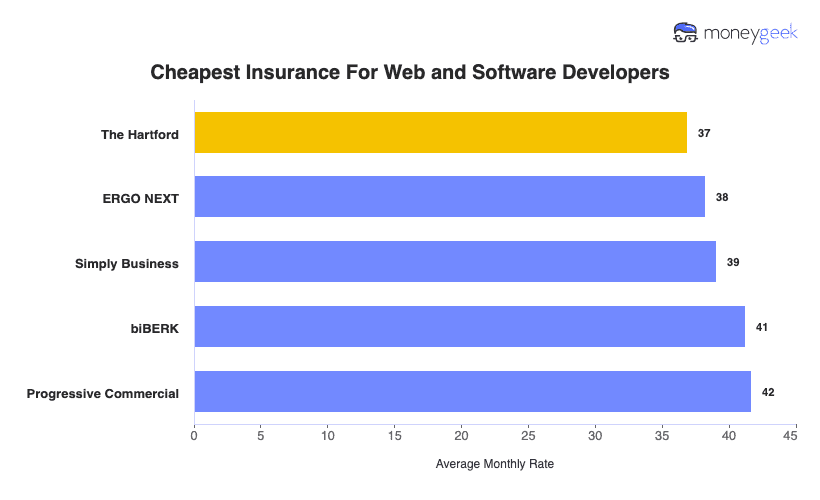

The Hartford not only earned our top spot as the best software development business insurer, but it also has the cheapest rates in the industry.

The company also includes coverage in its standard policies to protect anyone in the technology sector from unique risks and has specialized plan selections. We recommend looking into ERGO NEXT, biBERK, Simply Business and Nationwide for coverage for your business.