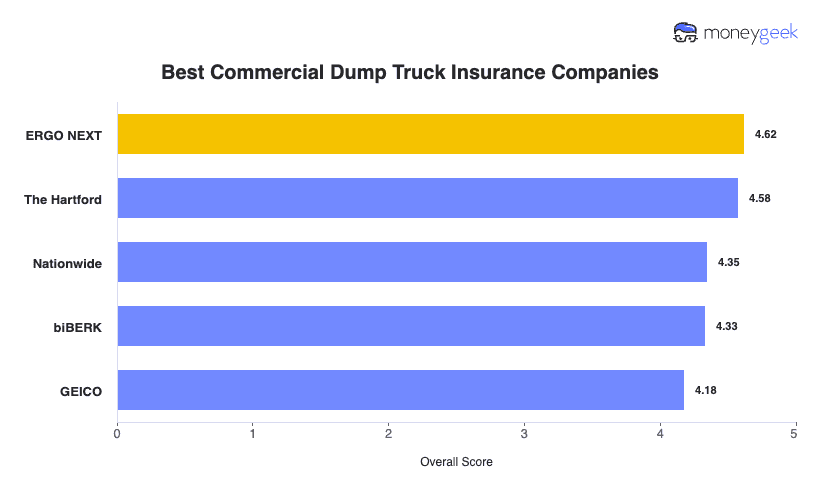

ERGO NEXT wins our top spot due to superior affordability and seamless digital experience. The Hartford follows with better coverage options and higher-rated customer experience. GEICO, Nationwide and biBERK serve as good alternatives depending on your needs.

Best Cheap Commercial Dump Truck Insurance

With rates starting at $504/mo, the best cheap commercial dump truck insurance is offered by ERGO NEXT, The Hartford and Nationwide.

Get matched to top commercial dump truck insurance providers below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

ERGO NEXT ranks best overall with a 4.62 score and perfect 5.0 coverage rating due to superior affordability and fast digital quotes for owner-operators and small fleets.

ERGO NEXT is also the cheapest at $504/month ($6,047 annually) for $1,000,000 CSL coverage on tandem and tri-axle dump trucks, saving $467/year versus the provider average.

Commercial dump truck insurance averages $549/month ($6,587 annually) for aggregate haulers, ranging from $309/month in Vermont to $841/month in New York.

Compare quotes from at least three insurers and stack discounts (paid-in-full, multi-vehicle, bundling) to save 15% to 30% on your fleet.

MoneyGeek scored commercial dump truck insurance providers across three weighted factors: Affordability (40%), Customer Experience (30%) and Coverage & Terms (30%). We analyzed $1,000,000 CSL (Combined Single Limit) Liability quotes from five major insurers across all 50 states. Affordability scores compare each provider's rates against market averages. Customer experience reflects claims handling, agent support and policyholder satisfaction. Coverage scores evaluate policy terms, endorsement options and coverage flexibility.

Best Cheap Commercial Dump Truck Insurance Companies

| ERGO NEXT | 4.62 | $504 | 4.27 | 5 |

| The Hartford | 4.58 | $542 | 4.63 | 5 |

| Nationwide | 4.35 | $563 | 4.44 | 4.48 |

| biBERK | 4.33 | $636 | 4.33 | 4.8 |

| GEICO | 4.18 | $562 | 4.09 | 4.27 |

Data Source

MoneyGeek analysis of $1,000,000 CSL (Combined Single Limit) Liability coverage from five insurers, November 2025. Scores reflect affordability, customer experience and coverage. Rates are national averages; your costs vary by location, driving record and operations.

Get Dump Truck Insurance Quotes From Your Top Provider

Compare rates from your top provider match for your business. Enter your industry and state to get a customized quote in minutes.

Best Commercial Dump Truck Insurance by State

Vermont operators pay as low as $309/month while New York's best available rate is $717/month. ERGO NEXT leads in 30 states, The Hartford ranks first in 13 states, Nationwide wins 5 Midwestern states and GEICO captures Maryland and New Jersey.

