Michigan homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Michigan.

Best Homeowners Insurance Companies in Michigan

Auto-Owners ranks No. 1 in our review of the best home insurance in Michigan, followed by USAA and Chubb.

See if you're overpaying for home insurance below.

Updated: January 22, 2026

Advertising & Editorial Disclosure

Auto-Owners is the best home insurance provider in Michigan with a score of 4.6 out of 5 from our review team.

USAA, Chubb, State Farm and Farmers rank high for homeowners insurance in Michigan based on reliable coverage, positive customer service and affordable rates.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Michigan?

Auto-Owners earned our top ranking for Michigan homeowners by delivering the state's lowest premiums alongside strong customer satisfaction scores. USAA, Chubb, State Farm and Farmers complete the top five, with each bringing distinct advantages from military-focused coverage to competitive pricing and established local networks.

Auto-Owners | 4.6 | $400 | Most Michigan homeowners |

USAA | 4.7 | $1,970 | Military families |

Chubb | 4.5 | $1,808 | Digital management |

State Farm | 4.2 | $1,956 | Local agent network |

Farmers | 4.1 | $2,063 | Specialized coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

621/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$400Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

Most affordable rates for Michigan homeowners

Comprehensive coverage options

consSlower claims process

Limited availability in some areas

Gaps in service coverage in some Michigan regions

Auto-Owners charges Michigan homeowners just $400 per year. The insurer stands out for its replacement cost coverage on personal belongings, paying full value rather than depreciated amounts after a loss. Auto-Owners includes water backup coverage in its policies, protecting against basement flooding common throughout Michigan.

Auto-Owners charges $400 annually for home insurance in Michigan, 82% less than the state average of $2,195 and 88% the national average of $3,467. Bundle your home policy with auto insurance to save, or reduce premiums by installing security systems.

Older Homes $35 $414 Newer Homes $30 $364 Young Homeowners $35 $419 Senior Homeowners $32 $381 High-Risk Fire Homes $37 $448 Smaller Homes $34 $413 Larger Homes $39 $464 Auto-Owners scored 621 out of 1,000 points in J.D. Power's study, below the 642-point industry average. The company works through independent agents who provide personalized service and local expertise. Auto-Owners' digital tools lag behind some competitors, which matters if you prefer managing your policy online.

Auto-Owners Insurance provides standard homeowners coverage with optional add-ons:

- Guaranteed home replacement cost: Rebuilds your home even if costs exceed your coverage limit

- Water backup coverage: Pays for damage from backed-up sewers or drains with multiple limit options

- Special personal property: Covers items for loss, misplacement, staining or defacing beyond standard protection

- Ordinance or law: Updates your home to current building codes after covered damage

- Homeowners Plus: Bundles appliance leak coverage, higher food spoilage limits, fungi coverage and inflation protection

- Equipment breakdown: Repairs or replaces failed appliances, HVAC systems and computers

- Identity theft expense: Provides up to $15,000 for financial identity restoration costs

- Home cyber protection: Covers data recovery, device restoration and legal counsel after cyber incidents

- Inland flood: Adds flood coverage for low-to-moderate risk homes, including contents and temporary housing

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,970Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Excellent financial stability ratings

Multiple add-on coverage options for customization

Military-specific coverages address deployment and relocation needs

consSmaller agent network than major competitors

Membership limited to military community and families

Rates run above state average for Michigan homeowners

USAA offers Michigan's most affordable home insurance at $1,970 annually. The insurer covers personal property at replacement cost, paying full value rather than depreciated amounts when you file a claim. USAA offers home-sharing coverage for homeowners who rent through Airbnb or similar platforms, protection most insurers exclude. The company designs its policies around military life, accounting for deployments and frequent relocations.

USAA charges $1,970 annually for home insurance in Michigan, 10% less than the state average of $2,195 and 37% below the national average of $3,467. Bundle home and auto policies to reduce costs, or install security systems for additional savings.

