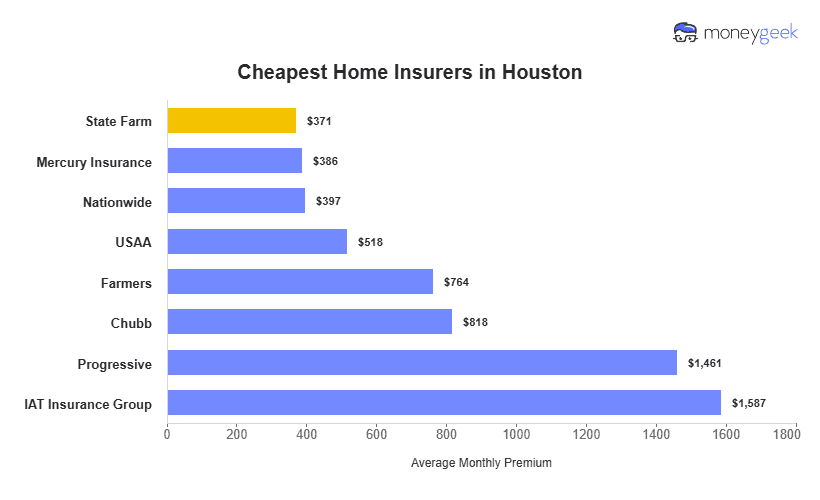

In Houston, State Farm ranks as the best home insurance company. We evaluated insurers based on affordability, coverage options and customer experience ratings to identify providers that offer the best value and service for Houston homeowners.

- State Farm

- USAA

- Chubb

- Nationwide

- Farmers