| Alabama | The Hartford | $384 | 5 | 4.62 |

| Alaska | ERGO NEXT | $443 | 5 | 4.27 |

| Arizona | ERGO NEXT | $481 | 5 | 4.27 |

| Arkansas | The Hartford | $426 | 5 | 4.62 |

| California | ERGO NEXT | $587 | 5 | 4.27 |

| Colorado | ERGO NEXT | $538 | 5 | 4.27 |

| Connecticut | ERGO NEXT | $560 | 5 | 4.27 |

| Delaware | The Hartford | $493 | 5 | 4.62 |

| Florida | ERGO NEXT | $640 | 5 | 4.27 |

| Georgia | ERGO NEXT | $438 | 5 | 4.27 |

| Hawaii | ERGO NEXT | $373 | 5 | 4.27 |

| Idaho | ERGO NEXT | $341 | 5 | 4.27 |

| Illinois | ERGO NEXT | $559 | 5 | 4.27 |

| Indiana | ERGO NEXT | $419 | 5 | 4.27 |

| Iowa | Nationwide | $347 | 4.54 | 4.52 |

| Kentucky | The Hartford | $433 | 5 | 4.62 |

| Louisiana | The Hartford | $703 | 5 | 4.62 |

| Maine | ERGO NEXT | $314 | 5 | 4.27 |

| Maryland | GEICO | $535 | 4.27 | 4.14 |

| Massachusetts | ERGO NEXT | $554 | 5 | 4.27 |

| Michigan | ERGO NEXT | $619 | 5 | 4.27 |

| Minnesota | ERGO NEXT | $476 | 5 | 4.27 |

| Mississippi | ERGO NEXT | $428 | 5 | 4.27 |

| Missouri | ERGO NEXT | $528 | 5 | 4.27 |

| Montana | The Hartford | $394 | 5 | 4.62 |

| Nebraska | Nationwide | $378 | 4.48 | 4.51 |

| Nevada | ERGO NEXT | $499 | 5 | 4.27 |

| New Hampshire | ERGO NEXT | $317 | 5 | 4.27 |

| New Jersey | GEICO | $572 | 4.27 | 4.09 |

| New Mexico | ERGO NEXT | $444 | 5 | 4.27 |

| New York | ERGO NEXT | $717 | 5 | 4.27 |

| North Carolina | ERGO NEXT | $397 | 5 | 4.27 |

| North Dakota | The Hartford | $340 | 5 | 4.62 |

| Ohio | ERGO NEXT | $428 | 5 | 4.27 |

| Oklahoma | The Hartford | $394 | 5 | 4.62 |

| Oregon | ERGO NEXT | $466 | 5 | 4.27 |

| Pennsylvania | ERGO NEXT | $492 | 5 | 4.27 |

| Rhode Island | ERGO NEXT | $586 | 5 | 4.27 |

| Rhode Island | The Hartford | $623 | 5 | 4.62 |

| South Carolina | ERGO NEXT | $454 | 5 | 4.27 |

| South Dakota | Nationwide | $512 | 4.48 | 4.43 |

| Tennessee | The Hartford | $462 | 5 | 4.62 |

| Texas | ERGO NEXT | $549 | 5 | 4.27 |

| Utah | ERGO NEXT | $389 | 5 | 4.27 |

| Vermont | Nationwide | $309 | 4.48 | 4.43 |

| Virginia | ERGO NEXT | $446 | 5 | 4.27 |

| Washington | ERGO NEXT | $542 | 5 | 4.27 |

| West Virginia | The Hartford | $450 | 5 | 4.62 |

| Wisconsin | Nationwide | $427 | 4.48 | 4.49 |

| Wyoming | The Hartford | $411 | 5 | 4.62 |

Data Source

Best company determined by highest Overall Score per state. Scores reflect affordability, customer experience and coverage. MoneyGeek analysis, November 2025.

Best for Affordability

Average Cost

$504/monthlyOur Survey: Claims Process

3.9/5Our Survey: Likely to Recommend

4.8/5

- pros

Offers the cheapest commercial dump truck insurance rates nationally

Perfect coverage score reflects comprehensive policy options

Digital-first platform streamlines applications and claims

Available in 48 states with flexible coverage

No agent fees reduce overall costs

consCustomer experience ranks fourth among reviewed insurers

Limited in-person support compared to traditional carriers

ERGO NEXT delivers the industry's lowest rates at $504 monthly ($6,047 annually), saving you $467 annually compared to the provider average. The digital platform eliminates traditional overhead and passes those savings directly to you. A perfect 5.0 coverage score proves these policies handle dump truck operators' needs exceptionally well.

ERGO NEXT has rates ideal for budget-conscious dump truck operators. You'll pay $504 monthly, $39 less than the $543 provider average for $1 million combined single limit liability coverage. Your business gets solid financial protection without breaking the budget.

Customer experience ranks ERGO NEXT fourth with a 4.27 score. The digital-first model excels at quick quotes and policy management but delivers less personal support than traditional insurers. Reviews praise fast claims processing and transparent pricing.

Coverage spans 48 states with $1 million combined single limit liability as standard protection. Increase limits based on your operation's needs, add physical damage coverage and secure specialized endorsements for hauling materials or working in high-risk areas. This flexible structure lets you build exactly the protection you need without paying for coverage you won't use.

