Georgia homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Georgia.

Best Homeowners Insurance Companies in Georgia

Auto-Owners ranks No. 1 in our review of the best home insurance in Georgia, followed by USAA and Chubb.

See if you're overpaying for home insurance below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Auto-Owners is the best home insurance provider in Georgia with a score of 4.7 out of 5 from our review team.

USAA, Chubb, State Farm and Allstate rank high for homeowners insurance in Georgia based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Georgia?

Auto-Owners ranks first for Georgia homeowners with the state's lowest premiums and above-average customer satisfaction. USAA, Chubb, State Farm and Allstate complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

Auto-Owners | 4.7 | $1,640 | Most Georgia homeowners |

USAA | 4.8 | $1,930 | Military families |

Chubb | 4.3 | $2,411 | Coverage quality |

State Farm | 4.2 | $2,656 | Local agent network |

Allstate | 4.1 | $2,112 | Specialized coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

621/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,640Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Lowest average premium in Georgia at $1,640 annually

Optional coverages include inland flood protection

Guaranteed home replacement cost covers rebuilding beyond limits

consRequires a local agent for policy management

Fewer digital tools than larger national carriers

Auto-Owners is Georgia's cheapest home insurer. Inland flood insurance comes as a unique add-on. You attach it directly to your homeowners policy. No separate National Flood Insurance Program policy needed. Georgia homeowners in low-to-moderate flood zones get protection without juggling multiple policies. Guaranteed home replacement cost coverage rebuilds your home completely. Construction costs exceeding your policy limits won't leave you short.

Georgia home insurance through Auto-Owners costs $1,640 yearly. The state average is $2,258, and Auto-Owners beats that by 27%. The national average reaches $3,467,and Auto-Owners undercuts that by 53%.

Several strategies cut your premium. Bundle home and auto policies together for savings. Install security systems or smoke detectors for additional discounts.

Older Homes $140 $1,680 Newer Homes $112 $1,339 Young Homeowners $143 $1,711 Senior Homeowners $120 $1,444 High-Risk Fire Homes $153 $1,838 Smaller Homes $128 $1,536 Larger Homes $145 $1,742 J.D. Power gave Auto-Owners 621 out of 1,000 points in the 2025 U.S. Home Insurance Study. The industry average reaches 642. Auto-Owners falls slightly short. Affordable rates and reliable claims handling still make it worthwhile for Georgia homeowners chasing cost savings. Local independent agents handle all policy management. These agents deliver personalized service and walk you through coverage decisions. The trade-off: fewer digital self-service tools than tech-focused competitors provide.

Auto-Owners sells standard homeowners coverage. Extensive optional add-ons let you customize protection. Optional coverages you can buy:

- Guaranteed home replacement cost: Pays full rebuilding costs when they exceed your coverage limit

- Water backup of sewers or drains: Covers damage from backed-up plumbing systems with limits up to $25,000

- Special personal property: Covers belongings for loss, misplacement and staining beyond standard policy protection

- Ordinance or law: Pays to upgrade your home to current building codes after a loss

- Homeowners Plus: Package adds appliance leak damage, increased food spoilage limits, limited fungi coverage and automatic inflation protection

- Equipment breakdown: Covers mechanical failures of home equipment, including HVAC systems, water heaters and appliances

- Identity theft expense: Covers up to $15,000 for identity restoration expenses

- Home cyber protection: Covers costs to recover stolen data, restore devices and resolve fraud

- Inland flood: Alternative to the National Flood Insurance Program for low-to-moderate flood zones

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,930Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Highest J.D. Power customer satisfaction score

Designed for military families' unique needs

Strong financial stability and claims handling reputation

consRestricted to military members and their families

Fewer optional coverages than some competitors

USAA earned the highest J.D. Power score at 737 points, 95 points above the industry average of 642. USAA focuses on military families, so every policy addresses the unique challenges of military life, from frequent moves to deployment-related concerns. Its Home Protector coverage automatically increases your dwelling and other structures limits by 25% when rebuilding costs exceed your coverage amount due to market changes, valuable in Georgia's fluctuating construction market. USAA's premiums run higher than some competitors. Military families report that the strong customer service and military-specific expertise justify the cost.

USAA charges an average of $1,930 annually for home insurance in Georgia, which is 15% below the state average of $2,258 and 44% cheaper than the national average of $3,467. USAA offers discounts of up to 10% for bundling home and auto policies, as well as loyalty discounts and savings for installing security systems and maintaining a claims-free history.

