With a MoneyGeek score of 4.25, Chubb ranks last among national providers in our analysis of 10 carriers across 79 industries. Chubb has strong financial stability but is less affordable than other insurers. While Chubb provides competitive coverage options and customer service, business owners might find better value with other companies.

Chubb Business Insurance Review

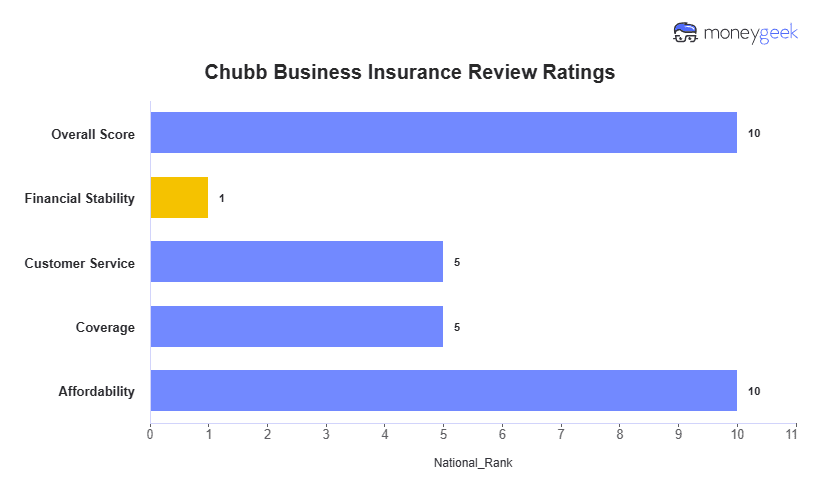

Chubb ranks 10th in MoneyGeek's study with a score of 4.25 out of 5. It's excellent for affordability and service.

Discover if Chubb is the best business insurance option for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Small businesses pay $118 monthly ($1,418 annually) for Chubb business insurance, placing tenth in our affordability rankings.

Chubb ranks fifth for customer service quality, showing average performance in claims handling and support.

With a fifth-place ranking for coverage options, Chubb provides standard policy choices that meet basic business needs.

Chubb Business Insurance Ratings

| Overall Score | 4.25 | 10 |

| Financial Stability | 5 | 1 |

| Customer Service | 4.34 | 5 |

| Coverage | 4.59 | 5 |

| Affordability | 3.95 | 10 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized business insurance match.

To ensure you're making the right choice for your business, we've linked our reviews to Chubb's competitors so you can compare:

Chubb Business Insurance Ratings by Industry

Chubb offers competitive rates for various businesses, including automotive, bakery and window cleaning services. The company leads in coverage and financial stability and ranks high for customer service.

