your workplace and not to job/client sites or other personal uses, you don't need it.

How should I go about buying commercial auto insurance?

When you start the buying and research process for commercial auto insurance you should first assess your coverage risks related to your work, specific vehicles and your employees to determine your needs. Once this is done researching provider reputations, pricing and coverage options/terms throroughly ensures you can have a true understanding of who is best. After this point, you can sign, ensure to keep documentation of everything and reassess every year to keep getting the right business auto coverage and align with state laws.

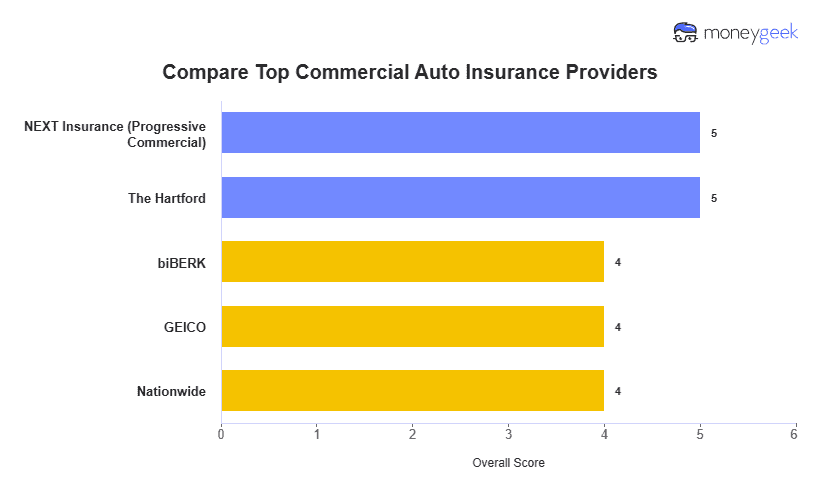

Compare The Best Commercial Auto Insurance Providers

Overall, the best commercial auto insurance provider in the U.S. is NEXT who offers their insurance through Progressive commercial. They primarily rank as the top company due to their low commercial car insurance rates ($293/mo on average) for the vast majority of cost factor combinations we studied and the 2nd best coverage options selection out of all insurers. While this is the case, we also recommend looking into The Hartford if you still want low rates and a top-rated customer experience and Nationwide for farm and agricultural focused businesses due to their specialized coverages.

| NEXT Insurance (Progressive Commercial) | 4.60 | $293 | 5 | 2 |

| The Hartford | 4.55 | $315 | 1 | 1 |

| Nationwide | 4.40 | $324 | 2 | 4 |

| biBERK | 4.36 | $367 | 3 | 3 |

| GEICO | 4.22 | $327 | 4 | 5 |

The best or the cheapest commercial auto insurance company for your business may differ depending on your vehicle type:

Get Matched To The Best Commercial Auto Insurer For You

Select your industry and state to get a customized commercial auto insurance quote from your top company match.

Best Commercial Auto Insurance By State

At the state level, The Hartford (top in 11 out of 50 states) and NEXT (top in 33 out of 50 states) dominate as the best commercial auto insurance providers. Below you can compare which insurers are best in your state below.