Older Homes $169 $2,033 Newer Homes $102 $1,229 Young Homeowners $178 $2,137 Senior Homeowners $162 $1,946 High-Risk Fire Homes $184 $2,207 Smaller Homes $153 $1,839 Larger Homes $176 $2,117 USAA earned 737 out of 1,000 points in J.D. Power's study, beating the 642-point industry average by 95 points. The insurer operates digitally, connecting you directly with representatives who understand military service. USAA's online policy management tools work well, though its mobile app lacks some features competitors offer. The company's representatives receive training on deployment schedules, PCS moves and other military-specific situations.

USAA provides standard homeowners coverage with military-focused enhancements:

- Replacement cost coverage: Pays full replacement value for personal property without depreciation

- Home-sharing coverage: Protects you when renting your home through Airbnb or VRBO

- Dwelling protection: Covers your home's structure from fire, wind, hail and other covered events

- Personal liability: Pays legal costs and damages if someone sues for injuries on your property

- Additional living expenses: Covers hotel stays and meals while your home undergoes covered repairs

- Personal property protection: Replaces belongings damaged at home or away from your property

J.D. Power Customer Satisfaction Score

677/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,808Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Flexible coverage options you can adjust to your needs

Independent agents offer local expertise and face-to-face service

Digital platform handles policy changes and payments efficiently

consLimited direct purchase options

Rates run slightly higher

Limited coverage availability

Michigan homeowners pay $1,808 annually for Chubb home insurance. With Chubb, you can get guaranteed replacement cost coverage to protect you when construction costs spike after major storms damage multiple homes simultaneously, a common scenario in Michigan's tornado-prone regions. High-value items can also receive stronger protection through Chubb, with coverage limits for jewelry, art and collectibles exceeding what standard endorsements offer.

At $1,808 per year, Chubb already prices below Michigan's $2,195 state average by 18% and undercuts the $3,467 national average by 37%. If you qualify, two discounts can help lower premiums beyond these base rates: bundling home insurance with auto coverage and installing security systems in your home.

Older Homes $139 $1,667 Newer Homes $128 $1,537 Young Homeowners $152 $1,827 Senior Homeowners $150 $1,797 High-Risk Fire Homes $169 $2,025 Smaller Homes $156 $1,867 Larger Homes $175 $2,099 Chubb operates through independent agents in Michigan who customize policies based on local property risks and market conditions. The insurer scored 677 out of 1,000 points in J.D. Power's study, exceeding the 642-point industry average. Policyholders can manage coverage, file claims and pay bills through Chubb's online platform without contacting their agent.

Chubb provides standard homeowners coverage with premium add-ons:

- Guaranteed replacement cost: Rebuilds your home at current construction prices, even when costs exceed your coverage limit

- Extended personal property coverage: Insures high-value items like jewelry, art and antiques with higher limits than standard policies

- Dwelling coverage: Pays to repair or rebuild your home after fire, wind, hail or other covered damage

- Personal liability protection: Covers legal costs and damages if someone gets injured on your property

- Additional living expenses: Pays for hotels, meals and other costs while your home undergoes covered repairs

- Customizable policy options: Add earthquake coverage, water backup protection or identity theft coverage based on your needs

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,956Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high ratings from rating agencies

Customizable coverage options

User-friendly digital tools for policy management and claims processing

consRates run above the Michigan state average for premiums

Some add-on coverages unavailable in certain regions

Coverage gaps in select Michigan areas

State Farm offers Michigan's most affordable home insurance at $1,956 annually. The insurer covers personal property at replacement cost, paying full value rather than depreciated amounts when you file a claim. State Farm's additional living expenses coverage pays for hotels and meals if ice storms, flooding or other disasters force you out of your home. The combination of below-average rates and comprehensive coverage makes State Farm worth comparing.

State Farm charges $1,956 annually for home insurance in Michigan, 11% less than the state average of $2,195 and 37% below the national average of $3,467. Bundle your home policy with auto insurance to save, or reduce premiums by installing security systems.

Older Homes $166 $1,989 Newer Homes $122 $1,468 Young Homeowners $165 $1,977 Senior Homeowners $162 $1,945 High-Risk Fire Homes $183 $2,192 Smaller Homes $168 $2,021 Larger Homes $189 $2,271 State Farm earned 657 out of 1,000 points in J.D. Power's study, beating the 642-point industry average. You can work with local agents who understand Michigan's weather risks and housing market, or buy directly online. State Farm's website handles quotes and claims well, though its mobile app lacks some features competitors offer.

