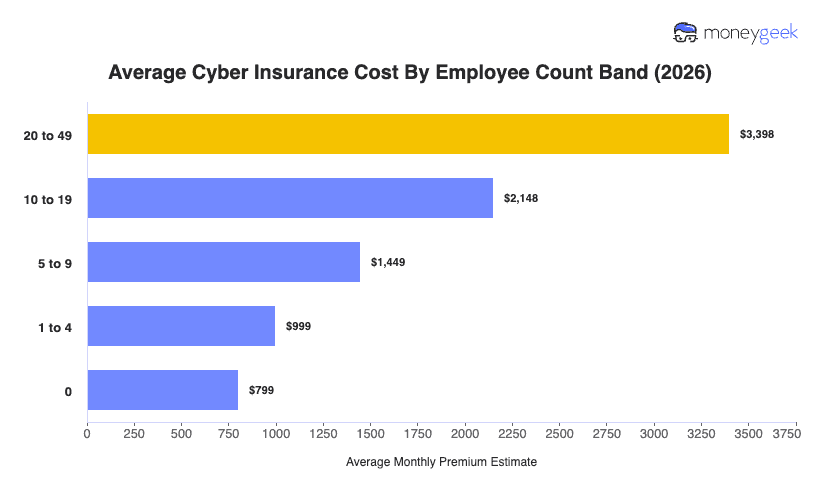

Small businesses pay $83 per month ($999 annually) on average for cyber insurance. This national benchmark comes from analysis of business insurance costs for over 400 industries across all 50 states and Washington, D.C.

Keep in mind that this is only an estimate, and you quote is based on your industry, the type and amount of information you store, where you operate, and how many employees have access to your systems.