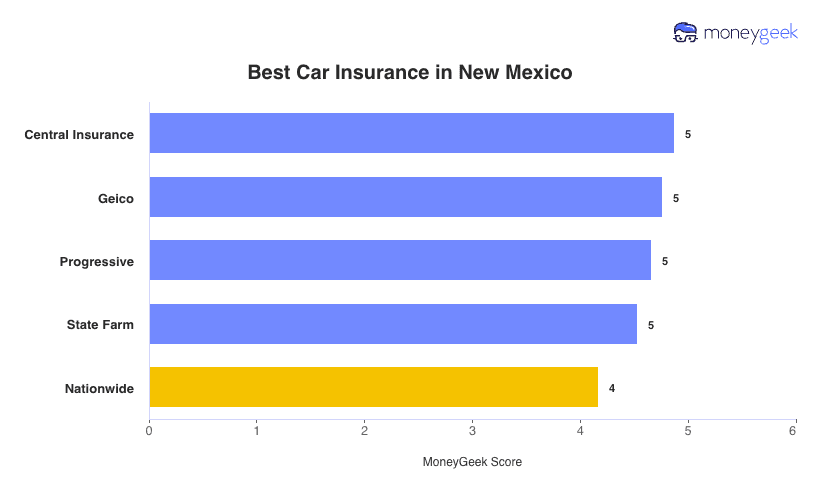

Central Insurance is the best car insurance company in New Mexico, with a 4.9 out of 5 MoneyGeek score. It excels in customer service and coverage options with perfect 5.0 scores in both categories.

Central offers competitive rates with full coverage at $102 monthly. Drivers with clean records pay rates that run 6% below state averages. The company ranks first overall in New Mexico for comprehensive coverage options.

State Farm ranks fourth overall and offers competitive rates for drivers with violations. GEICO ranks second overall and excels for low-income drivers with a perfect 5.0 affordability score combined with strong customer service.

Our recommendations provide a starting point, but your age, driving record and coverage needs determine which provider offers the best value. Compare these top companies to find the insurer that best fits your profile.