State Farm provides standard homeowners coverage with optional add-ons:

- Personal property replacement cost: Pays full replacement value for damaged belongings without subtracting depreciation

- Additional living expenses: Covers hotel stays, meals and other costs when covered damage forces you out of your home

- Dwelling coverage: Pays to repair or rebuild your home after fire, wind, hail or other covered damage

- Personal liability: Covers legal costs and damages if someone gets injured on your property

- Medical payments: Pays medical bills for guests injured at your home, regardless of fault

- Other structures: Covers detached garages, sheds, fences and other structures on your property

J.D. Power Customer Satisfaction Score

631/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,063Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Specialized coverage for farms, barns and agricultural equipment

A++ AM Best rating shows strong financial backing

Agricultural endorsements most standard insurers don't offer

consJ.D. Power score falls 11 points below industry average

Coverage unavailable in many Michigan regions

Premiums exceed state average

Sewer and drain backups plague Michigan basements, yet many policies exclude this coverage. Farmers includes water backup protection in its Michigan policies at $2,063 annually. The insurer pays replacement cost for personal property rather than depreciated values after covered losses. Farmers writes farm and rural property policies that most competitors won't touch, serving Michigan's agricultural communities.

Farmers' $2,063 annual rate undercuts Michigan's $2,195 average by 6% and beats the $3,467 national average by 37%. Install security systems or bundle home and auto policies for additional premium reductions beyond these base savings.

Older Homes $269 $3,230 Newer Homes $200 $2,396 Young Homeowners $298 $3,581 Senior Homeowners $282 $3,387 High-Risk Fire Homes $329 $3,947 Smaller Homes $302 $3,629 Larger Homes $339 $4,071 Independent agents deliver Farmers coverage across Michigan, writing policies for both standard homes and agricultural properties. These agents handle farms and rural homes most insurers won't cover. Farmers scored 631 out of 1,000 in J.D. Power's study, falling 11 points short of the 642 industry average. Basic digital tools manage routine policy tasks, though the platform offers fewer features than tech-focused insurers provide, which is a tradeoff for agent-centered service.

Farmers provides standard homeowners protection with optional add-ons for specialized coverage needs:

- Water backup coverage: Pays for damage when sewers or drains back up into your home

- Replacement cost for personal property: Covers belongings at full replacement value without depreciation

- Dwelling protection: Pays to repair or rebuild your home after fire, wind, hail or other covered damage

- Personal liability: Covers legal costs and damages if someone gets injured on your property

- Additional living expenses: Pays for hotels and meals while your home undergoes covered repairs

- Farm and agricultural coverage: Insures barns, silos, livestock equipment and farming operations

Best Michigan Home Insurance by City

Auto-Owners leads as the top home insurance provider across nine Michigan cities, including Detroit, Grand Rapids, Ann Arbor, Lansing and Warren. Annual premiums range from $261 in Ahmeek to $577 in Detroit, with rates varying based on local risk factors and property values.