| Accountants | 4.30 | 7 | 3 | 4 | 1 |

| Ad Agency | 4.30 | 7 | 3 | 4 | 1 |

| Automotive | 4.40 | 6 | 3 | 4 | 1 |

| Auto Repair | 4.40 | 6 | 3 | 4 | 1 |

| Bakery | 4.30 | 6 | 3 | 4 | 1 |

| Barber | 4.50 | 6 | 3 | 4 | 1 |

| Beauty Salon | 4.40 | 7 | 3 | 4 | 1 |

| Bounce House | 4.30 | 6 | 3 | 4 | 1 |

| Candle | 4.40 | 7 | 3 | 4 | 1 |

| Cannabis | 4.30 | 6 | 3 | 4 | 1 |

| Catering | 4.50 | 6 | 3 | 4 | 1 |

| Cleaning | 4.30 | 5 | 3 | 4 | 1 |

| Coffee Shop | 4.30 | 6 | 3 | 4 | 1 |

| Computer Programming | 4.30 | 7 | 3 | 4 | 1 |

| Computer Repair | 4.40 | 5 | 3 | 4 | 1 |

| Construction | 4.40 | 6 | 3 | 4 | 1 |

| Consulting | 4.30 | 5 | 3 | 4 | 1 |

| Contractor | 4.30 | 6 | 3 | 4 | 1 |

| Courier | 4.30 | 7 | 3 | 4 | 1 |

| Daycare | 4.30 | 6 | 3 | 4 | 1 |

| Dental | 4.30 | 6 | 3 | 4 | 1 |

| DJ | 4.30 | 7 | 3 | 4 | 1 |

| Dog Grooming | 4.30 | 6 | 3 | 4 | 1 |

| Drone | 4.30 | 6 | 3 | 4 | 1 |

| Ecommerce | 4.30 | 5 | 3 | 4 | 1 |

| Electrical | 4.50 | 4 | 3 | 4 | 1 |

| Engineering | 4.30 | 7 | 3 | 4 | 1 |

| Excavation | 4.30 | 7 | 3 | 4 | 1 |

| Florist | 4.30 | 7 | 3 | 4 | 1 |

| Food | 4.30 | 8 | 3 | 4 | 1 |

| Food Truck | 4.50 | 6 | 3 | 4 | 1 |

| Funeral Home | 4.30 | 7 | 3 | 4 | 1 |

| Gardening | 4.40 | 5 | 3 | 4 | 1 |

| Handyman | 4.50 | 6 | 3 | 4 | 1 |

| Home-based | 4.30 | 7 | 3 | 4 | 1 |

| Home-based business | 4.30 | 7 | 3 | 4 | 1 |

| Hospitality | 4.40 | 6 | 3 | 4 | 1 |

| HVAC | 4.30 | 5 | 3 | 4 | 1 |

| Janitorial | 4.40 | 5 | 3 | 4 | 1 |

| Jewelry | 4.30 | 6 | 3 | 4 | 1 |

| Junk Removal | 4.30 | 6 | 3 | 4 | 1 |

| Lawn/Landscaping | 4.50 | 4 | 3 | 4 | 1 |

| Lawyers | 4.30 | 7 | 3 | 4 | 1 |

| Manufacturing | 4.30 | 7 | 3 | 4 | 1 |

| Marine | 4.30 | 6 | 3 | 4 | 1 |

| Massage | 4.40 | 6 | 3 | 4 | 1 |

| Mortgage Broker | 4.30 | 7 | 3 | 4 | 1 |

| Moving | 4.30 | 6 | 3 | 4 | 1 |

| Nonprofit | 4.30 | 7 | 3 | 4 | 1 |

| Painting | 4.30 | 5 | 3 | 4 | 1 |

| Party Rental | 4.30 | 7 | 3 | 4 | 1 |

| Personal Training | 4.30 | 4 | 3 | 4 | 1 |

| Pest Control | 4.30 | 7 | 3 | 4 | 1 |

| Pet | 4.30 | 7 | 3 | 4 | 1 |

| Pharmacy | 4.30 | 7 | 3 | 4 | 1 |

| Photography | 4.30 | 5 | 3 | 4 | 1 |

| Physical Therapy | 4.30 | 7 | 3 | 4 | 1 |

| Plumbing | 4.40 | 6 | 3 | 4 | 1 |

| Pressure Washing | 4.30 | 6 | 3 | 4 | 1 |

| Real Estate | 4.40 | 6 | 3 | 4 | 1 |

| Restaurant | 4.30 | 6 | 3 | 4 | 1 |

| Retail | 4.30 | 6 | 3 | 4 | 1 |

| Roofing | 4.30 | 6 | 3 | 4 | 1 |

| Security | 4.30 | 6 | 3 | 4 | 1 |

| Snack Bars | 4.30 | 6 | 3 | 4 | 1 |

| Software | 4.30 | 6 | 3 | 4 | 1 |

| Spa/Wellness | 4.30 | 6 | 3 | 4 | 1 |

| Speech Therapist | 4.30 | 7 | 3 | 4 | 1 |

| Startup | 4.30 | 8 | 3 | 4 | 1 |

| Tech/IT | 4.30 | 7 | 3 | 4 | 1 |

| Transportation | 4.30 | 6 | 3 | 4 | 1 |

| Travel | 4.30 | 6 | 3 | 4 | 1 |

| Tree Service | 4.40 | 7 | 3 | 4 | 1 |

| Trucking | 4.30 | 7 | 3 | 4 | 1 |

| Tutoring | 4.30 | 7 | 3 | 4 | 1 |

| Veterinary | 4.30 | 6 | 3 | 4 | 1 |

| Wedding Planning | 4.30 | 6 | 3 | 4 | 1 |

| Welding | 4.30 | 6 | 3 | 4 | 1 |

| Wholesale | 4.30 | 8 | 3 | 4 | 1 |

| Window Cleaning | 4.40 | 5 | 3 | 4 | 1 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Chubb Business Insurance Ratings by State

