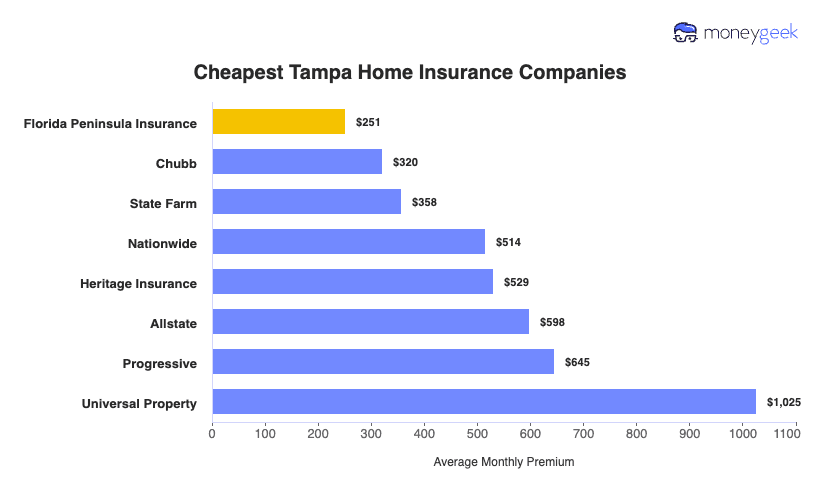

Chubb ranks as the best home insurance company after we evaluated insurers for affordability, coverage options and customer experience ratings. Our research identified providers offering the best value and service for Tampa homeowners.

- Chubb

- State Farm

- Nationwide

- Allstate

- Florida Peninsula