Best Customer Service

Average Cost

$542/monthlyOur Survey: Claims Process

4.5/5Our Survey: Likely to Recommend

4.5/5

- pros

Ranks first for customer experience with superior claims service

A++ AM Best rating demonstrates exceptional financial strength

Dedicated agents provide personalized support

Over 200 years of industry experience

Perfect coverage score with comprehensive policy options

consPremium costs $38 more monthly than cheapest option

Traditional model may process quotes slower than digital competitors

The Hartford has exceptional service quality and rock-solid financial stability. An A++ AM Best rating and 200+ years in business mean your claims get paid when accidents happen.

Monthly costs run $542, just $38 more than the cheapest option. That premium buys superior agent support and claims handling.

Affordability ranks The Hartford second at $542 monthly ($6,500 annually). You'll spend $38 more per month than the cheapest option, but that premium buys superior customer service and financial security. The $456 annual difference delivers dedicated agent support and claims expertise potentially saving thousands when you file claims.

The Hartford leads customer experience with a 4.60 score. Claims processing and service quality top the charts as customers consistently praise reps who handle claims efficiently. The traditional model delivers less instant online access than newer insurers, but most operators value the expertise and personal attention.

Nationwide coverage includes $1 million combined single limit liability as the foundation. Customize policies with higher liability limits, physical damage coverage and specialized endorsements for construction work or hazardous materials hauling. Bundle dump truck insurance with general liability and workers' compensation for additional savings and simpler policy management.

About These Reviews

Our provider evaluations are based on rate analysis, customer surveys, coverage options, and financial stability. Rates shown are national averages. Contact each insurer directly for personalized quotes and to verify current coverage availability in your state.

Cheapest Commercial Dump Truck Insurance Companies

ERGO NEXT offers the cheapest dump truck coverage in 31 states, with rates starting at $315/month in Maine. The Hartford leads 11 states, Nationwide wins five Midwestern markets and GEICO is cheapest in Maryland and New Jersey.

| Alabama | The Hartford | $135 |

Data Source

Cheapest provider determined by lowest monthly premium per state. Rates for $1,000,000 CSL (Combined Single Limit) Liability coverage. MoneyGeek analysis, November 2025.

How Much Does Commercial Dump Truck Insurance Cost on Average?

Commercial dump truck insurance costs $549 monthly ($6,587 annually) on average for $1,000,000 CSL coverage on tandem and tri-axle end dumps. Your state drives the biggest price gap: Vermont operators pay $309/month while New York businesses pay $841/month.

Average Monthly Premium | $549 |

Average Annual Premium | $6,587 |

Lowest State (Vermont) | $309/month |

Highest State (New York) | $841/month |

Monthly Range | $309 - $841 |

Data Source

Rates for $1,000,000 CSL (Combined Single Limit) Liability coverage. Averages based on five major providers. MoneyGeek analysis, November 2025.

Factors That Affect Commercial Dump Truck Insurance Costs

Your commercial dump truck insurance premium depends on several key factors:

Moving from $500,000 to $1,000,000 CSL adds 10% to 20% to your premium. Most broker contracts require $1,000,000 minimum regardless of FMCSA's $750,000 floor because a single dump truck accident can cause catastrophic property damage.

Raising your deductible from $1,000 to $2,500 lowers premiums 10% to 15%; a $5,000 deductible saves 15% to 25%. Choose based on cash flow since dump truck repairs average $10,000 to $50,000 after rollovers or collisions.

Tandem axle dump trucks cost less to insure than tri-axle or quad-axle configurations due to lower payload capacity. Super dumps and transfer dumps carrying 25+ cubic yards face higher premiums than standard end dumps. Trucks with roll-over protection and backup cameras qualify for discounts.

Clean aggregate haulers (sand, gravel, crushed stone) pay the lowest rates. Hauling construction debris, asphalt millings or contaminated soil triggers pollution liability requirements. Hazmat or petroleum transport requires $1,000,000 to $5,000,000 limits.

Dump trucks have elevated rollover risk due to high center of gravity when loaded and during bed-raise operations at quarries and job sites. Insurers factor in your load types, terrain and dumping frequency. Installing stability control systems reduces premiums.

One at-fault accident raises premiums 20% to 40% for three to five years. DUIs may disqualify you entirely. Insurers review CSA scores and look back 3 to 5 years for violations; clean MVRs for all CDL drivers qualify you for preferred rates.

Vermont operators pay $309/month while New York businesses pay $841/month for identical coverage. High-litigation states charge premium rates. Hauling between quarries, pits and construction sites in urban areas increases exposure versus rural earthwork operations.

Insuring two to five dump trucks saves 5% to 10% per vehicle through fleet discounts. Fleets of 10+ tandem or tri-axle trucks may negotiate 10% to 20% discounts plus dedicated account management. Single-truck owner-operators pay the highest per-vehicle rates.