Chubb provides insurance coverage across 47 states, with its strongest overall performance reaching eighth place in three markets. The company typically ranks ninth or tenth in most other locations.

| Alabama | 4.26 | 10 | 3 | 4 | 1 |

| Arizona | 4.26 | 9 | 3 | 4 | 1 |

| Arkansas | 4.26 | 10 | 3 | 4 | 1 |

| California | 4.27 | 10 | 3 | 4 | 1 |

| Colorado | 4.27 | 9 | 3 | 4 | 1 |

| Connecticut | 4.27 | 9 | 3 | 4 | 1 |

| Delaware | 4.28 | 9 | 3 | 4 | 1 |

| Florida | 4.27 | 9 | 3 | 4 | 1 |

| Georgia | 4.26 | 9 | 3 | 4 | 1 |

| Idaho | 4.27 | 10 | 3 | 4 | 1 |

| Illinois | 4.27 | 8 | 3 | 4 | 1 |

| Indiana | 4.28 | 9 | 3 | 4 | 1 |

| Iowa | 4.27 | 9 | 3 | 4 | 1 |

| Kansas | 4.26 | 10 | 3 | 4 | 1 |

| Kentucky | 4.26 | 9 | 3 | 4 | 1 |

| Maine | 4.27 | 10 | 3 | 4 | 1 |

| Maryland | 4.27 | 8 | 3 | 4 | 1 |

| Massachusetts | 4.26 | 10 | 3 | 4 | 1 |

| Michigan | 4.27 | 9 | 3 | 4 | 1 |

| Minnesota | 4.26 | 10 | 3 | 4 | 1 |

| Mississippi | 4.27 | 10 | 3 | 4 | 1 |

| Missouri | 4.26 | 9 | 3 | 4 | 1 |

| Montana | 4.26 | 9 | 3 | 4 | 1 |

| Nebraska | 4.26 | 9 | 3 | 4 | 1 |

| Nevada | 4.27 | 9 | 3 | 4 | 1 |

| New Hampshire | 4.28 | 9 | 3 | 4 | 1 |

| New Jersey | 4.26 | 9 | 3 | 4 | 1 |

| New Mexico | 4.27 | 9 | 3 | 4 | 1 |

| New York | 4.27 | 10 | 3 | 4 | 1 |

| North Carolina | 4.27 | 10 | 3 | 4 | 1 |

| North Dakota | 4.28 | 9 | 3 | 4 | 1 |

| Ohio | 4.28 | 9 | 3 | 4 | 1 |

| Oklahoma | 4.26 | 9 | 3 | 4 | 1 |

| Oregon | 4.26 | 9 | 3 | 4 | 1 |

| Pennsylvania | 4.26 | 9 | 3 | 4 | 1 |

| Rhode Island | 4.27 | 9 | 3 | 4 | 1 |

| South Carolina | 4.27 | 10 | 3 | 4 | 1 |

| South Dakota | 4.26 | 10 | 3 | 4 | 1 |

| Tennessee | 4.26 | 10 | 3 | 4 | 1 |

| Texas | 4.26 | 10 | 3 | 4 | 1 |

| Utah | 4.26 | 9 | 3 | 4 | 1 |

| Vermont | 4.26 | 10 | 3 | 4 | 1 |

| Virginia | 4.26 | 10 | 3 | 4 | 1 |

| Washington | 4.27 | 9 | 3 | 4 | 1 |

| West Virginia | 4.26 | 9 | 3 | 4 | 1 |

| Wisconsin | 4.26 | 8 | 3 | 4 | 1 |

| Wyoming | 4.27 | 10 | 3 | 4 | 1 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Chubb Business Insurance Cost?

You can get business insurance from Chubb for about $118 monthly ($1,418 annually). Prices for different coverage types start at $85 monthly for workers' compensation and go up to $178 for business owner's policies.

| Business Owners Policies | $178 | $2,136 |

| General Liability | $119 | $1,423 |

| Professional Liability (E&O) | $89 | $1,062 |

| Workers Compensation | $85 | $1,018 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Chubb Business Insurance Cost by Industry?

