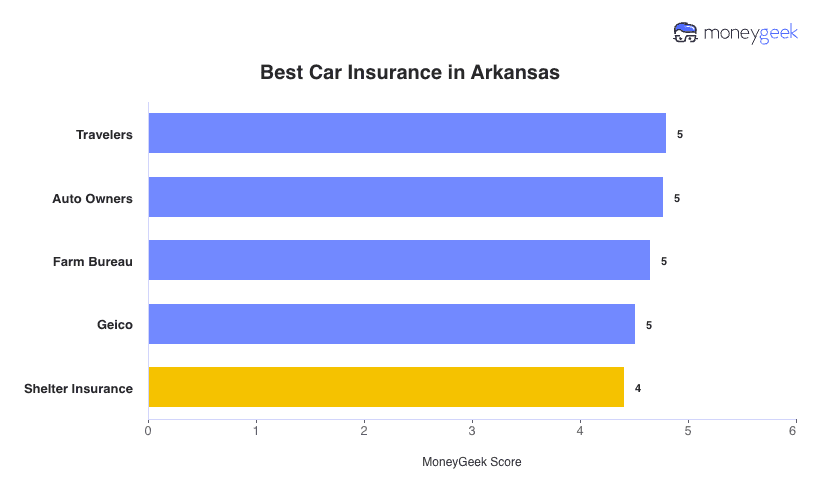

Travelers is the best car insurance company in Arkansas, with a 4.8 out of 5 MoneyGeek score. It excels in affordability and customer service.

Travelers offers competitive rates with full coverage at $89 monthly. Drivers with clean records pay rates that run 4% below state averages.

Farm Bureau leads in affordability with the lowest rates at $86 monthly for full coverage and $32 monthly for state minimums. Auto-Owners earns top marks for drivers with low income, combining competitive rates with perfect customer experience scores.

Our recommendations provide a starting point, but your age, driving record and coverage needs determine which provider offers the best value. Compare these top companies to find the insurer that best fits your profile.