CDL Class A or B holders with 5+ years hauling aggregate get better rates than newer drivers. Operations with 3+ years claims-free history qualify for 10% to 15% discounts. Adding inexperienced drivers to your dump truck operation increases rates 15% to 25%.

Commercial Dump Truck Insurance Requirements

FMCSA requires $750,000 CSL minimum for Class 8 dump trucks (33,001+ lbs GVWR) hauling aggregate interstate as for-hire carriers. Most brokers require $1,000,000 regardless of federal minimums. Intrastate-only operations and private carriers hauling their own materials follow state minimums, which vary from $300,000 to $750,000.

General Freight (sand, gravel, crushed stone) | $750,000 CSL | Class A or B |

Oil/Petroleum Products | $1,000,000 CSL | Class A or B |

Hazardous Materials | $1,000,000-$5,000,000 CSL | Class A or B + HazMat |

Disclaimer

Interstate for-hire operations must file BMC-91, MCS-90 and BOC-3. Your insurer handles these filings. Verify with FMCSA before operating.

Requirement | Details |

|---|---|

Federal Filings | Interstate dump truck operators need an active MC number, USDOT number, BMC-91 (proof of insurance), MCS-90 endorsement (environmental liability) and BOC-3 (process agent designation). Your insurer files BMC-91 and MCS-90; you file BOC-3 separately or through a service. |

State Requirements | Each state sets minimum liability for intrastate hauling. California requires $750,000 for trucks over 10,000 lbs GVWR. Texas requires $500,000 for motor carriers. Private carriers hauling their own aggregate between quarries and job sites may have lower requirements. Check your state's DOT for exact requirements. |

Broker Contract Standards | Large brokers like CH Robinson, TQL and Landstar require $1,000,000 auto liability and $100,000 cargo coverage minimum. Excavation contractors and earthwork companies often require pollution liability and $2,000,000+ limits for subhaulers. Meet broker requirements before accepting loads. |

Disclaimer

Requirements vary by state, cargo type and operating authority. Verify specific requirements with FMCSA and your state DOT before operating.

How to Get the Best Cheap Commercial Dump Truck Insurance

- 1Compare Quotes From Multiple Insurers

Request quotes from ERGO NEXT, The Hartford and at least one other provider. Provide identical coverage limits ($1,000,000 CSL) and deductibles to each insurer.

- 2Verify Coverage Meets Requirements

Confirm your policy meets broker contracts ($1,000,000 liability, $100,000 cargo). FMCSA requires $750,000 minimum but most contracts require more.

- 3Improve Your Risk Profile

Remove drivers with DUIs or multiple violations. Install dash cams and GPS. Maintain current DOT inspections.

- 4Stack Available Discounts

Combine paid-in-full (5% to 10%), multi-vehicle (5% to 15%), bundling (10% to 20%) and safety equipment (5% to 15%) discounts to save 15% to 30%.

- 5Review Coverage Annually

Request competing quotes 45-60 days before renewal. Rates change annually and the cheapest insurer last year may not be cheapest this year.

Commercial Dump Truck Insurance: Bottom Line

ERGO NEXT delivers the best value for aggregate haulers at $504/month with a perfect 5.0 coverage score. The Hartford costs $38 more but provides superior agent support for complex claims involving rollovers or pollution liability. Vermont operators pay under half what New York businesses pay, so get quotes from multiple providers to find your best rate.

Commercial Dump Truck Insurance: FAQ

We've answered the most common questions about finding affordable commercial dump truck insurance coverage:

What coverage do I need for commercial dump truck insurance?

You need at minimum $1 million combined single limit liability coverage to meet most state requirements and client contracts. Add physical damage coverage for your truck if you have a loan or lease. Consider higher limits if you haul valuable cargo or work in high-traffic areas. Learn more about commercial auto insurance and what coverages are required.

How can I lower my commercial dump truck insurance rates?

Lower rates by maintaining a clean driving record, increasing your deductible, bundling policies and paying annually. Installing GPS tracking and dash cameras can earn discounts. ERGO NEXT offers the cheapest rates at $504 monthly. Find more tips on getting cheap business insurance.

Why is dump truck insurance more expensive than other commercial vehicles?

Dump trucks cost more to insure because of their size, weight and operating conditions. These vehicles cause more severe damage in accidents due to their mass. Dump trucks often work in construction zones and congested areas, increasing accident probability.

Do I need workers' compensation with dump truck insurance?

Workers' compensation insurance is separate from dump truck insurance and covers employee injuries regardless of fault. Most states require it if you have employees. Truck insurance covers vehicle-related accidents and liability. Check if you need workers' compensation.

Can I get same-day commercial dump truck insurance coverage?

Yes, many insurers including ERGO NEXT and GEICO offer same-day coverage if you complete the application and payment before business hours end. The Hartford and Nationwide may need 24 to 48 hours. Learn how to get business insurance quickly.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.