The average cost of business insurance through Chubb varies, from $32 monthly for home-based businesses to $741 monthly for pressure washing services. Service businesses with physical customer contact and equipment typically pay more due to increased liability risks.

| Accountants | $66 | $790 |

| Ad Agency | $39 | $472 |

| Auto Repair | $175 | $2,095 |

| Automotive | $93 | $1,121 |

| Bakery | $99 | $1,193 |

| Barber | $43 | $519 |

| Beauty Salon | $71 | $849 |

| Bounce House | $79 | $951 |

| Candle | $65 | $782 |

| Cannabis | $108 | $1,291 |

| Catering | $92 | $1,107 |

| Cleaning | $131 | $1,573 |

| Coffee Shop | $99 | $1,188 |

| Computer Programming | $55 | $663 |

| Computer Repair | $57 | $681 |

| Construction | $190 | $2,279 |

| Consulting | $57 | $680 |

| Contractor | $250 | $3,005 |

| Courier | $221 | $2,650 |

| DJ | $32 | $387 |

| Daycare | $60 | $719 |

| Dental | $37 | $441 |

| Dog Grooming | $83 | $993 |

| Drone | $52 | $620 |

| Ecommerce | $74 | $891 |

| Electrical | $114 | $1,370 |

| Engineering | $68 | $816 |

| Excavation | $409 | $4,909 |

| Florist | $59 | $703 |

| Food | $133 | $1,590 |

| Food Truck | $143 | $1,713 |

| Funeral Home | $78 | $933 |

| Gardening | $108 | $1,302 |

| HVAC | $230 | $2,758 |

| Handyman | $224 | $2,687 |

| Home-based | $32 | $379 |

| Hospitality | $92 | $1,108 |

| Janitorial | $138 | $1,653 |

| Jewelry | $46 | $549 |

| Junk Removal | $173 | $2,075 |

| Lawn/Landscaping | $103 | $1,238 |

| Lawyers | $75 | $903 |

| Manufacturing | $53 | $634 |

| Marine | $89 | $1,063 |

| Massage | $110 | $1,322 |

| Mortgage Broker | $71 | $847 |

| Moving | $192 | $2,308 |

| Nonprofit | $51 | $608 |

| Painting | $170 | $2,034 |

| Party Rental | $86 | $1,036 |

| Personal Training | $45 | $542 |

| Pest Control | $71 | $849 |

| Pet | $64 | $765 |

| Pharmacy | $63 | $751 |

| Photography | $40 | $480 |

| Physical Therapy | $51 | $615 |

| Plumbing | $293 | $3,514 |

| Pressure Washing | $741 | $8,891 |

| Real Estate | $86 | $1,029 |

| Restaurant | $155 | $1,860 |

| Retail | $76 | $910 |

| Roofing | $551 | $6,613 |

| Security | $156 | $1,875 |

| Snack Bars | $118 | $1,415 |

| Software | $51 | $611 |

| Spa/Wellness | $121 | $1,453 |

| Speech Therapist | $56 | $674 |

| Startup | $47 | $568 |

| Tech/IT | $53 | $638 |

| Transportation | $120 | $1,434 |

| Travel | $47 | $561 |

| Tree Service | $186 | $2,226 |

| Trucking | $188 | $2,257 |

| Tutoring | $38 | $460 |

| Veterinary | $73 | $873 |

| Wedding Planning | $47 | $561 |

| Welding | $176 | $2,108 |

| Wholesale | $62 | $746 |

| Window Cleaning | $191 | $2,294 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Chubb Business Insurance Cost by State?

State regulations, natural disaster risks and local legal environments affect business insurance rates across the country. Chubb offers their cheapest business insurance in Maine at $102 per month, while business owners in Washington pay around $146 per month.