| Ahmeek | Auto-Owners Insurance | $261 |

| Ann Arbor | Auto-Owners Insurance | $385 |

| Detroit | Auto-Owners Insurance | $577 |

| Grand Rapids | Auto-Owners Insurance | $327 |

| Lansing | Auto-Owners Insurance | $337 |

| Pontiac | Auto-Owners Insurance | $442 |

| Sterling Heights | Auto-Owners Insurance | $374 |

| Stockbridge | Auto-Owners Insurance | $323 |

| Warren | Auto-Owners Insurance | $398 |

Cheapest Michigan Home Insurance Companies

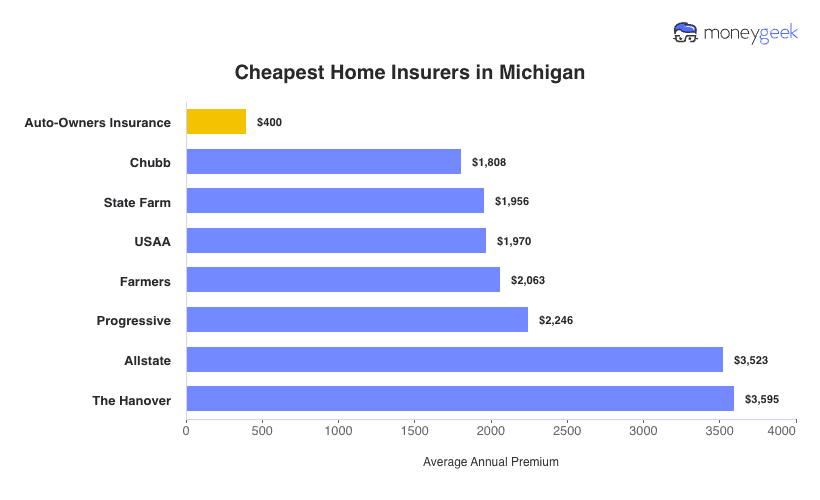

Michigan homeowners pay $2,195 annually for home insurance, 37% less than the national average of $3,467. Auto-Owners offers the state's most affordable home insurance at $400 annually, 82% below the state average. Chubb provides the second-best rates at $1,808 per year, still 18% below average. Premiums vary among insurers. The Hanover represents the high end, charging 4% more than the national benchmark.

Guide to Finding the Best Michigan Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Get quotes from at least three to five insurers. Premiums among Michigan's top providers range from $400 to $2,063 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Start by examining complaint ratios through the Michigan Department of Insurance and Financial Services, then review J.D. Power scores that range from 621 to 737 among the state's leading insurers. This compares favorably to the 642 industry average. Pay special attention to customer reviews about claims handling during Michigan's tornado season, rather than just policy purchase experiences.

Base your coverage on replacement cost rather than market value, particularly since construction costs surge in Michigan after flooding and tornadoes strike communities. Review extended or guaranteed replacement cost options alongside essential protections like flood insurance and wind/hail coverage that address your home's specific risk profile.

Digital-first insurers like Lemonade, Hippo and Root excel at online policy management, while Farmers Insurance, State Farm and Allstate maintain strong local agent networks for face-to-face support. Choose based on your preferred interaction style and avoid paying premium prices for services you won't actually use.

Michigan experienced over $300 million in flood damage in 2020 alone, according to the Michigan State Police. Flooding is a leading cause of property damage in Michigan, yet many homeowners don't realize their standard insurance policies exclude flood coverage. Your homeowners insurance covers many disasters, but you'll need separate flood insurance through your insurer or the National Flood Insurance Program to protect against flooding.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Michigan: FAQ

Explore our FAQ section for answers to common questions about selecting the right Michigan home insurance provider for your needs.

Does home insurance cover damage from fallen trees in Michigan?

Home insurance covers fallen tree damage to your house when wind, lightning or other covered perils cause the tree to fall. Coverage excludes trees that fell due to rot or neglect. Tree removal is covered only if the tree damaged a structure, and most policies limit coverage to $500 to $1,000 per tree.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current market prices without factoring in depreciation. Actual cash value coverage deducts depreciation based on your property's age and condition, resulting in lower claim payouts. Actual cash value policies cost less upfront, but you'll pay more out of pocket when filing a claim.

Why do Detroit homeowners pay higher insurance premiums than other Michigan cities?

Detroit homeowners pay $577 annually through Auto-Owners, which is 121% higher than the $261 rate in Ahmeek and 76% higher than the $327 rate in Grand Rapids. Annual premiums vary based on local risk factors, property values and city-specific claims history.

Do I need flood insurance in Michigan even though I'm not near the Great Lakes?

Yes, standard homeowners insurance policies in Michigan exclude flood coverage, even for inland properties. Michigan experienced over $300 million in flood damage in 2020 alone, so you'll need separate flood insurance through your insurer or the National Flood Insurance Program to protect against flooding.

Our Methodology: Determining the Best Michigan Home Insurers

Michigan homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Michigan's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Michigan State Police. "Michigan State Police." Accessed February 7, 2026.