In our analysis of 10 major industry areas and 18 vehicle types, ERGO NEXT is the best commercial auto insurance provider in Florida due to its affordability. The Hartford follows closely with the highest customer service scores and strong coverage options and terms. Nationwide, biBerk and GEICO complete the top five, offering competitive pricing and service.

Best Commercial Auto Insurance in Florida

ERGO NEXT offers the best and cheapest commercial auto insurance in Florida, with rates starting at $56 monthly.

Compare commercial auto insurance quotes now.

Updated: January 28, 2026

Advertising & Editorial Disclosure

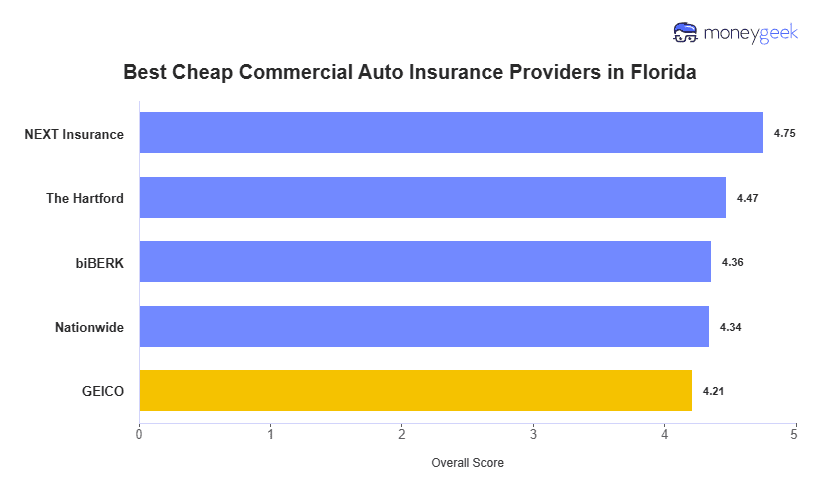

The best commercial auto insurers in Florida are ERGO NEXT, The Hartford, biBerk, Nationwide and GEICO, based on our analysis (Click to learn more).

ERGO NEXT offers the cheapest commercial auto insurance in Florida at $177 monthly or $2,120 annually for minimum coverage (Click to learn more).

Florida commercial auto insurance costs range from $56 to $2,042 monthly, depending on vehicle type, use and location (Click to learn more).

Florida's commercial auto insurance requirements vary from $10,000 in personal injury protection (PIP) and property damage liability to $5 million combined single limit (CSL), depending on vehicle type and use (Click to read more).

Compare business insurance quotes for your vehicle, research costs and providers, and decide on coverage needs to get the right policy in Florida (Click to learn more).

Best Commercial Auto Insurance Companies in Florida

| ERGO NEXT | 4.75 | 5.00 | 4.27 | 4.84 |

| The Hartford | 4.47 | 4.16 | 4.64 | 4.97 |

| biBERK | 4.36 | 4.20 | 4.36 | 4.75 |

| Nationwide | 4.34 | 4.20 | 4.43 | 4.57 |

| GEICO | 4.21 | 4.17 | 4.18 | 4.37 |

How We Found the Best Cheap Commercial Auto Insurers

MoneyGeek evaluated commercial auto insurance providers in Florida using this scoring system:

- Affordability (50%): MoneyGeek compared rates across 10 major industries and 18 vehicle types, including discount offerings.

- Customer experience (30%): Our team aggregated customer reviews from location-specific forums and Reddit discussions.

- Coverage options and terms (20%): We compared terms and conditions, add-ons and payment flexibility to determine policy structure quality.

ERGO NEXT: Best Cheap Florida Commercial Auto Insurance

Cheapest commercial auto rates in Florida

Advanced coverage matching system during quote process

Top digital experience for small business insurance

Extensive coverage selection

Offers commercial auto products indirectly through Progressive

ERGO NEXT leads Florida's commercial auto insurance market with the lowest rates and extensive coverage options backed by Progressive. The insurer's digital platform earns strong mobile app ratings, completes quotes in under 10 minutes and matches coverage types and amounts for commercial auto and other business policies. ERGO NEXT offers vehicle coverage indirectly through Progressive, so post-purchase service operates separately from the company.

The Hartford: Best Florida Commercial Auto Insurance Coverage and Customer Experience

Highest customer experience rating for Florida commercial auto customers

Dedicated industry experts across all industries

Strong coverage options for midsize to large fleets

Limited discount offerings compared to competitors

Lowest affordability score in our study

The Hartford ranks second in Florida with 200+ years of commercial insurance experience, top customer ratings for claims and agent service across thousands of reviews and tailored coverage options. The insurer includes broad form coverage on all vehicles, providing flexibility when drivers switch between unlisted vehicles and covering more items than competitors. The Hartford's FleetAhead telematics program helps manage risk across multiple vehicles, benefiting larger operations.