| Alabama | $115 | $1,386 |

| Arizona | $111 | $1,336 |

| Arkansas | $113 | $1,354 |

| California | $131 | $1,573 |

| Colorado | $116 | $1,397 |

| Connecticut | $128 | $1,533 |

| Delaware | $127 | $1,520 |

| Florida | $127 | $1,528 |

| Georgia | $119 | $1,429 |

| Idaho | $111 | $1,337 |

| Illinois | $130 | $1,555 |

| Indiana | $115 | $1,377 |

| Iowa | $112 | $1,343 |

| Kansas | $115 | $1,376 |

| Kentucky | $110 | $1,319 |

| Maine | $102 | $1,220 |

| Maryland | $112 | $1,349 |

| Massachusetts | $124 | $1,484 |

| Michigan | $111 | $1,330 |

| Minnesota | $110 | $1,325 |

| Mississippi | $119 | $1,423 |

| Missouri | $116 | $1,396 |

| Montana | $117 | $1,403 |

| Nebraska | $112 | $1,344 |

| Nevada | $134 | $1,608 |

| New Hampshire | $117 | $1,405 |

| New Jersey | $133 | $1,601 |

| New Mexico | $118 | $1,422 |

| New York | $137 | $1,641 |

| North Carolina | $102 | $1,222 |

| North Dakota | $111 | $1,331 |

| Ohio | $119 | $1,432 |

| Oklahoma | $111 | $1,327 |

| Oregon | $109 | $1,314 |

| Pennsylvania | $136 | $1,634 |

| Rhode Island | $129 | $1,552 |

| South Carolina | $122 | $1,461 |

| South Dakota | $110 | $1,325 |

| Tennessee | $115 | $1,382 |

| Texas | $118 | $1,421 |

| Utah | $112 | $1,341 |

| Vermont | $113 | $1,354 |

| Virginia | $107 | $1,283 |

| Washington | $146 | $1,754 |

| West Virginia | $123 | $1,476 |

| Wisconsin | $116 | $1,386 |

| Wyoming | $119 | $1,422 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Chubb Business Insurance Customer Experience Ratings

We analyzed over 1,100 customer reviews to evaluate how Chubb compares to other insurers. The company ranks fourth nationally with a customer score of 4.2. Chubb is known for its customer service and efficient claims handling, though some customers note higher premiums and limited digital tools compared to competitors.

| Affordability | 4.00 | 10 |

| Claims Process | 4.20 | 2 |

| Customer Service | 4.40 | 2 |

| Digital Experience | 3.90 | 9 |

| Policy Management | 4.30 | 3 |

| Recommend to Others | 4.30 | 6 |

Chubb Business Insurance Customer Reviews and Sentiment

Customer feedback for Chubb shows a mix of experiences depending on the type of coverage and customer profile. These reviews provide a look at how Chubb handles real business insurance situations when clients need support.

Official Website Reviews | No reviews for business insurance are available on Chubb’s official site. |

Better Business Bureau (U.S.) | Reviews tend to be negative for slow claims resolution, difficulty reaching representatives and unresolved billing or policy issues. |

Trustpilot | Low overall satisfaction score. Common themes include unresponsive service, poor claim experiences, and disputes over settlement amounts. While not business-specific, these reviews suggest potential customer service concerns. |

Reddit | Users often describe Chubb as having strong coverage and attentive service but premiums are higher than competitors. |

Chubb’s customer sentiment is mixed: it lacks official business-insurance reviews, draws negative feedback on BBB and Trustpilot around claims delays and poor communication, yet earns recognition on Reddit for strong coverage and attentive service.

Chubb Business Insurance Industry Ratings

Independent ratings show how well Chubb handles customer needs when they file a claim. Industry assessments confirm its strong performance in customer service and claims processing.

Chubb ranked first in the 2025 U.S. Property Claims Satisfaction Study with a score of 773 out of 1,000. This indicates strong performance in property claims handling.

Chubb’s commercial property and liability complaint indices are well below the national average of 1.00, reflecting fewer formal complaints relative to its size.

Chubb is not a BBB-accredited company.

These ratings suggest Chubb handles claims effectively and maintains a low volume of regulator-filed complaints, though BBB responsiveness scores leave room for improvement.

Chubb Business Insurance Financial Strength Ratings

Chubb holds strong financial strength ratings from all major U.S. rating agencies:

- AM Best: A++ (Superior)

- S&P: AA (Very Strong)

- Moody’s: Aa2 (High Quality)

Chubb Business Insurance Coverage Options and Add-ons

Chubb offers a range of business insurance coverages, allowing businesses to choose protection to suit their needs.