Older Homes $161 $1,926 Newer Homes $92 $1,100 Young Homeowners $169 $2,033 Senior Homeowners $157 $1,885 High-Risk Fire Homes $180 $2,162 Smaller Homes $146 $1,748 Larger Homes $176 $2,109 USAA leads customer satisfaction with a J.D. Power score of 737 out of 1,000 points: the highest score in the study and above the 642 industry average. Military families praise USAA's understanding of deployment situations, PCS moves and insurance challenges with military service. USAA's digital platform lets you manage your policy, file claims and communicate with representatives from anywhere. This matters for military families stationed overseas or dealing with frequent relocations.

USAA offers standard homeowners protection with military-focused optional coverages:

- Home Protector: Increases dwelling and other structure limits by 25% when rebuilding costs exceed coverage due to market changes

- Water backup: Covers damage from water or sewage backing up through plumbing, including sump pump overflow

- Earthquake: Covers damage to your home and belongings from earthquakes, shock waves or tremors

- Personal injury: Covers liability if you're accused of libel, slander, defamation or other reputation-damaging actions

J.D. Power Customer Satisfaction Score

677/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,411Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Highest coverage score from our team among Georgia insurers

Complimentary home appraisals from risk consultants

HomeScan technology detects hidden problems early

consPremiums exceed the state average

Serves high-net-worth homeowners with valuable properties

Chubb targets high-value homes. Coverage features surpass what standard policies deliver. J.D. Power gave Chubb 677 points. This ranks second among top insurers.

Extended replacement cost coverage rebuilds your home to original condition. Costs exceeding your policy limit won't stop the rebuild. Modern building code upgrades get covered too. Complimentary risk consulting sends appraisers to your home. They document features and recommend security improvements.

Your coverage matches your property's actual value. Chubb charges more than competitors. Homeowners with valuable properties accept higher premiums for comprehensive protection and white-glove service.

Georgia home insurance through Chubb costs $2,411 yearly. The state average is $2,258, and Chubb charges 7% more. The national average reaches $3,467. Chubb still undercuts that by 30%.

Bundle multiple policies together for discounts. Install advanced security systems for additional savings. The company prioritizes comprehensive coverage over aggressive discount programs though.

Older Homes $203 $2,434 Newer Homes $166 $1,991 Young Homeowners $202 $2,422 Senior Homeowners $200 $2,398 High-Risk Fire Homes $225 $2,701 Smaller Homes $188 $2,258 Larger Homes $213 $2,560 J.D. Power gave Chubb 677 out of 1,000 points. This earns the second spot in the study's ranking. Homeowners with high-value properties consistently praise personalized service, knowledgeable agents and smooth claims processing.

The risk consulting team prevents losses proactively. Security assessments and maintenance recommendations stop problems before they start. Reactive problem-solving isn't their style.

Chubb sells premium homeowners coverage built for high-value properties. Extensive customization lets you tailor protection. Coverage features you can get:

- Extended replacement cost: Pays to rebuild your home to its original condition when costs exceed policy limits, including building code upgrades

- Temporary living arrangements: Covers temporary housing in your school district or a suitable hotel while your home is rebuilt

- Risk consulting: Complimentary home appraisals from consultants who document your property's features and give security advice

- Cash settlement: Receive payment up to your policy limit if you choose not to rebuild at the original location

- Replacement cost: Replaces belongings at current prices without depreciation deductions and upgrades appliances to the latest models

- HomeScan: Infrared technology service detects hidden problems like leaks, insulation gaps and electrical issues

- Additional coverages: Tree removal after storms, lock replacement for lost or stolen keys and other covered situations

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,656Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Extensive local agent network

Offers some of the best bundling discounts

J.D. Power score of 657 beats industry average

consMost expensive premiums of the top 5 Georgia insurers

Service quality varies by local agent location

State Farm has a large network of local agents throughout Georgia. You can find in-person support for claims or coverage questions. State Farm earned a J.D. Power score of 657 points, above the 642 industry average. State Farm offers optional coverages for common homeowner concerns, including service line coverage for underground utility repairs, valuable in Georgia, where aging infrastructure leads to expensive pipe replacements. State Farm's local service and coverage options appeal to homeowners who want face-to-face meetings with their agent, though you'll pay higher prices for this service model.

Georgia home insurance through State Farm costs $2,656 yearly. The state average hits $2,258. State Farm charges 18% more.

Bundle home and auto policies together for discounts. Install safety and security features for additional savings. Fire alarms, burglar alarms and impact-resistant roofing products all qualify.