| Alabama | The Hartford | 4.87 | $277 |

| Alaska | NEXT Insurance (Progressive Commercial) | 4.76 | $324 |

| Arizona | NEXT Insurance (Progressive Commercial) | 4.76 | $339 |

| Arkansas | The Hartford | 4.87 | $296 |

| California | NEXT Insurance (Progressive Commercial) | 4.76 | $403 |

| Colorado | NEXT Insurance (Progressive Commercial) | 4.76 | $369 |

| Connecticut | NEXT Insurance (Progressive Commercial) | 4.74 | $390 |

| Delaware | The Hartford | 4.87 | $335 |

| Florida | NEXT Insurance (Progressive Commercial) | 4.76 | $447 |

| Georgia | NEXT Insurance (Progressive Commercial) | 4.76 | $311 |

| Hawaii | NEXT Insurance (Progressive Commercial) | 4.76 | $266 |

| Idaho | NEXT Insurance (Progressive Commercial) | 4.76 | $245 |

| Illinois | NEXT Insurance (Progressive Commercial) | 4.76 | $378 |

| Indiana | NEXT Insurance (Progressive Commercial) | 4.76 | $303 |

| Iowa | Nationwide | 4.79 | $262 |

| Kansas | Nationwide | 4.77 | $259 |

| Kentucky | The Hartford | 4.87 | $311 |

| Louisiana | The Hartford | 4.87 | $472 |

| Maine | NEXT Insurance (Progressive Commercial) | 4.76 | $225 |

| Maryland | GEICO | 4.64 | $386 |

| Massachusetts | NEXT Insurance (Progressive Commercial) | 4.76 | $390 |

| Michigan | NEXT Insurance (Progressive Commercial) | 4.76 | $413 |

| Minnesota | NEXT Insurance (Progressive Commercial) | 4.76 | $342 |

| Mississippi | NEXT Insurance (Progressive Commercial) | 4.76 | $303 |

| Missouri | NEXT Insurance (Progressive Commercial) | 4.76 | $369 |

| Montana | The Hartford | 4.87 | $282 |

| Nebraska | Nationwide | 4.78 | $272 |

| Nevada | NEXT Insurance (Progressive Commercial) | 4.76 | $350 |

| New Hampshire | NEXT Insurance (Progressive Commercial) | 4.76 | $236 |

| New Jersey | GEICO | 4.63 | $397 |

| New Mexico | NEXT Insurance (Progressive Commercial) | 4.76 | $318 |

| New York | NEXT Insurance (Progressive Commercial) | 4.76 | $510 |

| North Carolina | NEXT Insurance (Progressive Commercial) | 4.76 | $287 |

| North Dakota | The Hartford | 4.87 | $250 |

| Ohio | NEXT Insurance (Progressive Commercial) | 4.76 | $309 |

| Oklahoma | The Hartford | 4.87 | $292 |

| Oregon | NEXT Insurance (Progressive Commercial) | 4.76 | $333 |

| Pennsylvania | NEXT Insurance (Progressive Commercial) | 4.76 | $345 |

| Rhode Island | NEXT Insurance (Progressive Commercial) | 4.74 | $407 |

| South Carolina | NEXT Insurance (Progressive Commercial) | 4.76 | $322 |

| South Dakota | Nationwide | 4.75 | $358 |

| Tennessee | The Hartford | 4.87 | $333 |

| Texas | NEXT Insurance (Progressive Commercial) | 4.76 | $379 |

| Utah | NEXT Insurance (Progressive Commercial) | 4.76 | $274 |

| Vermont | Nationwide | 4.75 | $232 |

| Virginia | NEXT Insurance (Progressive Commercial) | 4.76 | $322 |

| Washington | NEXT Insurance (Progressive Commercial) | 4.76 | $385 |

| West Virginia | The Hartford | 4.87 | $313 |

| Wisconsin | Nationwide | 4.77 | $293 |

| Wyoming | The Hartford | 4.87 | $287 |

Compare Commercial Auto Insurance Rates and Quotes

When comparing commercial auto insurance costs by state, common coverage levels, industry and general vehicle types, we found rates vary anywhere from $21/month to $2,391/month. Commercial truck insurance pricing ranges from $43/month to $2,391/month. Filter for your specific business's details below to find what costs will be on average with top providers.

| The Hartford | $141 | $1,688 |

| GEICO | $164 | $1,963 |

| Nationwide | $170 | $2,037 |

| NEXT Insurance (Progressive Commercial) | $178 | $2,134 |

Compare Commercial Auto Insurance Coverage Types

Commercial auto insurance coverage policies can function similar to personal auto insurance policies and have liability splits and a deductible for comprehensive and collision coverages and add-ons also function similarly. The main difference is that is covers vehicles used for business purposes. However, there are more options businesses can consider that can better suit their needs and customize their coverage.

You can compare the types of commercial auto insurance below.

Split Limits Liability | Three separate limits (e.g., 100/300/50) | Divides coverage into distinct buckets: bodily injury per person, bodily injury per accident, and property damage per accident. Each limit applies independently. | Businesses wanting lower premiums with tailored coverage that can be customized based on specific risk tolerance. |

Combined Single Limit (CSL) | One total limit (e.g., $500,000) | Provides one overall maximum for all damages (bodily injury and property) without separate per-person or per-accident restrictions. Can be allocated flexibly to any combination of claims. | Businesses with operations involving valuable cargo, high-risk environments, or densely populated areas requiring broader reassurance and flexibility. |

Standard Commercial Auto | Customizable limits for owned vehicles | Covers owned, leased, or financed business vehicles with liability, comprehensive, collision, medical payments, and uninsured/underinsured motorist coverage. | Businesses owning or leasing company vehicles (delivery trucks, service vans, company cars) for regular business operations. |