Core | Combines general liability, commercial property and often business income coverage | |

Core | Covers bodily injury, property damage and advertising injury claims from third parties | |

Core | Protects buildings, equipment, inventory and other business property | |

Business Income | Core | Replaces lost revenue after a covered property damage event |

Core | Pays for medical expenses and lost wages for employees injured on the job | |

Core | Covers liability and physical damage for business vehicles | |

Commercial Umbrella | Core | Provides additional liability protection above underlying policy limits |

Cyber ERM / DigiTech ERM | Specialized | Covers data breaches, cyberattacks, business interruption and related cyber liability |

Management & Professional Liability | Specialized | Includes directors and officers (D&O), employment practices liability (EPLI) and errors & omissions (E&O) coverage |

Multinational / International Advantage | Specialized | Coordinates insurance for businesses with overseas operations |

Industry-Specific BOP Enhancements | Specialized | Expands standard BOP terms for certain industries, such as life sciences or technology firms |

Multinational Choice | Specialized | International business coverage for overseas operations |

Home-Based Business | Specialized | Coverage for businesses operating from residential locations |

Disclaimer

Deductibles, coverage limits and specific terms vary by policy and business type. Contact Chubb for detailed coverage information, including deductibles.

Coverage availability, eligibility, and pricing vary by state, industry, and business size. Certain products have specific underwriting criteria, and not all coverages are available for online quoting. Businesses should confirm availability during the application process.

Chubb Business Insurance: Bottom Line

Chubb's small business coverage averages $118 monthly, higher than many competitors. Customers like the company's efficient claims processing and responsive customer service teams. The digital tools and online self-service options lag behind other insurers.

Chubb Business Insurance: FAQ

Based on our analysis of Chubb business insurance offerings, these frequently asked questions cover essential information you need to know.

How much can I expect to pay for Chubb business insurance?

Chubb business insurance costs an average of $118 per month ($1,418 annually). Coverage prices range from $85 per month for workers compensation to $178 per month for business owners policies.

How much does Chubb business insurance cost by industry?

Chubb business insurance costs range from $32 per month for home-based businesses to $741 per month for pressure washing companies. Service-based operations with minimal physical risks have lower premiums.

What industries does Chubb rank best for?

Chubb doesn't lead overall in the 79 industries evaluated, performing strongest in automotive, auto repair and window cleaning sectors.

Which states offer the cheapest Chubb business insurance rates?

Maine offers the lowest Chubb business insurance rates at $102 per month, while Washington rates average $146 monthly. Chubb isn't the most affordable option in any state but ranks second-lowest in 12 states.

How does Chubb's customer service compare to other insurers?

Chubb ranks second nationally for both customer service (4.40) and claims processing (4.20).

How We Rated Chubb Business Insurance

Small business owners need clear facts when choosing insurance carriers like Chubb. Our analysis looks at the most important factors that affect your coverage and costs:

- Affordability (50% of score): We compared Chubb's rates for all coverage types against nine other national carriers to find the best value for businesses.

- Customer experience (30% of score): We analyzed J.D. Power scores, complaint records and agency feedback to see how well Chubb handles claims and customer service.

- Coverage options (15% of score): We checked Chubb's insurance offerings, policy limits and extra coverage options to determine how well they match business needs.

- Financial strength (5% of score): We reviewed financial ratings and stability reports to confirm Chubb can reliably pay claims.

Our research covered 79 industries and four types of coverage. We based quotes on a business with two employees, $300,000 in yearly revenue and $150,000 in payroll. These results show which business types might benefit from Chubb's coverage and which might want to look elsewhere.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Assigns Issue Credit Rating to Chubb." Accessed September 1, 2025.

- Better Business Bureau. "Chubb Ltd. Customer Reviews." Accessed September 1, 2025.

- Better Business Bureau. "Chubb Ltd. Complaints." Accessed September 1, 2025.

- Chubb. "Business & Personal Insurance Solutions | Chubb." Accessed September 1, 2025.

- J.D. Power. "2025 U.S. Property Claims Satisfaction Study." Accessed September 1, 2025.

- National Association of Insurance Commissioners. "Company Complaint Index." Accessed September 1, 2025.

- Reddit. "CHUBB?." Accessed September 1, 2025.

- Trustpilot. "Chubb Reviews." Accessed September 1, 2025.