Older Homes $223 $2,670 Newer Homes $166 $1,987 Young Homeowners $222 $2,670 Senior Homeowners $220 $2,640 High-Risk Fire Homes $248 $2,976 Smaller Homes $207 $2,488 Larger Homes $235 $2,821 J.D. Power gave State Farm 657 out of 1,000 points. This beats the 642 industry average. USAA and Chubb score higher though. Homeowners appreciate State Farm's widespread agent network. Local insurance professionals become easily accessible. They explain coverage options and assist with claims. State Farm has operated in Georgia for decades. Agents understand regional risks. Severe storms and tornado damage are familiar territory.

State Farm sells standard homeowners protection. Practical add-ons fill common coverage gaps. Optional coverages you can buy:

- Personal articles policy: Covers high-value items like jewelry, art and collectibles against broader risks than standard policies

- Umbrella policy: Increases personal liability protection beyond your homeowners and auto policy limits

- Service line: Pays for repairs to underground utility lines on your property

- Sewer back-up: Covers water damage and cleanup costs from sewer backups starting inside your home

- Energy efficiency upgrade: Covers additional costs to replace damaged systems with energy-efficient models

- Identity fraud protection: Covers costs to restore your identity after theft

J.D. Power Customer Satisfaction Score

633/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,112Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Competitive premiums below the state average

Specialized coverage for sports equipment and musical instruments

Strong network of local agents in Georgia

consBelow-average score in the J.D. Power study

Local agent quality varies across locations

Allstate pairs reasonable pricing with practical optional coverages. Modern homeowner needs get addressed. J.D. Power gave Allstate 633 points. The industry average reaches 642. Allstate falls slightly short.

Optional coverages include electronic data recovery for lost computer files. Green improvement reimbursement pays extra costs. Damaged items get replaced with energy-efficient alternatives. Below-average pricing combines with comprehensive optional coverages. Georgia homeowners get solid value.

Georgia home insurance through Allstate costs $2,112 yearly. The state average hits $2,258, so Allstate charges 6% less.

Several strategies cut your premium. Bundle home and auto policies together. Pay bills on time. Sign up for a policy at least seven days early. Maintain a claims-free record over multiple years. All these actions earn discounts.

Older Homes $173 $2,072 Newer Homes $134 $1,607 Young Homeowners $180 $2,164 Senior Homeowners $171 $2,058 High-Risk Fire Homes $197 $2,366 Smaller Homes $146 $1,751 Larger Homes $189 $2,271 J.D. Power gave Allstate 633 out of 1,000 points. The industry average reaches 642. Allstate falls just short. Homeowners report mixed experiences. Service quality depends heavily on the local agent handling their policy. Allstate has operated in Georgia for decades. Agents become easily accessible for people wanting in-person service.

Allstate sells standard homeowners protection. Optional add-ons cover specialized needs. Optional coverages you can buy:

- Identity theft restoration: Covers legal fees, lost wages and related costs if your identity is stolen

- Water backup: Covers water damage from backed-up drains or broken sump pumps

- Scheduled personal property: Covers appraised valuable items like engagement rings and antiques

- Business property: Increases limits for business-related items stored in your home, including inventory

- Sports equipment: Increases coverage for expensive gear like golf clubs and ski equipment

- Green improvement reimbursement: Pays additional costs to replace damaged items with energy-efficient alternatives

- Yard and garden: Increases limits for trees, landscaping and riding lawn mowers

- Electronic data recovery: Covers costs to recover lost personal computer data like photos and videos

- Musical instruments: Increases coverage for instruments like guitars and violins

Best Georgia Home Insurance by City

Auto-Owners ranks first in 10 of 11 major Georgia cities based on affordability, coverage quality and customer service. USAA ranks first in McDonough for military families, while Auto-Owners' premiums range from $1,400 in Athens to $2,548 in coastal Savannah.