Hired Auto Coverage | Added to main policy or separate endorsement | Covers liability and optional physical damage for rented or leased vehicles used temporarily for business purposes. | Businesses that rent vehicles during peak seasons, special events, or for occasional deliveries and transportation needs. |

Non-Owned Auto Coverage | Excess liability over employee's personal policy | Applies after employee's personal auto limit is exhausted when employees use personal vehicles for business tasks. Protects the business from liability, not the vehicle itself. | Businesses whose employees use personal cars for work errands, client meetings, deliveries, or business travel. |

Broad Form (Named Operator) | Driver-based liability limits | Coverage follows one specific named driver regardless of vehicle driven, rather than insuring specific vehicles. Available for employees or executives supplied with company vehicles who don't own personal vehicles or have personal auto policies. | Executives or employees with company-supplied vehicles who lack personal auto insurance and drive multiple company vehicles. Single drivers who never allow others to drive. |

All Risk/Open Perils | Standard liability limits with comprehensive physical damage | Covers all potential physical damage risks to vehicles except those explicitly excluded in the policy, rather than only named perils. Broader than standard comprehensive coverage. | Businesses wanting maximum physical damage protection beyond standard comprehensive and collision, covering unexpected incidents not typically listed in named perils policies. |

Business Auto Policy (BAP) | Comprehensive scheduled coverage per vehicle | Covers all vehicles used by business (owned, leased, hired, and employee-owned) with different coverage types, limits, and deductibles for each vehicle based on risk. | Large fleets or businesses with diverse vehicle types needing comprehensive coverage across multiple vehicle categories with varying risk levels. |

How To Compare Commercial Auto Insurance

When buying commercial auto insurance, we recommend using the following steps to find the best coverage possible.

- 1Assess Your Needs and Research Providers

Start by cataloging all vehicles in your fleet with their make, model, year, value, and primary use along with the driving records of employees. Once done, determine what coverage types you need beyond basic liability, such as collision, comprehensive, cargo insurance, and specialized endorsements. Then compile a list of potential insurers national carriers and regional providers that are specialized for your industry to compare.

- 2Gather Information and Request Multiple Quotes

Prepare all necessary documentation including your business details, comprehensive vehicle information, driver information with 3-5 years of driving history, and any previous claims history. Contact at least 4-6 insurance providers to request detailed quotes based on identical coverage specifications while being completely honest to ensure accurate comparisons. Ask each provider to itemize their quote in writing so you can compare side-by-side while inquiring about available discounts such as multi-vehicle, safety equipment, bundling, or telematics programs. Calculate the true annual cost including any installment fees or additional charges to make accurate comparisons between providers.

- 3Compare Coverage Details and Policy Terms

You should contact at least 4-6 insurance providers to request detailed quotes based on identical coverage specifications. Ask each provider to itemize their quote in writing so you can compare them side-by-side. Also inquire about available discounts such as multi-vehicle, safety equipment, bundling, or telematics programs in order to take advantage of all possible savings opportunities.

- 4Evaluate Claims Process and Service Quality

Look beyond just the price when reviewing each policy. You need to examine coverage territories, driver restrictions, deductibles, and how each insurer handles hired and non-owned vehicles. Pay attention to endorsements, exclusions, and special conditions that affect your operations. Also, compare specific features like cargo coverage limits, rental reimbursement, and roadside assistance, then review payment options, cancellation policies, renewal rate structures, and any fees beyond the premium.

- 5Evaluate Claims Process and Service Quality

Research how each company handles claims by checking processing times and reading customer reviews about claims experiences. You should contact customer service to gauge their responsiveness and ask about dedicated claims adjusters, response times, rental vehicle provisions, and repair shop options. Further than this, consider value-added benefits like safety training programs, fleet management tools, and bundling discounts that can provide additional value.

- 6Review Contract and Make Your Decision

Request full policy documents from your top 2-3 candidates and review the language carefully. You should pay attention to exclusions, conditions, and requirements to maintain coverage and other detailed you've already gathered on their service reputation and pricing. Confirm all details in writing before signing, review your policy documents to ensure they match your agreement, and reevaluate your policy needs annually to ensure you have the right protection.

Business Auto Insurance: Bottom Line

Overall, the best cheap commercial auto insurance providers are NEXT (Progressive Commercial), The Hartford and Nationwide. While this is the case, the right provider for you varies widely by your state, coverage level wanted, vehicles you want insured and your industry. So, we recommend comparing plenty of providers, researching your needs before buying and paying close attention to coverage terms and details to get the best fit possible for your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.