Cheapest Commercial Auto Insurance Companies in Florida

ERGO NEXT is the cheapest commercial auto insurer in Florida, averaging $36 monthly less than the next most affordable provider for minimum coverage. The Hartford, biBerk, Nationwide and GEICO offer competitive rates based on business vehicles, industry and coverage level.

| ERGO NEXT | $177 | $2,120 |

| Nationwide | $213 | $2,558 |

| biBERK | $214 | $2,570 |

| The Hartford | $215 | $2,581 |

| GEICO | $216 | $2,595 |

How Much Is Commercial Auto Insurance in Florida?

Florida commercial auto insurance costs average $207 monthly for minimum coverage, $517 for the most common full coverage policy and $577 for a $1 million combined single limit (CSL) plan. Florida ranks 48th in affordability, making it the third most expensive state for business vehicle insurance. Rates range from $674 to $24,505 annually based on business type, vehicle and coverage needs.

| $1,000,000 CSL (Combined Single Limit) Liability | $577 | $6,920 |

| 100/300/100 Liability Insurance With $1,000 deductible For Comp and Collision | $517 | $6,202 |

| State Minimum Liability | $207 | $2,485 |

Average Florida Commercial Auto Insurance Cost by Vehicle Type

Florida's commercial auto insurance rates for minimum coverage range from $89 monthly for sedans to $639 for tanker trucks with hazardous cargo.

| Box Truck | $178 | $2,142 |

| Bus | $604 | $7,249 |

| Dump Truck | $261 | $3,127 |

| Farm Tractor | $110 | $1,324 |

| Flatbed Truck | $261 | $3,128 |

| Food Truck | $187 | $2,246 |

| Van | $133 | $1,602 |

| Forklift | $189 | $2,271 |

| Limousine | $494 | $5,931 |

| Pickup Truck | $122 | $1,463 |

| Sedan | $89 | $1,070 |

| Semi-Truck | $291 | $3,495 |

| Semi-Truck - HAZMAT Cargo | $613 | $7,356 |

| Snow Plow | $475 | $5,704 |

| SUV | $92 | $1,107 |

| Tanker Truck | $319 | $3,833 |

| Tanker Truck - HAZMAT Cargo | $639 | $7,668 |

| Taxi | $543 | $6,515 |

Florida Commercial Auto Insurance Requirements

Florida requires commercial auto insurance with minimum coverage based on vehicle weight and use:

- Light commercial vehicles (under 26,000 lbs): $10,000 personal injury protection (PIP) and $10,000 property damage liability (PDL)

- Medium commercial vehicles (26,000-34,999 lbs GVW): $50,000 combined bodily injury and property damage liability

- Heavy commercial vehicles (35,000-43,999 lbs GVW): $100,000 combined single limit (CSL)

- Extra heavy commercial vehicles (44,000+ lbs GVW): $300,000 CSL

- Interstate nonhazardous freight under 10,001 lbs: $300,000 CSL

- Interstate nonhazardous freight over 10,000 lbs: $750,000 CSL

- Interstate oil transport: $1,000,000 CSL

- Interstate hazardous materials (HAZMAT) transport: $5,000,000 CSL

- Passenger transporters (15 or fewer passengers): $1,500,000 CSL for interstate carriers

- Passenger transporters (16 or more passengers): $5,000,000 CSL for interstate carriers

GVW stands for gross vehicle weight, which includes the vehicle itself, passengers, cargo and fuel. Ensure your coverage meets the GVW-based requirements to avoid penalties.

How to Get the Best Cheap Commercial Auto Insurance in Florida

Florida's commercial auto insurance market varies based on fleet size and operation complexity.

- 1Determine your Florida commercial auto insurance needs

Research state requirements through Florida's Department of Highway Safety and Motor Vehicles. Consider vehicle travel radius, cargo value and passenger capacity. High-value goods transported across state lines require higher CSL coverage than local food trucks operating within city limits.

- 2Research costs and discounts

Compare average commercial auto insurance costs for your business and vehicle profile to establish pricing benchmarks. Research available discounts, including fleet discounts, safety device credits and telematics programs.

- 3Compare provider reputations and coverage options

Look for customer reviews specific to your area and coverage type. Forums like Reddit provide detailed customer feedback beyond standard review sites. Consult agents and company websites about add-ons and terms.

- 4Get commercial auto quotes from multiple sources

Compare quotes from at least five companies with identical coverage limits. Pricing varies by quote method. Call captive agents by phone, contact an independent agency and compare online rates.

- 5Reassess your needs every year

Expanding operations, additional vehicles and new employees affect coverage requirements. Inform your insurer of operational changes, safety improvements and employee additions. Verify continued compliance with Florida commercial auto insurance requirements.

Get Cheap Florida Commercial Auto Insurance Quotes

MoneyGeek matches businesses with Florida's top commercial auto insurance providers. Enter your industry and state below to get quotes for your business.

Get Florida Commercial Auto Insurance From Top Providers

Select your industry and state to get a customized commercial auto insurance quote from Florida's top insurers.

Best Commercial Auto Insurance Florida: Bottom Line

The top three commercial auto insurance providers in Florida are ERGO NEXT, The Hartford and Nationwide. Compare quotes, research costs and verify coverage requirements before purchasing.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.