| Athens | Auto-Owners Insurance | $1,400 |

| Atlanta | Auto-Owners Insurance | $1,583 |

| Augusta | Auto-Owners Insurance | $1,495 |

| Columbus | Auto-Owners Insurance | $1,577 |

| Macon | Auto-Owners Insurance | $1,665 |

| Mcdonough | USAA | $2,044 |

| Newnan | Auto-Owners Insurance | $1,445 |

| Savannah | Auto-Owners Insurance | $2,548 |

| Valdosta | Auto-Owners Insurance | $1,594 |

| Waleska | Auto-Owners Insurance | $1,441 |

| Warner Robins | Auto-Owners Insurance | $1,563 |

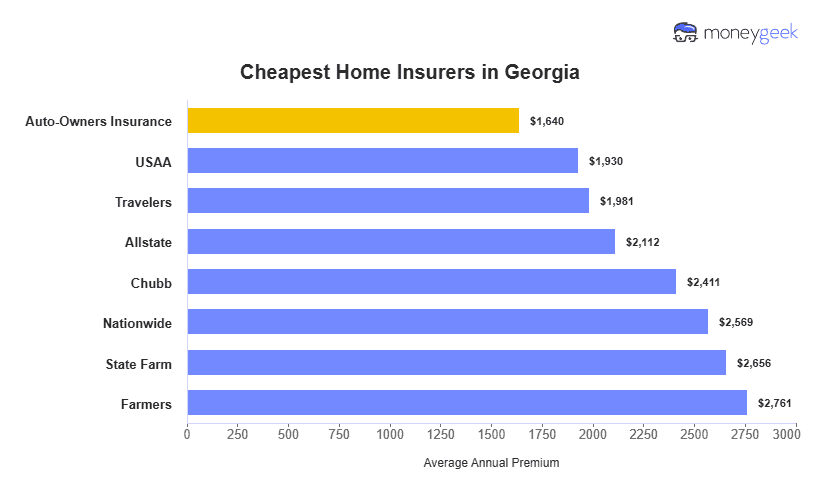

Cheapest Georgia Home Insurance Companies

Georgia homeowners pay $2,258 annually for home insurance, 35% less than the national average of $3,467. Auto-Owners offers the state's most affordable home insurance at $1,640 annually, 27% below the state average. USAA ranks second at $1,930 per year but restricts coverage to military members, veterans and their families. Premiums vary among Georgia insurers. The most expensive provider charges 68% more than the cheapest option.

Guide to Finding the Best Georgia Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Get quotes from at least three to five insurers. Premiums among top Georgia providers range from $1,640 to $2,656 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Review J.D. Power scores, which range from 633 to 737 among Georgia's top providers compared to the 642 industry average. Check complaint ratios through the Georgia Insurance and Safety Fire Commissioner's office. Read recent customer reviews focusing on claims experiences during Georgia's severe weather season, not just policy shopping.

Base your coverage on replacement cost rather than market value, especially important in Georgia, where construction costs spike after hurricanes and severe storms. Consider extended or guaranteed replacement cost options. Review optional coverages like water backup protection, inland flood coverage for homes near rivers and wind/hail coverage given Georgia's tornado activity.

Choose insurers with local agent networks like State Farm if you want face-to-face support or digital-first insurers like USAA if you prefer online policy management. Don't pay premium prices for services you won't use.

Georgia ranked as the third-most dangerous state for tornadoes in a 2024 study, with five tornadoes per 1,000 square miles between January 2019 and May 2024. Georgia allows insurers to include hurricane or named storm deductibles in homeowners policies, calculated as a percentage of your home's insured value ranging from 1% to 10%. Standard homeowners insurance covers tornado and wind damage but doesn't cover flood damage. You'll need separate flood insurance coverage through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Georgia: FAQ

Explore our FAQ section for answers to common questions about selecting the right Georgia home insurance provider for your needs.

Does home insurance cover damage from fallen trees in Georgia?

Home insurance covers damage to your house from fallen trees when wind, lightning or other covered perils caused the tree to fall. Your policy won't cover tree removal unless the tree damaged a covered structure. Policies exclude damage from trees that fell due to neglect or rot. Most policies limit tree removal coverage to $500 to $1,000 per tree.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage rebuilds your home or replaces belongings at current prices. Depreciation gets ignored. Actual cash value coverage subtracts depreciation from claim payments. Your property's age and condition reduce what you receive. Actual cash value policies cost less upfront. You cover more expenses out of pocket after a loss though.

Does home insurance cover sinkholes in Georgia?

Most Georgia home insurance policies exclude sinkhole damage. Some insurers sell it as an optional endorsement for extra premium. Georgia's limestone bedrock creates sinkhole susceptibility in certain areas. Southern and southwestern parts of the state face particular risk. Check your policy's exclusions. Consider adding sinkhole coverage if you live in a high-risk area.

Can I get home insurance if I have a trampoline or swimming pool?

Georgia insurers view trampolines and swimming pools as liability risks that increase your chances of injury claims. Insurers often require higher premiums or additional liability coverage. Some companies exclude trampoline coverage entirely or require safety features like nets and padding. Swimming pools require fencing, self-closing gates and liability coverage of at least $300,000.

Our Methodology: Determining the Best Georgia Home Insurers

Georgia homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Georgia's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- National Association of Insurance Commissioners. "What Are Named Storm Deductibles?." Accessed February 7, 2026.

- Office of the Insurance and Safety Fire Commissioner. "Safety Tips for Severe Weather." Accessed February 7, 2026.